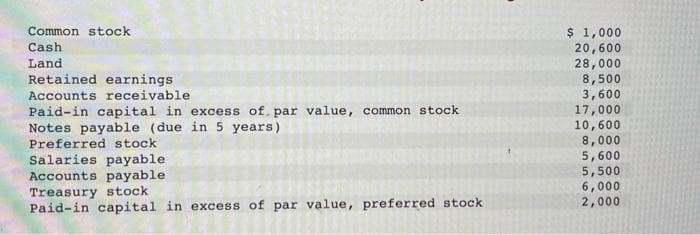

Common stock Cash Land Retained earnings Accounts receivable Paid-in capital in excess of par value, common stock Notes payable (due in 5 years) Preferred stock Salaries payable Accounts payable Treasury stock Paid-in capital in excess of par value, preferred stock $ 1,000 20,600 28,000 8,500 3,600 17,000 10,600 8,000 5,600 5,500 6,000 2,000

Q: he Regal Cycle Company manu

A: Product line analysis is required when there is more than one product in a company.…

Q: [The following information applies to the questions displayed below.] Iguana, Inc., manufactures…

A: “Since you have posted a question with multiple sub-parts, we will solve first three sub-parts for…

Q: Angel Corporation reported pretax book income of $1,002,000. During the current year, the net…

A: Introduction:- Hypothetical tax expenses refer to estimated or projected tax expenses that a company…

Q: On June 30, Year 3, Campbell Company's total current assets were $503,000 and its total current…

A: Working capital is calculated as difference between current assets and current liabilities. The…

Q: Astro Company sold 22,000 units of its only product and reported income of $70,200 for the current…

A: Break even is the point at which the entity is in a situation of no profit and no loss. It is the…

Q: Required information [The following information applies to the questions displayed below] Following…

A: The journal entries are prepared to record the transactions on regular basis. The accounting…

Q: ederal T-note interest $ 2,476 Included on federal return e depreciation expense was $51,200.…

A: Indiana state tax is a type of tax that is paid by the Indiana businessman at the state and federal…

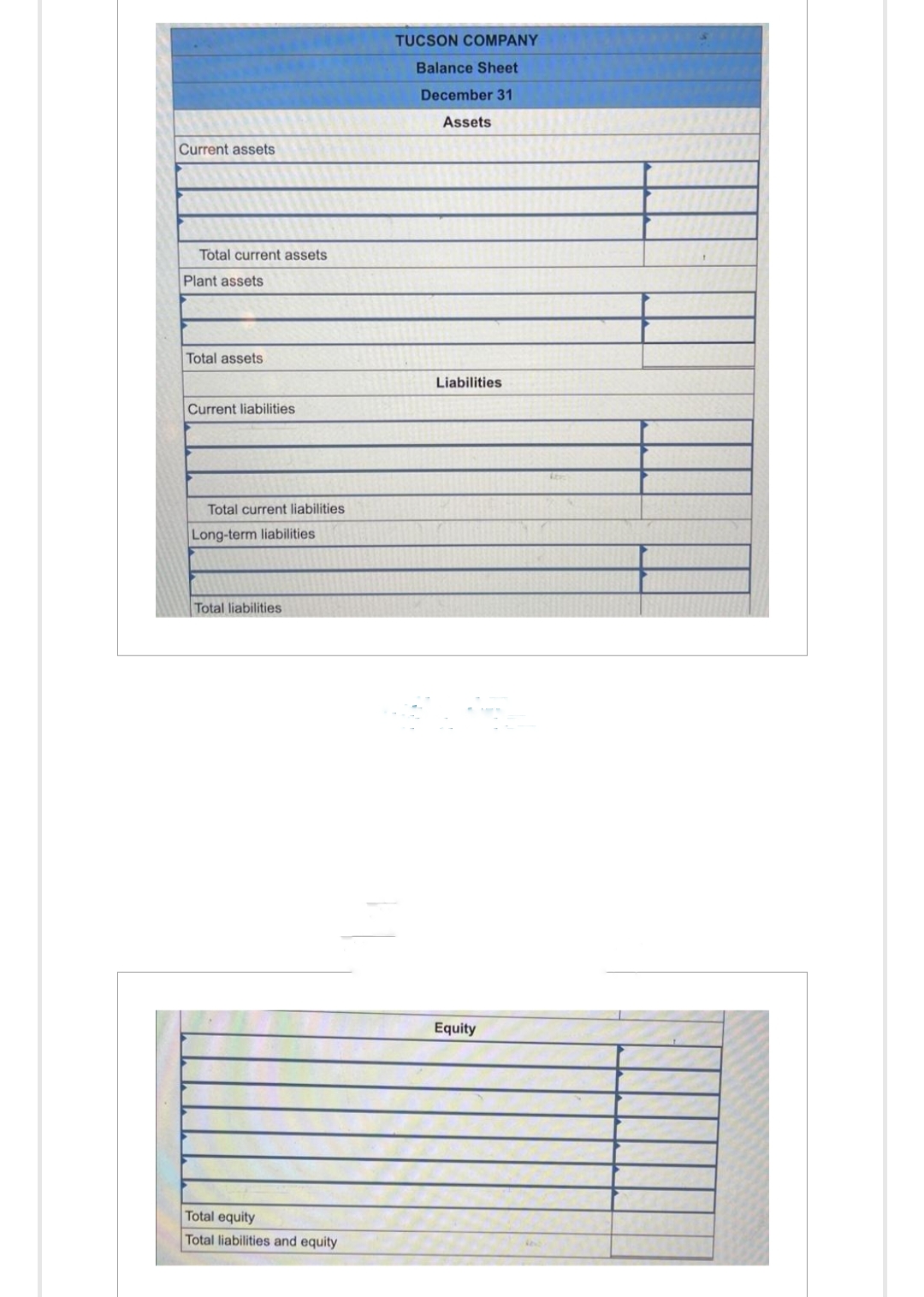

Q: Required: 1-a. What is the amount of current liabilities? Current liabilities 1-b. Compute working…

A: Current liabilities- Current liabilities are obligations to be paid in one year. These are given on…

Q: Ayayai, Inc. has identifiable assets with a total fair value of $6,019,000 and liabilities of…

A: Goodwill is the term which is defined as the intangible assets that arise when the buyer acquire the…

Q: Financial data for Beaker Company for last year appear below: Beaker Company Statements of Financial…

A: Operating income is the difference between total revenue and total operating expense of the…

Q: authorized J. Guerrero to operate as a franchisee for an initial franchisee fee of P1,500,000. Of…

A: Note receivable is one of the current asset being used in business. Unearned revenue is that revenue…

Q: On August 31, a hurricane destroyed a retail location of Vinny's Clothier including the entire…

A: Effective inventory management is important to the success of any business that sells physical…

Q: 1. Break-even point for each machine. 2. Level of sales at which profit is the same for the…

A: The break-even point is the level of sales at which the total revenue equals the total costs, and…

Q: Division X supplies partially completed units of product to division Y. The divisions negotiated a…

A: Given, Price = $30 plus 20% Units = 5,000 units.

Q: Required information [The following information applies to the questions displayed below.] Javier…

A: Answer:- Tax benefit meaning:- Any tax law that lowers the tax liability of the tax payer is…

Q: M11-5 (Algo) Calculating Accounting Rate of Return, Payback Period [LO 11-1, 11-2] Blue Marlin…

A: Payback period :— It is the time period in years which is required to recover all the cash outflows…

Q: following information pertains to Austin, Incorporated and Huston Company: Account Title Austin…

A: Ratio analysis is quantitive method of getting inside review of an organisation. Ratio analysis is…

Q: Steele's Enterprises has purchased a new machine tool which will allow the company to improve the…

A: Annual cash flow of a project to the amount that would be generated by the project on an annual…

Q: Grace Jones was just hired as an accounting intern at your company. Can you assist Grace and…

A: Direct material is the costs directly associated with the product. Conversion costs are the costs…

Q: Riverbed Corp was organized on January 1, 2025. It is authorized to issue 20,300 shares of 5%, $50…

A: Stated value of common stock is called as par value. Difference between issue price per share and…

Q: Summary financial information for Waterway Company is as follows. Compute the amount and percentage…

A: Percentage change is calculated by subtracting the previous year values from current year value and…

Q: During the year, Wright Company sells 520 remote-control airplanes for $100 each. The company has…

A: Last-In First-Out Method - Under the Last-In First-Out Method Company uses inventory in the…

Q: The predetermined overhead rate for Sheffield Corp. is $4, comprised of a variable overhead rate of…

A: Total overhead variance is a measure of the difference between the actual overhead costs incurred by…

Q: Discuss the types of transfer pricing policy available to a company and explain why a company needs…

A: Transfer pricing refers to the practice of pricing goods or services that are transferred between…

Q: Account Cash Accounts Receivable Inventory Supplies Prepaid Rent Land Building Accumulated…

A: Temporary accounts are those accounts which will be closed at the end of each accounting period.…

Q: Which of the following would be considered a general capital asset? Select one: a. Real estate…

A: Example of general Capital assets includes improvements to land, easements, buildings, building…

Q: The following information was obtained from Knox Company's income statement for 20-2, balance sheets…

A: Cash flow statements are the statements that determine the inflow and outflow of cash from three…

Q: 1. Express the balance sheets in common-size percents 2. Assuming annual sales have not changed in…

A: Lets understand the basics. Common size comparative statement is a statement which is expressed in…

Q: Kindly answer numbers 1-4.

A: The bank reconciliation statement is prepared to equate the balances of cash book and passbook with…

Q: CL Electronics is considering two plans for raising $2,000,000 to expand operations. Plan A is to…

A: INCOME STATEMENT Income Statement is one of the Important Financial Statement of the Company. Income…

Q: Problem 2-11 (AICPA Adapted) AAD 01-& eldos Pearl Company maintains a checking accounts at the City…

A: Bank reconciliation is prepared so that, the correct balance of cash in the bank can be known.

Q: At the end of June, the job cost sheets at Ace Roofers show the following costs accumulated on three…

A: Lets understand the basics. Predetermined overhead rate is calculated by the management in order to…

Q: It costs Bonita Industries $11 of variable and $5 of fixed costs to produce one scale which normally…

A: The fixed cost remains the same in every option. While if there is no production there is always a…

Q: Department F had 4,000 units in Work in Process that were 40% completed at the beginning of the…

A: Conversion cost is the cost incurred for converting raw materials into finished products. Therefore…

Q: The balance sheet data of Kohler Company at the end of 2021 and 2020 follow: 2021 2020 Cash $…

A: Cash flows from financing activities is one of the important section of cash flows statement. It…

Q: Problem 2-11 (AICPA Adapted) AN 01-& residos Pearl Company maintains a checking accounts at the City…

A: Bank reconciliation is prepared so that, the correct balance of cash in the bank can be known.

Q: 19 The 10% GST is applicable in this question. The perpetual system is used. On May 1, Retailer Co.…

A: The first step in the accounting process is to create journal entries, which are used to record a…

Q: Carmelita Inc., has the following information available: Costs from Costs from Beginning Inventory…

A: The conversion costs include the indirect costs incurred for the production. The unit cost is…

Q: Beautyme Ltd has 2 divisions. Division A has a Profit of £350,000 after charging the allocated head…

A: Residual income is a useful metric for evaluating the financial performance of a company because it…

Q: how did you get the -2500

A: CVP analysis is used to identify the changes in costs and volume affect a company's operating…

Q: A. What effect does the rental activity have on her AGI for the year?

A: Alexa's AGI from other sources = $90,000 As her AGI is less than $ 100,000 so…

Q: Product X sells for $35 per unit and has related variable costs of $25 per unit. The fixed costs of…

A: Number of units of product that must be sold to earn desired income = (Fixed cost + Desired…

Q: The following information relates to the pension plan for the employees of RR Co.: 1/1/19…

A: The gain or loss on plan assets is the difference between the actual return on plan assets and…

Q: The declaration, record, and payment dates in connection with a cash dividend of $1,525,000 on a…

A: Dividend is the company's distribution of profit to shareholders. Dividend comes out of retained…

Q: On Jan. 2, 2016, Gino Services Inc. signed an agreement authoring Triple 8 Company to operate as a…

A: Franchise means the right or licence granted to an entity to sell the goods or services in a…

Q: At the beginning of the year, Albertson Incorporated reports inventory of $7,700. During the year,…

A: Cost of goods sold means the amount of cost incurred on the making of the goods sold in the market.…

Q: VAT can be ignored on all transactions. The following transactions took place in the month of…

A: Accounting equation is one of fundamental concept being used in accounting. Three important elements…

Q: Sleep Tight, Inc., manufactures comforters. The estimated inventories on January 1 for finished…

A: The cost of goods sold (COGS) budget shows the expenses incurred for producing a product. The cost…

Q: On December 1, 2023, Carrie's Day Care receives $4,200 in advance for an agreement to care for…

A: The journal entries are prepared to record the transactions on regular basis. The adjustment entries…

Q: The following is Starfish Corporation's contribution format income statement for December 2023:…

A: Income statement :— It is one of the financial statement that shows profitability, total revenue and…

Please do not give solution in image format thanku

Step by step

Solved in 3 steps

- Contributed Capital Adams Companys records provide the following information on December 31, 2019: Additional information: 1. Common stock has a 5 par value, 50,000 shares are authorized, 15,000 shares have been issued and are outstanding. 2. Preferred stock has a 100 par value, 3,000 shares are authorized, 800 shares have been issued and are outstanding. Two hundred shares have been subscribed at 120 per share. The stock pays an 8% dividend, is cumulative, and is callable at 130 per share. 3. Bonds payable mature on January 1, 2023. They carry a 12% annual interest rate, payable semiannually. Required: Prepare the Contributed Capital section of the December 31, 2019, balance sheet for Adams. Include appropriate parenthetical notes.Cash Dividends on Common and Preferred Stock Lemon Inc. has the following information regarding its preferred and common stock: Preferred stock, S30 par, 12% cumulative; 300,000 shares authorized; 150,000 shares issued and outstanding Common stock, $2 par; 2,500,000 shares authorized; 1,200,000 shares issued; 1,000,000 outstanding As of December 31, 2019, Lemon was 3 years in arrears on its dividends. During 2020, Lemon declared and paid dividends. As a result, the common stockholders received dividends of $0.45 per share. Required: What was the total amount of dividends declared and paid? What journal entry was made at the date of declaration?Selected transactions completed by Equinox Products Inc. during the fiscal year ended December 31, 2016, were as follows: a. Issued 15,000 shares of 20 par common stock at 30, receiving cash. b. Issued 4, 000 shares of 80 par preferred 5% stock at 100, receiving cash. c. Issued 500,000 of 10-year, 5% bonds at 104, with interest payable semiannually. d. Declared a quarterly dividend of 0.50 per share on common stock and 1.00 per share on preferred stock. On the date of record, 100,000 shares of common stock were outstanding, no treasury shares were held, and 20,000 shares of preferred stock were outstanding. e. Paid the cash dividends declared in (d). f. Purchased 7,500 shares of Solstice Corp. at 40 per share, plus a 150 brokerage commission. The investment is classified as an available-for-sale investment. g. Purchased 8,000 shares of treasury common stock at 33 per share. h. Purchased 40,000 shares of Pinkberry Co. stock directly from the founders for 24 per share. Pinkberry has 125,000 shares issued and outstanding. Equinox Products Inc. treated the investment as an equity method investment. i. Declared a 1.00 quarterly cash dividend per share on preferred stock. On the date of record, 20,000 shares of preferred stock had been issued. j. Paid the cash dividends to the preferred stockholders. k. Received 27,500 dividend from Pinkberry Co. investment in (h). l. Purchased 90,000 of Dream Inc. 10-year, 5% bonds, directly from the issuing company, at their face amount plus accrued interest of 37 5. The bonds are classified as a held-to-maturity long -term investment. m. Sold, at 38 per share, 2,600 shares of treasury common stock purchased in (g). n. Received a dividend of 0 .60 per share from the Solstice Corp. investment in (f). o. Sold 1,000 shares of Solstice Corp. at 45, including commission. p. Recorded the payment of semiannual interest on the bonds issue d in (c) and the amortization of the premium for six months. The amortization is determined using the straight-line method . q. Accrued interest for three months on the Dream Inc. bonds purchased in (I). r. Pinkberry Co. recorded total earnings of 240 ,000. Equinox Products recorded equity earnings for its share of Pinkberry Co. net income. s. The fair value for Solstice Corp. stock was 39. 02 per share on December 31, 2016. The investment is adjusted to fair value , using a valuation allowance account. Assume Valuation Allowance for Available-for-Sale Investments h ad a beginning balance of zero. Instructions 1. Journalize the selected transactions. 2. After all of the transaction s for the year ended December 31, 201 6, had been poste d [including the transactions recorded in part (1) and all adjusting entries), the data that follows were taken from the records of Equinox Products Inc. a. Prepare a multiple-step in come statement for the year ended December 31, 201 6, concluding with earnings per share . In computing earnings per share, assume that the average number of common shares outstanding was 100,000 and preferred dividends were 100,000. ( Round earnings per share to the nearest cent.) b. Prepare a retained earnings statement for the year ended December 31, 20 6. c. Prepare a balance sheet in report form as of December 31, 2016.

- Raun Company had the following equity items as of December 31, 2019: Preferred stock, 9% cumulative, 100 par, convertible Paid-in capital in excess of par value on preferred stock Common stock, 1 stated value Paid-in capital in excess of stated value on common stock| Retained earnings The following additional information about Raun was available for the year ended December 31, 2019: 1. There were 2 million shares of preferred stock authorized, of which 1 million were outstanding. All 1 million shares outstanding were issued on January 2, 2016, for 120 a share. The preferred stock is convertible into common stock on a 1-for-1 basis until December 31, 2025; thereafter, the preferred stock ceases to be convertible and is callable at par value by the company. No preferred stock has been converted into common stock, and there were no dividends in arrears at December 31, 2019. 2. The common stock has been issued at amounts above stated value per share since incorporation in 2002. Of the 5 million shares authorized, 3,580,000 were outstanding at January 1, 2019. The market price of the outstanding common stock has increased slowly but consistently for the last 5 years. 3. Raun has an employee share option plan where certain key employees and officers may purchase shares of common stock at 100% of the marker price at the date of the option grant. All options are exercisable in installments of one-third each year, commencing 1 year after the date of the grant, and expire if not exercised within 4 years of the grant date. On January 1, 2019, options for 70,000 shares were outstanding at prices ranging from 47 to 83 a share. Options for 20,000 shares were exercised at 47 to 79 a share during 2019. During 2019, no options expired and additional options for 15,000 shares were granted at 86 a share. The 65,000 options outstanding at December 31, 2019, were exercisable at 54 to 86 a share; of these, 30,000 were exercisable at that date at prices ranging from 54 to 79 a share. 4. Raun also has an employee share purchase plan whereby the company pays one-half and the employee pays one-half of the market price of the stock at the date of the subscription. During 2019, employees subscribed to 60,000 shares at an average price of 87 a share. All 60,000 shares were paid for and issued late in September 2019. 5. On December 31, 2019, there was a total of 355,000 shares of common stock set aside for the granting of future share options and for future purchases under the employee share purchase plan. The only changes in the shareholders equity for 2019 were those described previously, the 2019 net income, and the cash dividends paid. Required: Prepare the shareholders equity section of Rauns balance sheet at December 31, 2019. Substitute, where appropriate, Xs for unknown dollar amounts. Use good form and provide full disclosure. Write appropriate notes as they should appear in the publisher financial statements.Cumulative Preferred Dividends Capital stock of Barr Company includes: As of December 31, 2018, 2 years dividends are in arrears on the preferred stock. During 2019, Barr plans to pay dividends that total S360.000. Required: Determine the amount of dividends that will be paid to Barrs common and preferred stockholders in 2019. If Barr paid $280,000 of dividends, determine how much each group of stockholders would receive.Stock Dividends Crystal Corporation has the following information regarding its common stock: S10 par. with 500.000 shares authorized, 213,000 shares issued, and 183,700 shares outstanding. On August 22, 2019, Crystal declared and paid a 15% stock dividend when the market price of the common stock was $30 per share. Required: Prepare the journal entries to record declaration and payment of this stock dividend. Prepare the journal entries to record declaration and payment assuming it was a 30% stock dividend.

- STOCK ISSUANCE (NONCASH ASSETS, SUBSCRIPTIONS, AND TREASURY STOCK) Brant Evans had the following stock transactions during the year: (a) Issued 6,000 shares of common stock with a 5 par value in exchange for real estate (land) with a fair market value of 33,500. (b) Issued 5,500 shares of common stock with a 5 par value and 7 fair market value in exchange for a building with an uncertain fair market value. (c) Received subscriptions for 11,000 shares of 5 par common stock for 58,000. (d) Received a payment of 29,000 on the stock subscription in transaction (c). (e) Received the balance in full for the stock subscription in transaction (c) and issued the stock. (f) Purchased 2,000 shares of its own 5 par common stock for 6 a share. (g) Sold 1,000 shares of the treasury stock in transaction (f) for 6.50 a share. (h) Sold 1,000 shares of the treasury stock in transaction (f) for 5.75 a share. Prepare general journal entries for these transactions, identifying each by letter.Common Dividends Thompson Payroll Service began in 2019 with 1,500,000 authorized and 820,000 issued and outstanding S8 par common shares. During 2019, Thompson entered into the following transactions: Declared a S0.20 per-share cash dividend on March 24. Paid the S0.20 per-share dividend on April 6. Repurchased 13,000 common shares for the treasury at a cost of S12 each on May 9. Sold 2,500 unissued common shares for $15 per share on June 19. Declared a $0.40 per-share cash dividend on August 1. Paid the $0.40 per-share dividend on September 14. Declared and paid a 10% stock dividend on October 25 when the market price of the common stock was $15 per share. Declared a 50.45 per-share cash dividend on November 20. Paid the $0.45 per-share dividend on December 20. Required: Prepare journal entries for each of these transactions. (Note: Round to the nearest dollar.) What is the total dollar amount of dividends (cash and stock) for the year? CONCEPTUAL CONNECTION Determine the effect on total assets and total stockholders equity of these dividend transactions.Treasury Stock, Cost Method Bush-Caine Company reported the following data on its December 31, 2018, balance sheet: The following transactions were reported by the company during 2019: 1. Reacquired 200 shares of its preferred stock at 57 per share. 2. Reacquired 500 shares of its common stock at 16 per share. 3. Sold 100 shares of preferred treasury stock at 58 per share. 4. Sold 200 shares of common treasury stock at 17 per share. 5. Sold 100 shares of common treasury stock at 9 per share. 6. Retired the shares of common stock remaining in the treasury. The company maintains separate treasury stock accounts and related additional paid-in capital accounts for each class of stock. Required: 1. Prepare the journal entries required to record the treasury stock transactions using the cost method. 2. Assuming the company earned a net income in 2019 of 30.000 and declared and paid dividends of 10,000, prepare the shareholders equity section of its balance sheet at December 31, 2019.

- Preferred Dividends Eastern Inc.s equity includes 8%, $25 par preferred stock. There are 100,000 shares authorized and 45,000 shares outstanding. Assume that Eastern declares and pays preferred dividends quarterly. Required: Prepare the journal entry to record declaration of one quarterly dividend. Prepare the journal entry to record payment of the one quarterly dividend.Stock Dividend The balance sheet of Cohen Enterprises includes the following stockholders equity section: Required: On April 15, 2019, when its stock was selling for $18 per share, Cohen Enterprises issued a small stock dividend. After making the journal entry to recognize the stock dividend, Cohens total capital stock increased by $270,000. In percentage terms, what was the size of the stock dividend? Ignoring the small stock dividend discussed in Requirement 1, assume that on June 1, 2019, when its stock was selling for $22 per share, Cohen issued a large stock dividend. After making the journal entry to recognize the stock dividend, Cohens retained earnings decreased by $75,000. In percentage terms, what was the size of the stock dividend?The Castle Company recently reported net profits after taxes of $15.8 million. It has 2.5 million shares of common stock outstanding and pays preferred dividends of $1 million a year. The company’s stock currently trades at $60 per share. Compute the stock’s earnings per share (EPS). What is the stock’s P/E ratio? Determine what the stock’s dividend yield would be if it paid $1.75 per share to common stockholders.