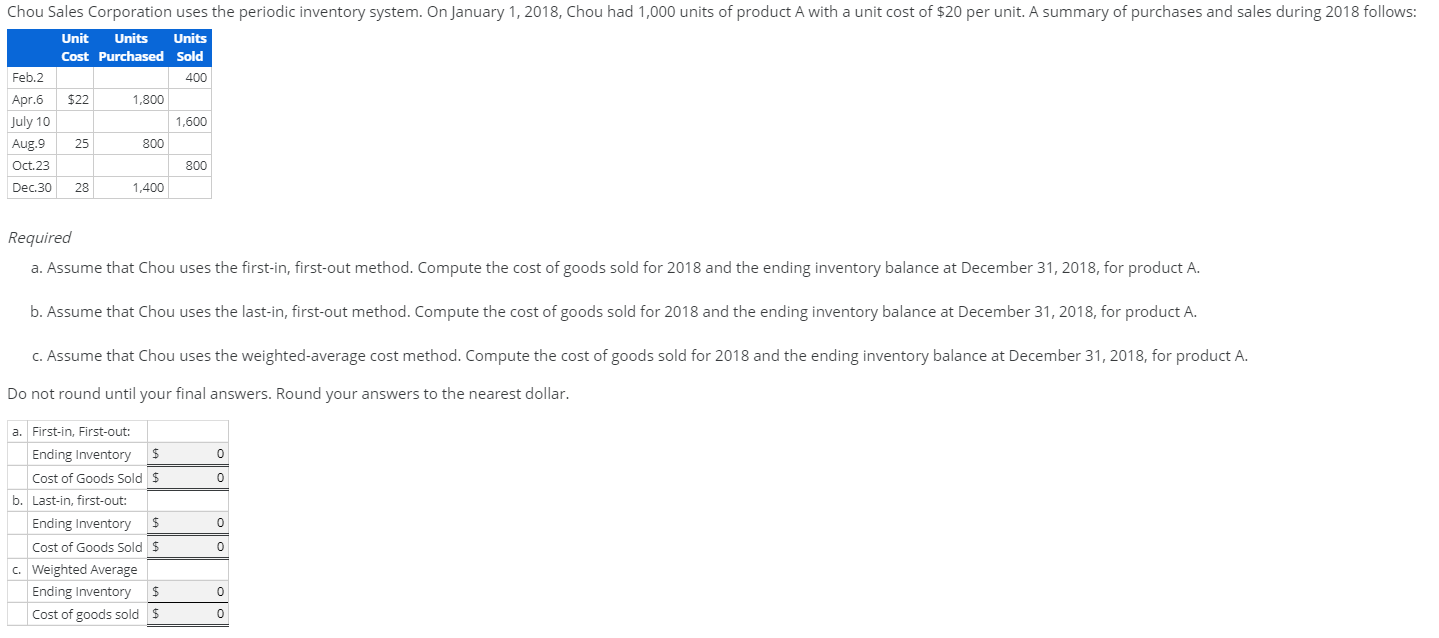

Chou Sales Corporation uses the periodic inventory system. On January 1, 2018, Chou had 1,000 units of product A with a unit cost of $20 per unit. A summary of purchases and sales during 2018 follows: Unit Units Units Cost Purchased Sold Feb.2 400 Apr.6 $22 1,800 July 10 1,600 Aug.9 25 800 Oct.23 800 Dec.30 28 1,400 Required a. Assume that Chou uses the first-in, first-out method. Compute the cost of goods sold for 2018 and the ending inventory balance at December 31, 2018, for product A. b. Assume that Chou uses the last-in, first-out method. Compute the cost of goods sold for 2018 and the ending inventory balance at December 31, 2018, for product A. c. Assume that Chou uses the weighted-average cost method. Compute the cost of goods sold for 2018 and the ending inventory balance at December 31, 2018, for product A. Do not round until your final answers. Round your answers to the nearest dollar. a. First-in, First-out: Ending Inventory Cost of Goods Sold $ b. Last-in, first-out: Ending Inventory 24 Cost of Goods Sold $ c. Weighted Average Ending Inventory Cost of goods sold $

Chou Sales Corporation uses the periodic inventory system. On January 1, 2018, Chou had 1,000 units of product A with a unit cost of $20 per unit. A summary of purchases and sales during 2018 follows: Unit Units Units Cost Purchased Sold Feb.2 400 Apr.6 $22 1,800 July 10 1,600 Aug.9 25 800 Oct.23 800 Dec.30 28 1,400 Required a. Assume that Chou uses the first-in, first-out method. Compute the cost of goods sold for 2018 and the ending inventory balance at December 31, 2018, for product A. b. Assume that Chou uses the last-in, first-out method. Compute the cost of goods sold for 2018 and the ending inventory balance at December 31, 2018, for product A. c. Assume that Chou uses the weighted-average cost method. Compute the cost of goods sold for 2018 and the ending inventory balance at December 31, 2018, for product A. Do not round until your final answers. Round your answers to the nearest dollar. a. First-in, First-out: Ending Inventory Cost of Goods Sold $ b. Last-in, first-out: Ending Inventory 24 Cost of Goods Sold $ c. Weighted Average Ending Inventory Cost of goods sold $

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter6: Cost Of Goods Sold And Inventory

Section: Chapter Questions

Problem 50E: Inventory Costing Methods Crandall Distributors uses a perpetual inventory system and has the...

Related questions

Question

Transcribed Image Text:Chou Sales Corporation uses the periodic inventory system. On January 1, 2018, Chou had 1,000 units of product A with a unit cost of $20 per unit. A summary of purchases and sales during 2018 follows:

Unit

Units

Units

Cost Purchased Sold

Feb.2

400

Apr.6

$22

1,800

July 10

1,600

Aug.9

25

800

Oct.23

800

Dec.30

28

1,400

Required

a. Assume that Chou uses the first-in, first-out method. Compute the cost of goods sold for 2018 and the ending inventory balance at December 31, 2018, for product A.

b. Assume that Chou uses the last-in, first-out method. Compute the cost of goods sold for 2018 and the ending inventory balance at December 31, 2018, for product A.

c. Assume that Chou uses the weighted-average cost method. Compute the cost of goods sold for 2018 and the ending inventory balance at December 31, 2018, for product A.

Do not round until your final answers. Round your answers to the nearest dollar.

a. First-in, First-out:

Ending Inventory

Cost of Goods Sold $

b. Last-in, first-out:

Ending Inventory

24

Cost of Goods Sold $

c. Weighted Average

Ending Inventory

Cost of goods sold $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 2 images

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT