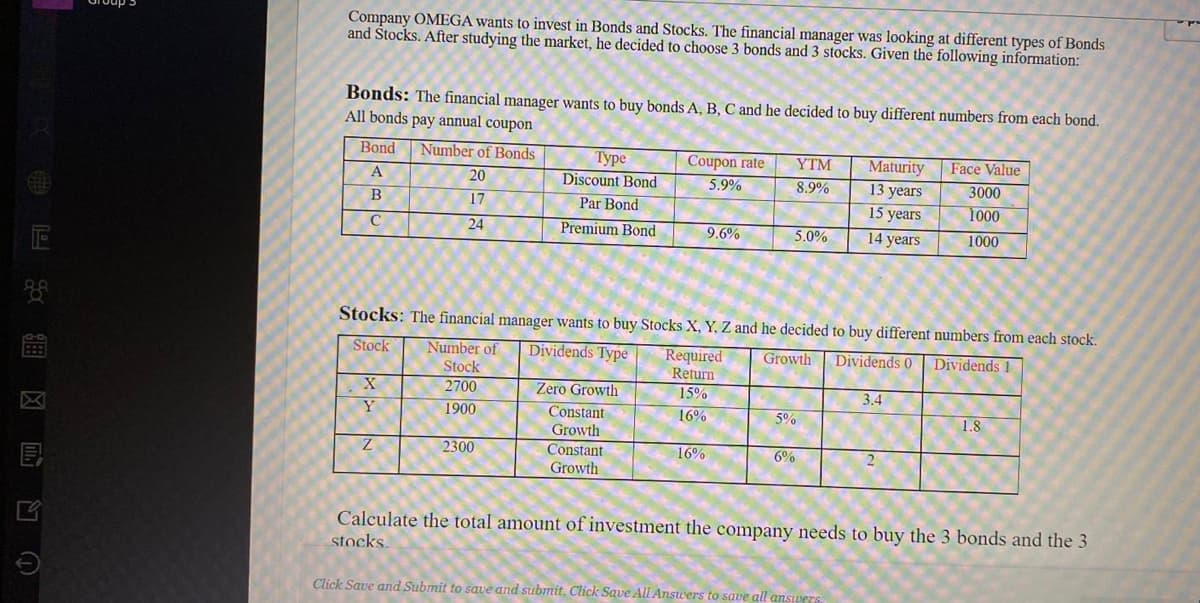

Company OMEGA wants to invest in Bonds and Stocks. The financial manager was looking at different types of Bonds and Stocks. After studying the market, he decided to choose 3 bonds and 3 stocks. Given the following information: Bonds: The financial manager wants to buy bonds A, B, C and he decided to buy different numbers from each bond. All bonds pay annual coupon Bond Number of Bonds Maturity Coupon rate 5.9% YTM Face Value Туре Discount Bond Par Bond A 20 8.9% 13 years 3000 17 15 years 1000 C 24 Premium Bond 9.6% 5.0% 14 years 1000 Stocks: The financial manager wants to buy Stocks X, Y, Z and he decided to buy different numbers from each stock. Stock Number of Dividends Type Required Return 15% Growth Dividends 0 Dividends 1 Stock X 2700 Zero Growth 3.4 1900 Constant Growth Constant Y 16% 5% 1.8 2300 16% 6% Growth Calculate the total amount of investment the company needs to buy the 3 bonds and the 3 stocks.

Company OMEGA wants to invest in Bonds and Stocks. The financial manager was looking at different types of Bonds and Stocks. After studying the market, he decided to choose 3 bonds and 3 stocks. Given the following information: Bonds: The financial manager wants to buy bonds A, B, C and he decided to buy different numbers from each bond. All bonds pay annual coupon Bond Number of Bonds Maturity Coupon rate 5.9% YTM Face Value Туре Discount Bond Par Bond A 20 8.9% 13 years 3000 17 15 years 1000 C 24 Premium Bond 9.6% 5.0% 14 years 1000 Stocks: The financial manager wants to buy Stocks X, Y, Z and he decided to buy different numbers from each stock. Stock Number of Dividends Type Required Return 15% Growth Dividends 0 Dividends 1 Stock X 2700 Zero Growth 3.4 1900 Constant Growth Constant Y 16% 5% 1.8 2300 16% 6% Growth Calculate the total amount of investment the company needs to buy the 3 bonds and the 3 stocks.

Financial Management: Theory & Practice

16th Edition

ISBN:9781337909730

Author:Brigham

Publisher:Brigham

Chapter5: Bonds, Bond Valuation, And Interest Rates

Section: Chapter Questions

Problem 11P: Goodwynn & Wolf Incorporated (G&W) issued a bond 7 years ago. The bond had a 20-year maturity, a 14%...

Related questions

Question

Transcribed Image Text:Company OMEGA wants to invest in Bonds and Stocks. The financial manager was looking at different types of Bonds

and Stocks. After studying the market, he decided to choose 3 bonds and 3 stocks. Given the following information:

Bonds: The financial manager wants to buy bonds A, B, C and he decided to buy different numbers from each bond.

All bonds pay annual coupon

Bond

Number of Bonds

Туре

YTM

Coupon rate

5.9%

Maturity Face Value

13 years

A

20

Discount Bond

8.9%

3000

B

17

Par Bond

15 years

1000

24

Premium Bond

9.6%

5.0%

14 years

1000

Stocks: The financial manager wants to buy Stocks X, Y, Z and he decided to buy different numbers from each stock.

Stock

Number of

Stock

Dividends Type

Required

Return

15%

Dividends 0

Growth

Dividends 1

2700

Zero Growth

3.4

区

Y

1900

Constant

16%

5%

1.8

Growth

2300

Constant

Growth

16%

6%

2

Calculate the total amount of investment the company needs to buy the 3 bonds and the 3

stocks.

Click Save and Submit to save and submit. Click Save AllAnswers to save all answers

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT