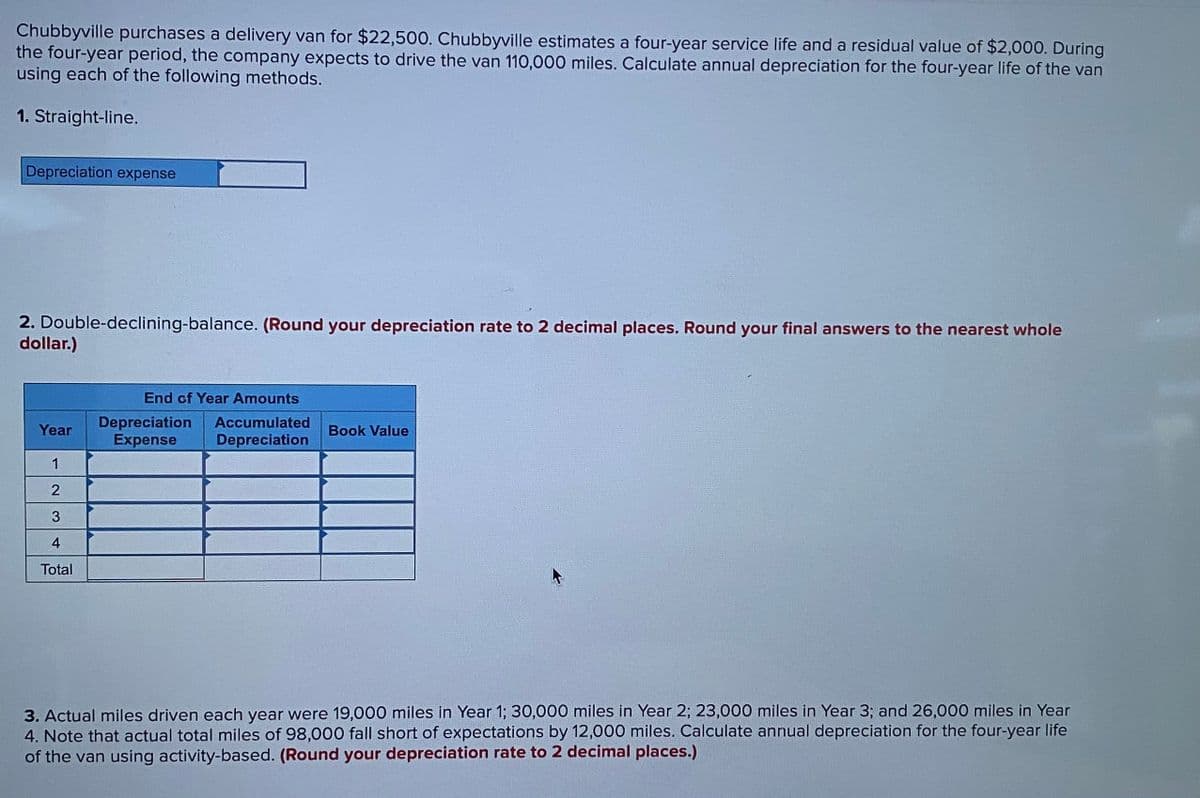

Chubbyville purchases a delivery van for $22,500. Chubbyville estimates a four-year service life and a residual value of $2,000. During the four-year period, the company expects to drive the van 110,000 miles. Calculate annual depreciation for the four-year life of the van using each of the following methods. 1. Straight-line. Depreciation expense 2. Double-declining-balance. (Round your depreciation rate to 2 decimal places. Round your final answers to the nearest whole dollar.) End of Year Amounts Depreciation Expense Accumulated Year Book Value Depreciation 1 4 Total 3. Actual miles driven each year were 19,000 miles in Year 1; 30,000 miles in Year 2; 23,000 miles in Year 3; and 26,000 miles in Year 4. Note that actual total miles of 98,000 fall short of expectations by 12,000 miles. Calculate annual depreciation for the four-year life of the van using activity-based. (Round your depreciation rate to 2 decimal places.)

Chubbyville purchases a delivery van for $22,500. Chubbyville estimates a four-year service life and a residual value of $2,000. During the four-year period, the company expects to drive the van 110,000 miles. Calculate annual depreciation for the four-year life of the van using each of the following methods. 1. Straight-line. Depreciation expense 2. Double-declining-balance. (Round your depreciation rate to 2 decimal places. Round your final answers to the nearest whole dollar.) End of Year Amounts Depreciation Expense Accumulated Year Book Value Depreciation 1 4 Total 3. Actual miles driven each year were 19,000 miles in Year 1; 30,000 miles in Year 2; 23,000 miles in Year 3; and 26,000 miles in Year 4. Note that actual total miles of 98,000 fall short of expectations by 12,000 miles. Calculate annual depreciation for the four-year life of the van using activity-based. (Round your depreciation rate to 2 decimal places.)

Chapter11: Long-term Assets

Section: Chapter Questions

Problem 13PB: Montezuma Inc. purchases a delivery truck for $20,000. The truck has a salvage value of $8,000 and...

Related questions

Question

Transcribed Image Text:Chubbyville purchases a delivery van for $22,500. Chubbyville estimates a four-year service life and a residual value of $2,000. During

the four-year period, the company expects to drive the van 110,000 miles. Calculate annual depreciation for the four-year life of the van

using each of the following methods.

1. Straight-line.

Depreciation expense

2. Double-declining-balance. (Round your depreciation rate to 2 decimal places. Round your final answers to the nearest whole

dollar.)

End of Year Amounts

Depreciation

Expense

Accumulated

Year

Book Value

Depreciation

1.

2

3

4

Total

3. Actual miles driven each year were 19,000 miles in Year 1; 30,000 miles in Year 2; 23,000 miles in Year 3; and 26,000 miles in Year

4. Note that actual total miles of 98,000 fall short of expectations by 12,000 miles. Calculate annual depreciation for the four-year life

of the van using activity-based. (Round your depreciation rate to 2 decimal places.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning