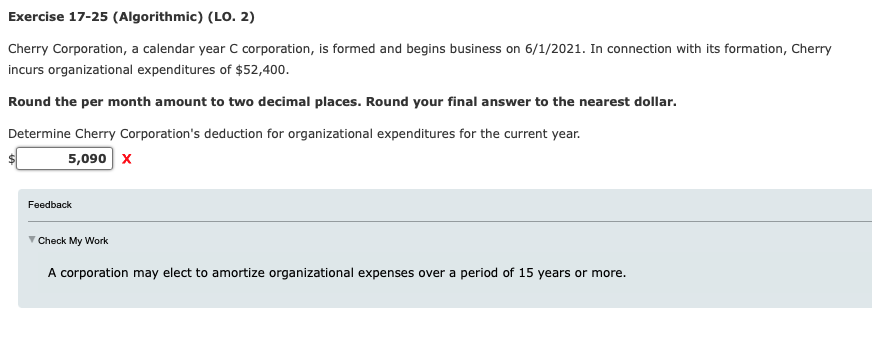

Cherry Corporation, a calendar year C corporation, is formed and begins business on 6/1/2021. In connection with its formation, Cherry incurs organizational expenditures of $52,400. Round the per month amount to two decimal places. Round your final answer to the nearest dollar. Determine Cherry Corporation's deduction for organizational expenditures for the current year. 5,090 X Feedback Check My Work A corporation may elect to amortize organizational expenses over a period of 15 years or more.

Cherry Corporation, a calendar year C corporation, is formed and begins business on 6/1/2021. In connection with its formation, Cherry incurs organizational expenditures of $52,400. Round the per month amount to two decimal places. Round your final answer to the nearest dollar. Determine Cherry Corporation's deduction for organizational expenditures for the current year. 5,090 X Feedback Check My Work A corporation may elect to amortize organizational expenses over a period of 15 years or more.

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter12: Corporations: Organization, Capital Structure, And Operating Rules

Section: Chapter Questions

Problem 34P

Related questions

Question

Subject - account

Please help me.

Thankyou.

Transcribed Image Text:Exercise 17-25 (Algorithmic) (LO. 2)

Cherry Corporation, a calendar year C corporation, is formed and begins business on 6/1/2021. In connection with its formation, Cherry

incurs organizational expenditures of $52,400.

Round the per month amount to two decimal places. Round your final answer to the nearest dollar.

Determine Cherry Corporation's deduction for organizational expenditures for the current year.

5,090 X

Feedback

✓ Check My Work

A corporation may elect to amortize organizational expenses over a period of 15 years or more.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you