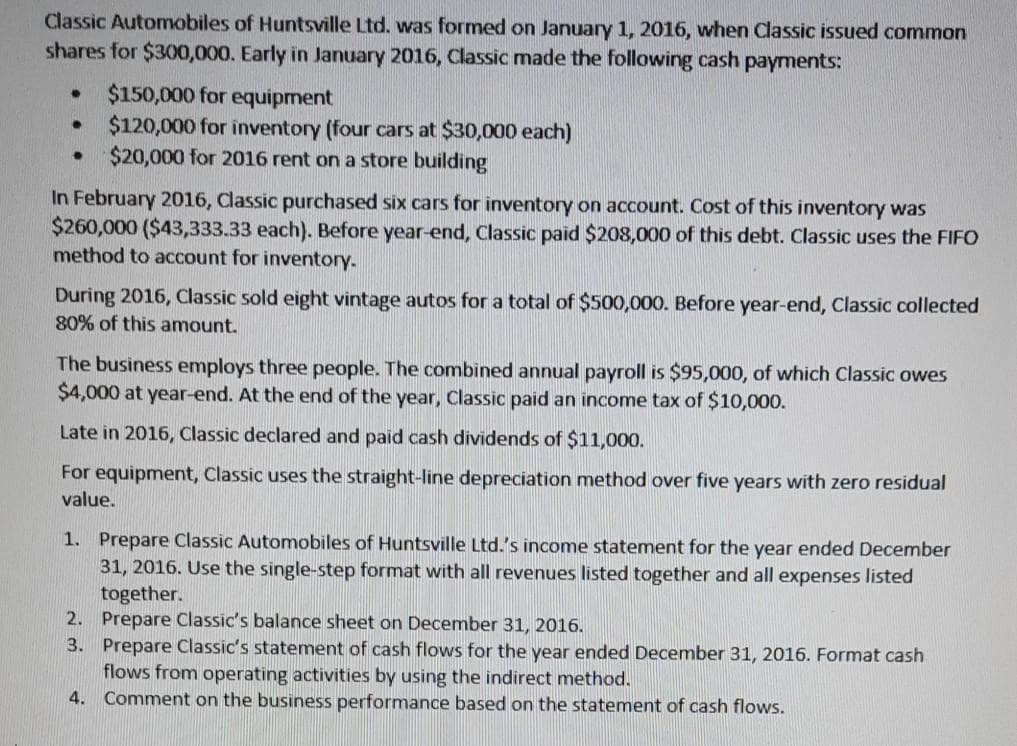

Classic Automobiles of Huntsville Ltd. was formed on January 1, 2016, when Classic issued common shares for $300,000. Early in January 2016, Classic made the following cash payments: $150,000 for equipment $120,000 for inventory (four cars at $30,000 each) • $20,000 for 2016 rent on a store building In February 2016, Classic purchased six cars for inventory on account. Cost of this inventory was $260,000 ($43,333.33 each). Before year-end, Classic paid $208,000 of this debt. Classic uses the FIFO method to account for inventory. During 2016, Classic sold eight vintage autos for a total of $500,000. Before year-end, Classic collected 80% of this amount. The business employs three people. The combined annual payroll is $95,000, of which Classic owes $4,000 at year-end. At the end of the year, Classic paid an income tax of $10,000. Late in 2016, Classic declared and paid cash dividends of $11,000. For equipment, Classic uses the straight-line depreciation method over five years with zero residual value. 1. Prepare Classic Automobiles of Huntsville Ltd.'s income statement for the year ended December 31, 2016. Use the single-step format with all revenues listed together and all expenses listed together. 2. Prepare Classic's balance sheet on December 31, 2016. 3. Prepare Classic's statement of cash flows for the year ended December 31, 2016. Format cash flows from operating activities by using the indirect method. 4. Comment on the business performance based on the statement of cash flows.

Classic Automobiles of Huntsville Ltd. was formed on January 1, 2016, when Classic issued common shares for $300,000. Early in January 2016, Classic made the following cash payments: $150,000 for equipment $120,000 for inventory (four cars at $30,000 each) • $20,000 for 2016 rent on a store building In February 2016, Classic purchased six cars for inventory on account. Cost of this inventory was $260,000 ($43,333.33 each). Before year-end, Classic paid $208,000 of this debt. Classic uses the FIFO method to account for inventory. During 2016, Classic sold eight vintage autos for a total of $500,000. Before year-end, Classic collected 80% of this amount. The business employs three people. The combined annual payroll is $95,000, of which Classic owes $4,000 at year-end. At the end of the year, Classic paid an income tax of $10,000. Late in 2016, Classic declared and paid cash dividends of $11,000. For equipment, Classic uses the straight-line depreciation method over five years with zero residual value. 1. Prepare Classic Automobiles of Huntsville Ltd.'s income statement for the year ended December 31, 2016. Use the single-step format with all revenues listed together and all expenses listed together. 2. Prepare Classic's balance sheet on December 31, 2016. 3. Prepare Classic's statement of cash flows for the year ended December 31, 2016. Format cash flows from operating activities by using the indirect method. 4. Comment on the business performance based on the statement of cash flows.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter5: The Income Statement And The Statement Of Cash Flows

Section: Chapter Questions

Problem 3RE: Shaquille Corporation began the current year with inventory of 50,000. During the year, its...

Related questions

Topic Video

Question

Transcribed Image Text:Classic Automobiles of Huntsville Ltd. was formed on January 1, 2016, when Classic issued common

shares for $300,000. Early in January 2016, Classic made the following cash payments:

$150,000 for equipment

$120,000 for inventory (four cars at $30,000 each)

$20,000 for 2016 rent on a store building

In February 2016, Classic purchased six cars for inventory on account. Cost of this inventory was

$260,000 ($43,333.33 each). Before year-end, Classic paid $208,000 of this debt. Classic uses the FIFO

method to account for inventory.

During 2016, Classic sold eight vintage autos for a total of $500,000. Before year-end, Classic collected

80% of this amount.

The business employs three people. The combined annual payroll is $95,000, of which Classic owes

$4,000 at year-end. At the end of the year, Classic paid an income tax of $10,000.

Late in 2016, Classic declared and paid cash dividends of $11,000.

For equipment, Classic uses the straight-line depreciation method over five years with zero residual

value.

1. Prepare Classic Automobiles of Huntsville Ltd.'s income statement for the year ended December

31, 2016. Use the single-step format with all revenues listed together and all expenses listed

together.

2. Prepare Classic's balance sheet on December 31, 2016.

3. Prepare Classic's statement of cash flows for the year ended December 31, 2016. Format cash

flows from operating activities by using the indirect method.

Comment on the business performance based on the statement of cash flows.

4.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning