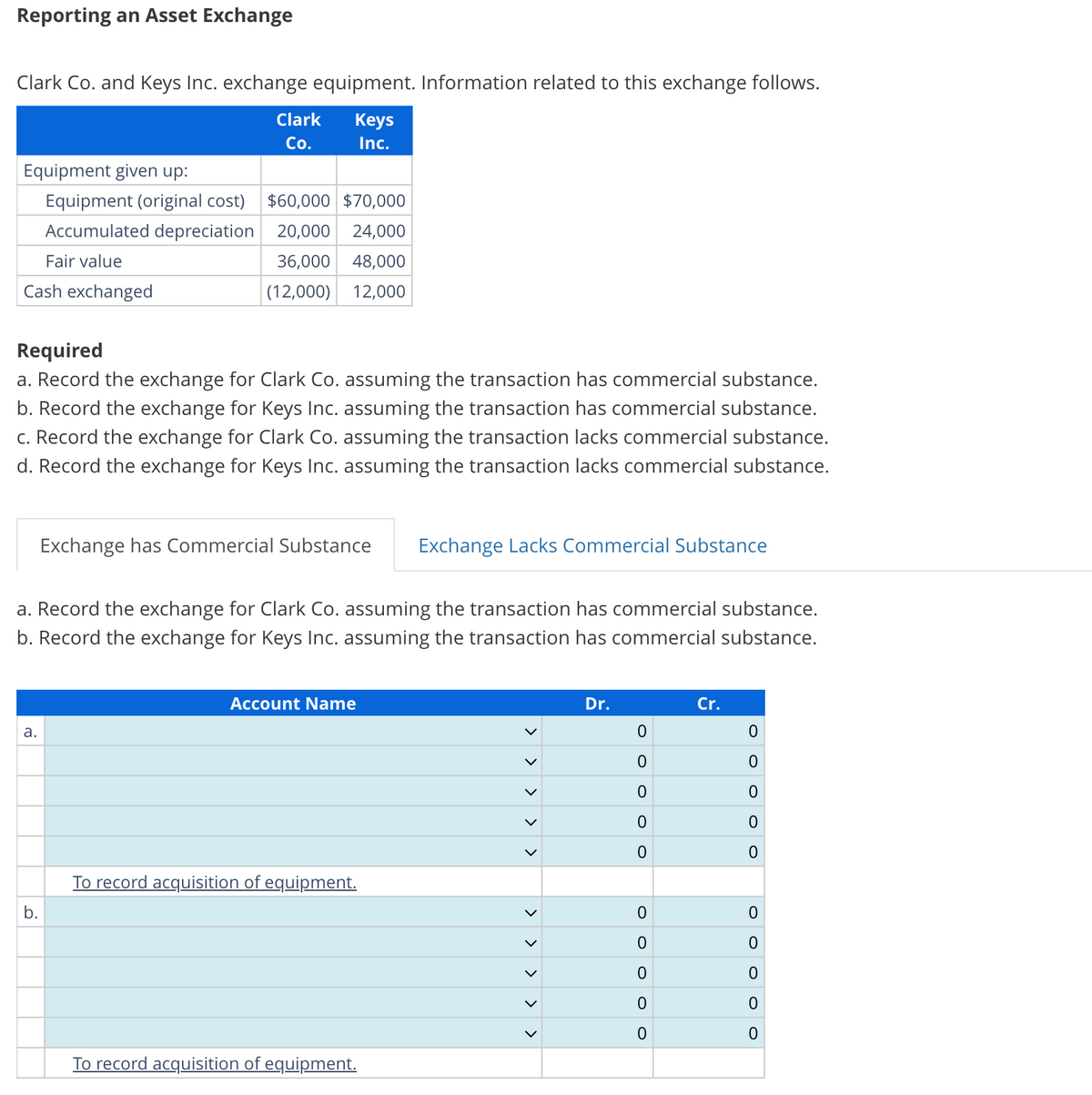

Clark Co. and Keys Inc. exchange equipment. Information related to this exchange follows. Clark Keys Co. Inc. Equipment given up: Equipment (original cost) $60,000 $70,000 Accumulated depreciation 20,000 24,000 Fair value 36,000 48,000 Cash exchanged (12,000) 12,000 Required a. Record the exchange for Clark Co. assuming the transaction has commercial substance. b. Record the exchange for Keys Inc. assuming the transaction has commercial substance. c. Record the exchange for Clark Co. assuming the transaction lacks commercial substance. d. Record the exchange for Keys Inc. assuming the transaction lacks commercial substance.

Clark Co. and Keys Inc. exchange equipment. Information related to this exchange follows. Clark Keys Co. Inc. Equipment given up: Equipment (original cost) $60,000 $70,000 Accumulated depreciation 20,000 24,000 Fair value 36,000 48,000 Cash exchanged (12,000) 12,000 Required a. Record the exchange for Clark Co. assuming the transaction has commercial substance. b. Record the exchange for Keys Inc. assuming the transaction has commercial substance. c. Record the exchange for Clark Co. assuming the transaction lacks commercial substance. d. Record the exchange for Keys Inc. assuming the transaction lacks commercial substance.

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter4: Balance Sheet: Presenting And Analyzing Resources And Financing

Section: Chapter Questions

Problem 23E

Related questions

Question

Transcribed Image Text:Reporting an Asset Exchange

Clark Co. and Keys Inc. exchange equipment. Information related to this exchange follows.

Keys

Inc.

Equipment given up:

Equipment (original cost) $60,000 $70,000

Accumulated depreciation 20,000 24,000

Fair value

36,000 48,000

12,000

Cash exchanged

(12,000)

Clark

Co.

Required

a. Record the exchange for Clark Co. assuming the transaction has commercial substance.

b. Record the exchange for Keys Inc. assuming the transaction has commercial substance.

c. Record the exchange for Clark Co. assuming the transaction lacks commercial substance.

d. Record the exchange for Keys Inc. assuming the transaction lacks commercial substance.

a.

a. Record the exchange for Clark Co. assuming the transaction has commercial substance.

b. Record the exchange for Keys Inc. assuming the transaction has commercial substance.

b.

Exchange has Commercial Substance Exchange Lacks Commercial Substance

Account Name

To record acquisition of equipment.

To record acquisition of equipment.

くく くく く

>

>

>

Dr.

0

0

0

0

0

0

0

0

0

0

Cr.

0

0

0

0

0

0

0

0

0

0

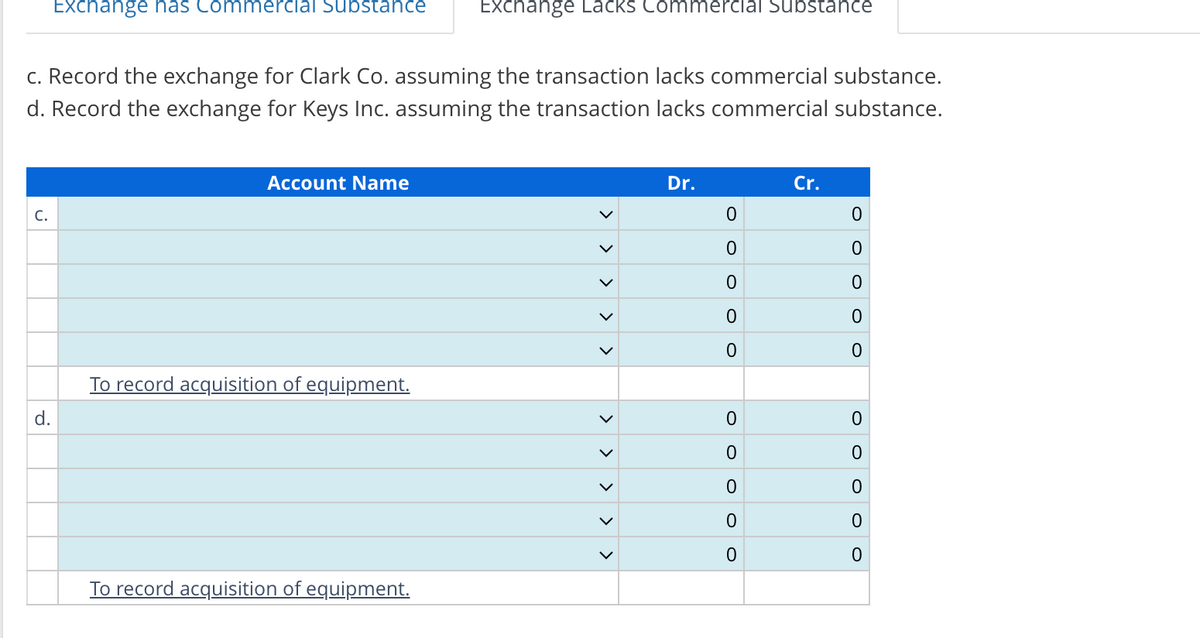

Transcribed Image Text:c. Record the exchange for Clark Co. assuming the transaction lacks commercial substance.

d. Record the exchange for Keys Inc. assuming the transaction lacks commercial substance.

C.

Exchange has Commercial Substance Exchange Lacks Commercial Substance

d.

Account Name

To record acquisition of equipment.

To record acquisition of equipment.

>

<

>

Dr.

0

0

0

0

0

0

0

0

0

0

Cr.

0

0

0

O

0

0

0

0

0

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,