Common shares (no-par value; authorized 60,000 shares; outstanding 21,000 shares) Contributed surplus Retained earnings On February 1, 2020, the board of directors declared a 8 percent stock dividend to be issued on April 30, 2020. The market value of the shares on February 1, 2020, was $16.00 per share. Required: 1. For comparative purposes, prepare the shareholders' equity section of the balance sheet (a) immediately before the stock dividend and (b) immediately after the stock dividend. (Amounts to be deducted should be indicated with a minus sign.) Contributed capital Total contributed capital Shareholders' Equity Before Stock Dividend 0 After Adjustment Stock Dividend $210,000 11,600 71,000 0 0

Common shares (no-par value; authorized 60,000 shares; outstanding 21,000 shares) Contributed surplus Retained earnings On February 1, 2020, the board of directors declared a 8 percent stock dividend to be issued on April 30, 2020. The market value of the shares on February 1, 2020, was $16.00 per share. Required: 1. For comparative purposes, prepare the shareholders' equity section of the balance sheet (a) immediately before the stock dividend and (b) immediately after the stock dividend. (Amounts to be deducted should be indicated with a minus sign.) Contributed capital Total contributed capital Shareholders' Equity Before Stock Dividend 0 After Adjustment Stock Dividend $210,000 11,600 71,000 0 0

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter15: Contributed Capital

Section: Chapter Questions

Problem 2MC: Cary Corporation has 50,000 shares of 10 par common stock authorized. The following transactions...

Related questions

Question

Do not give answer in image

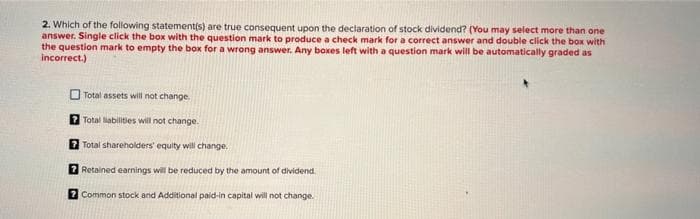

Transcribed Image Text:2. Which of the following statement(s) are true consequent upon the declaration of stock dividend? (You may select more than one

answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with

the question mark to empty the box for a wrong answer. Any boxes left with a question mark will be automatically graded as

incorrect.)

Total assets will not change.

? Total liabilities will not change.

7 Total shareholders' equity will change.

7 Retained earnings will be reduced by the amount of dividend.

? Common stock and Additional paid-in capital will not change.

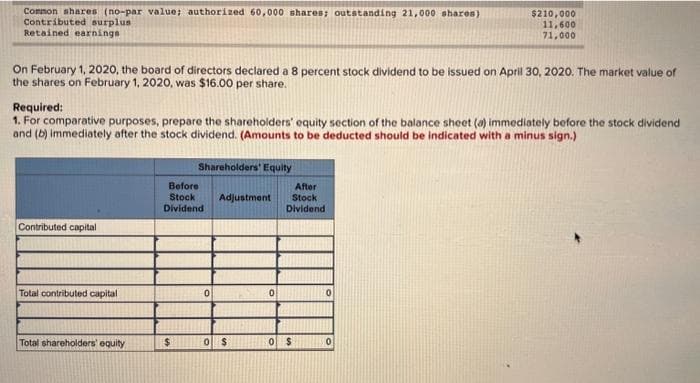

Transcribed Image Text:Common shares (no-par value; authorized 60,000 shares; outstanding 21,000 shares)

Contributed surplus

Retained earnings

On February 1, 2020, the board of directors declared a 8 percent stock dividend to be issued on April 30, 2020. The market value of

the shares on February 1, 2020, was $16.00 per share.

Required:

1. For comparative purposes, prepare the shareholders' equity section of the balance sheet (a) immediately before the stock dividend

and (b) immediately after the stock dividend. (Amounts to be deducted should be indicated with a minus sign.)

Contributed capital

Total contributed capital

Total shareholders' equity

Shareholders' Equity

Before

Stock

Dividend

$

0

Adjustment

0 $

0

0

After

Stock

Dividend

$

$210,000

11,600

71,000

0

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning