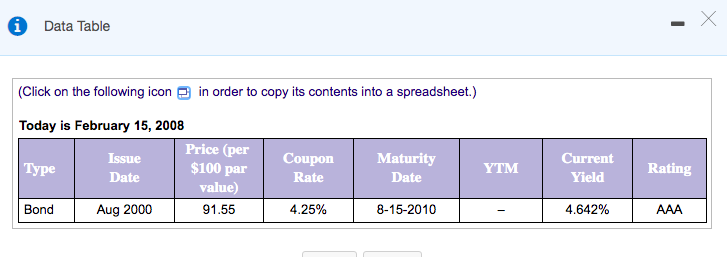

Click on the following icon e in order to copy its contents into a spreadsheet.) Today is February 15, 2008 Price (per $100 par Issue Coupon Maturity Сurrent Туре YTM Rating Date Rate Date Yield value) Bond Aug 2000 91.55 4.25% 8-15-2010 4.642% AAA

Click on the following icon e in order to copy its contents into a spreadsheet.) Today is February 15, 2008 Price (per $100 par Issue Coupon Maturity Сurrent Туре YTM Rating Date Rate Date Yield value) Bond Aug 2000 91.55 4.25% 8-15-2010 4.642% AAA

Chapter8: Analysis Of Risk And Return

Section: Chapter Questions

Problem 9P

Related questions

Question

Please see attached. Definitions:

Yield to maturity (YTM) is the return the bond holder receives on the bond if held to maturity.

Treasury note is a U.S. government bond with a maturity of between two and ten years.

Current yield is the annual bond coupon payment divided by the current price.

Transcribed Image Text:i

Data Table

(Click on the following icon 9 in order to copy its contents into a spreadsheet.)

Today is February 15, 2008

Price (per

$100 рar

value)

Issue

Coupon

Maturity

Сurrent

| Туре

YTM

Rating

Date

Rate

Date

Yield

Bond

Aug 2000

91.55

4.25%

8-15-2010

4.642%

AAA

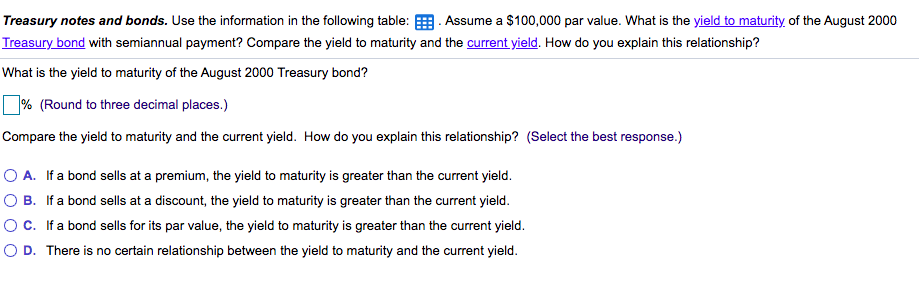

Transcribed Image Text:Treasury notes and bonds. Use the information in the following table: E Assume a $100,000 par value. What is the yield to maturity, of the August 2000

Treasury bond with semiannual payment? Compare the yield to maturity and the current yield. How do you explain this relationship?

What is the yield to maturity of the August 2000 Treasury bond?

% (Round to three decimal places.)

Compare the yield to maturity and the current yield. How do you explain this relationship? (Select the best response.)

O A. If a bond sells at a premium, the yield to maturity is greater than the current yield.

O B. If a bond sells at a discount, the yield to maturity is greater than the current yield.

OC. If a bond sells for its par value, the yield to maturity is greater than the current yield.

O D. There is no certain relationship between the yield to maturity and the current yield.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT