Companies use capital investment analysis to evaluate long-term investments. Capital investment evaluation methods that use present values are (1) Net present value method (NPV) and (2) Internal rate of return (IRR) method. Methods That Use Present Values Of the two capital investment evaluation methods, a defining characteristic NPV and IRR is that they the time value of money. This means that money tomorrow is worth money today. And, that cash invested today has the potential to earn income and in value over time.

Mastery Problem:

Part One

Companies use capital investment analysis to evaluate long-term investments. Capital investment evaluation methods that use present values are (1) Net present value method (NPV) and (2) Internal rate of return (IRR) method.

Methods That Use Present Values

Of the two capital investment evaluation methods, a defining characteristic NPV and IRR is that they

the time value of money. This means that money tomorrow is worth

money today. And, that cash invested today has the potential to earn income and

in value over time.

True or False: When making an investment decision between two mutually exclusive projects, the project with the greatest

Review the definition of Methods that use present value by rolling your mouse over the underlined item.

Review the definition of Mutually Exclusive Projects by rolling your mouse over the underlined item.

Part Two

Net Present Value Method

Net present value (NPV) is one method that can be used to evaluate the financial viability of potential projects. It determines the present value of all future

acceptable rate of return that an investment must yield for it to make sense economically. Managers often choose a required rate of return above their cost of capital to ensure that the inherent uncertainties surrounding future cash flows is addressed. This can be risky, however, as it biases the process toward short-term projects. If the NPV is positive, then the project should be

; if it is negative, then the project should be

.

Let's look at a net present value example using the present value of an ordinary annuity table.

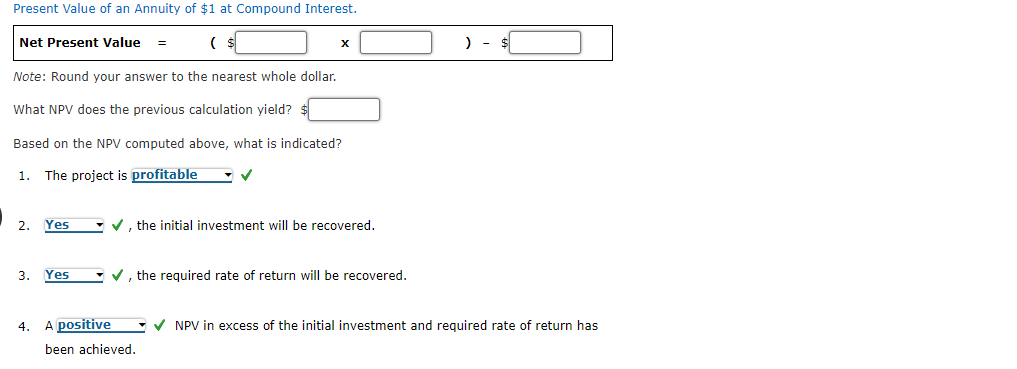

The company has a project with a 5-year life that requires an initial investment of $190,000, and is expected to yield annual cash flows of $58,000. What is the net present value of the project if the required rate of return is set at 12%?

Calculation Steps

part A

The statement is true.

Towards making inveatment decision of mutually exclusive projects ,NPV or IRR method is being considered.

If NPV is positive the project should be accepted.

If NPV is negative, the project should be rejected

Trending now

This is a popular solution!

Step by step

Solved in 2 steps