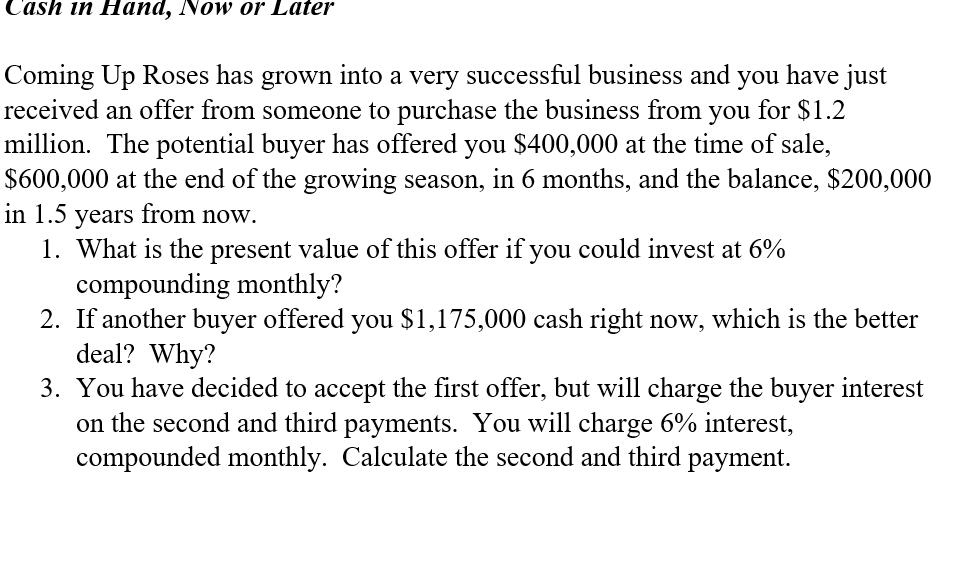

Coming Up Roses has grown into a very successful business and you have just received an offer from someone to purchase the business from you for $1.2 million. The potential buyer has offered you $400,000 at the time of sale, $600,000 at the end of the growing season, in 6 months, and the balance, $200,000 in 1.5 years from now. 1. What is the present value of this offer if you could invest at 6% compounding monthly? 2. If another buyer offered you $1,175,000 cash right now, which is the better deal? Why? 3. You have decided to accept the first offer, but will charge the buyer interest on the second and third payments. You will charge 6% interest, compounded monthly. Calculate the second and third payment.

Coming Up Roses has grown into a very successful business and you have just received an offer from someone to purchase the business from you for $1.2 million. The potential buyer has offered you $400,000 at the time of sale, $600,000 at the end of the growing season, in 6 months, and the balance, $200,000 in 1.5 years from now. 1. What is the present value of this offer if you could invest at 6% compounding monthly? 2. If another buyer offered you $1,175,000 cash right now, which is the better deal? Why? 3. You have decided to accept the first offer, but will charge the buyer interest on the second and third payments. You will charge 6% interest, compounded monthly. Calculate the second and third payment.

Financial Management: Theory & Practice

16th Edition

ISBN:9781337909730

Author:Brigham

Publisher:Brigham

Chapter12: Corporate Valuation And Financial Planning

Section: Chapter Questions

Problem 7P: Upton Computers makes bulk purchases of small computers, stocks them in conveniently located...

Related questions

Question

Transcribed Image Text:Cash in Hand, Now or Later

Coming Up Roses has grown into a very successful business and you have just

received an offer from someone to purchase the business from you for $1.2

million. The potential buyer has offered you $400,000 at the time of sale,

$600,000 at the end of the growing season, in 6 months, and the balance, $200,000

in 1.5

from now.

years

1. What is the present value of this offer if you could invest at 6%

compounding monthly?

2. If another buyer offered you $1,175,000 cash right now, which is the better

deal? Why?

3. You have decided to accept the first offer, but will charge the buyer interest

on the second and third payments. You will charge 6% interest,

compounded monthly. Calculate the second and third payment.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 6 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you