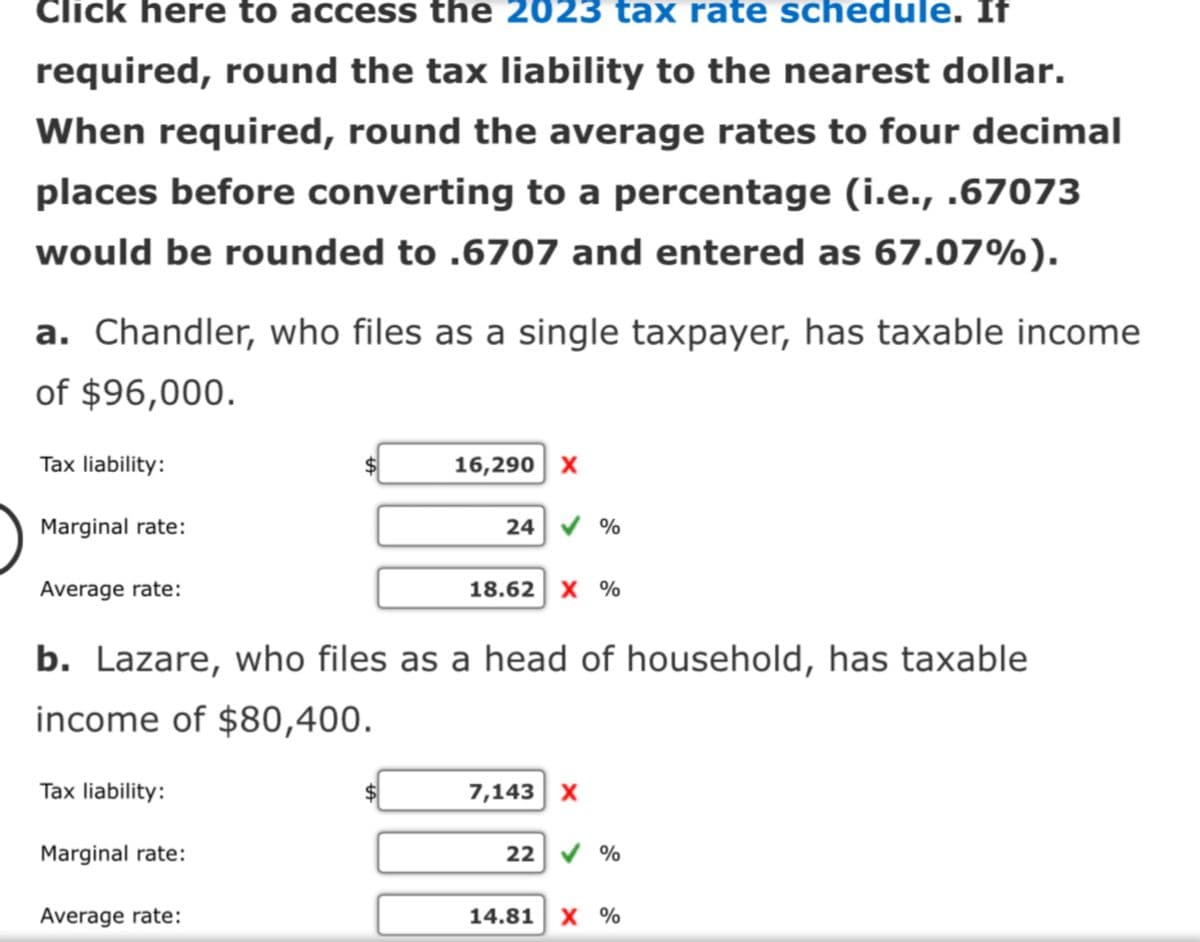

Click here to access the 2023 tax rate schedule. If required, round the tax liability to the nearest dollar. When required, round the average rates to four decimal places before converting to a percentage (i.e., .67073 would be rounded to .6707 and entered as 67.07%). a. Chandler, who files as a single taxpayer, has taxable income of $96,000. Tax liability: Marginal rate: Average rate: tA 16,290 X 24 % 18.62 X % b. Lazare, who files as a head of household, has taxable income of $80,400. Tax liability: Marginal rate: Average rate: tA 7,143 X 22 % 14.81 X %

Click here to access the 2023 tax rate schedule. If required, round the tax liability to the nearest dollar. When required, round the average rates to four decimal places before converting to a percentage (i.e., .67073 would be rounded to .6707 and entered as 67.07%). a. Chandler, who files as a single taxpayer, has taxable income of $96,000. Tax liability: Marginal rate: Average rate: tA 16,290 X 24 % 18.62 X % b. Lazare, who files as a head of household, has taxable income of $80,400. Tax liability: Marginal rate: Average rate: tA 7,143 X 22 % 14.81 X %

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter9: Individuals As Taxpayers

Section: Chapter Questions

Problem 4CE

Related questions

Question

100%

Transcribed Image Text:Click here to access the 2023 tax rate schedule. If

required, round the tax liability to the nearest dollar.

When required, round the average rates to four decimal

places before converting to a percentage (i.e., .67073

would be rounded to .6707 and entered as 67.07%).

a. Chandler, who files as a single taxpayer, has taxable income

of $96,000.

Tax liability:

Marginal rate:

Average rate:

tA

16,290 X

24 %

18.62 X %

b. Lazare, who files as a head of household, has taxable

income of $80,400.

Tax liability:

Marginal rate:

Average rate:

tA

7,143 X

22 %

14.81 X %

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT