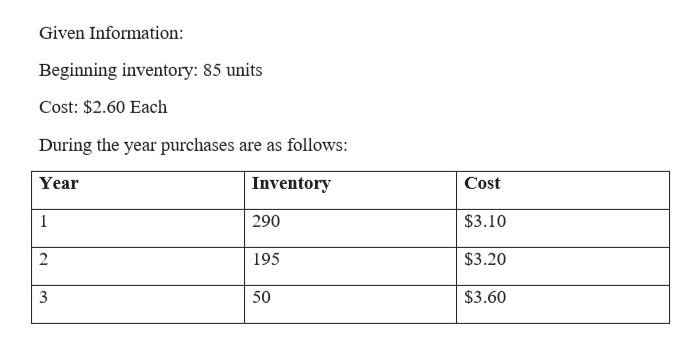

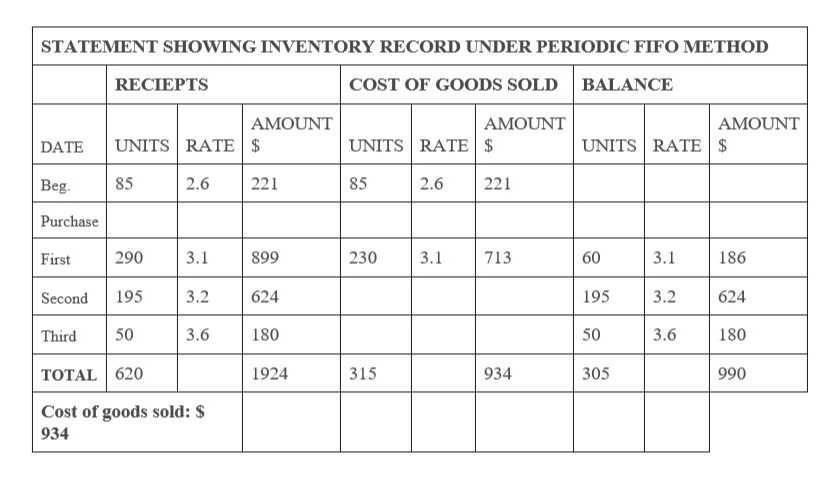

Company "A" started the period with 85 units in beginning inventory that cost $2.60 each. During the period, the company purchased inventory items as follows. Company sold 315 units after purchase 3 for $10.80 each. Purchase, No. of Items, Cost1 290 $ 3.102 195 $ 3.203 50 $ 3.60Companies cost of goods sold under FIFO would be

Company "A" started the period with 85 units in beginning inventory that cost $2.60 each. During the period, the company purchased inventory items as follows. Company sold 315 units after purchase 3 for $10.80 each. Purchase, No. of Items, Cost1 290 $ 3.102 195 $ 3.203 50 $ 3.60Companies cost of goods sold under FIFO would be

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter7: Inventories: Cost Measurement And Flow Assumptions

Section: Chapter Questions

Problem 3RE: Reid Company uses the periodic inventory system. On January 1, it had an inventory balance of...

Related questions

Topic Video

Question

Company "A" started the period with 85 units in beginning inventory that cost $2.60 each. During the period, the company purchased inventory items as follows. Company sold 315 units after purchase 3 for $10.80 each. Purchase, No. of Items, Cost

1 290 $ 3.10

2 195 $ 3.20

3 50 $ 3.60

Companies cost of goods sold under FIFO would be

Expert Solution

Step 1

Step 2

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College