Choosing between two projects with acceptable payback periods Shell Camping Gear, Inc., is considering two mutually exclusive projects. Each requires an initial investment of $180,000. John Shell, president of the company, has set a maximum payback period of 4 years. The after-tax cash inflows associated with each project are shown in the following table: a. Determine the payback period of each project. b. Because they are mutually exclusive, Shell must choose one. Which should the company invest in? a. The payback period of project A is years. (Round to two decimal places.) Librai

Choosing between two projects with acceptable payback periods Shell Camping Gear, Inc., is considering two mutually exclusive projects. Each requires an initial investment of $180,000. John Shell, president of the company, has set a maximum payback period of 4 years. The after-tax cash inflows associated with each project are shown in the following table: a. Determine the payback period of each project. b. Because they are mutually exclusive, Shell must choose one. Which should the company invest in? a. The payback period of project A is years. (Round to two decimal places.) Librai

Financial And Managerial Accounting

15th Edition

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:WARREN, Carl S.

Chapter26: Capital Investment Analysis

Section: Chapter Questions

Problem 2CMA: Staten Corporation is considering two mutually exclusive projects. Both require an initial outlay of...

Related questions

Question

Transcribed Image Text:Help

Choosing between two projects with acceptable payback periods Shell Camping Gear, Inc., is considering two mutually exclusive projects. Each requires an initial

investment of $180,000. John Shell, president of the company, has set a maximum payback period of 4 years. The after-tax cash inflows associated with each project

ne

are shown in the following table:

a. Determine the payback period of each project.

b. Because they are mutually exclusive, Shell must choose one. Which should the company invest in?

nts

un

a. The payback period of project A is

years. (Round to two decimal places.)

neText

edia Librai

cial Calculat

ter Resource Enter your answer in the answer box and then click Check Answer.

Check Answer

mic Study

ules

parts

remaining

Clear All

nmunication Tools >

10:02 PNM

4/19/202

P Type here to search

insert

prt

fg

f1o

Transcribed Image Text:ar to)

projects wi

John Shell

table:

Husive pro

inflows a

Data Table

k period of

ually exclus

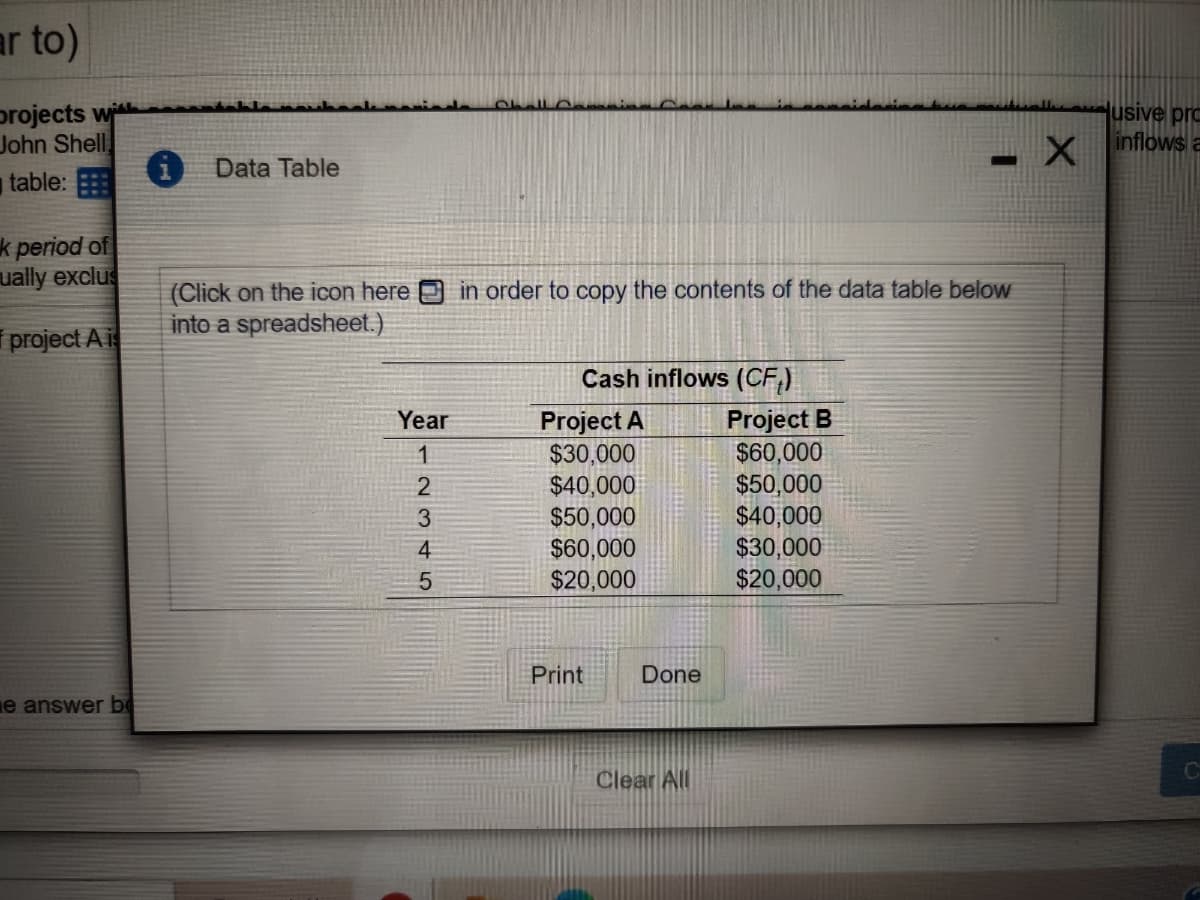

(Click on the icon here O in order to copy the contents of the data table below

into a spreadsheet.)

project Ai

Cash inflows (CF,).

Project A

$30,000

$40,000

$50,000

$60,000

$20,000

Project B

$60,000

$50,000

$40,000

$30,000

$20,000

Year

Print

Done

e answer be

Co

Clear All

123 4t 5

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT