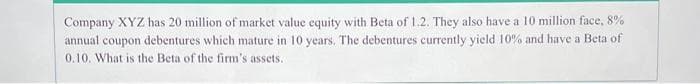

Company XYZ has 20 million of market value equity with Beta of 1.2. They also have a 10 million face, 8% annual coupon debentures which mature in 10 years. The debentures currently yield 10% and have a Beta of 0.10. What is the Beta of the firm's assets.

Q: What is its WACC

A: WACC is the weighted average company’s cost of capital, that is debt and equity. Cost is the return…

Q: A firm has 10,000,000 shares of common stock outstanding, each with a market price of $15.00 per…

A: given, coupon rate =9%n =15market price = $1020 let par = $1000

Q: Welltodo Ltd has the following capital structure, which it considers to be optimal: debt = 15%,…

A: Note : Dividend Discount Model applies to those companies who use to pay dividends and Capital Asset…

Q: A firm has 2,000,000 shares of common stock outstanding with a market price of $2.00 per share. It…

A: Weighted average cost of capital (WACC) is the overall cost of the funds deployed in a company or…

Q: Acetate, Inc. has equity with a market value of $20 million and debt with a market value of $10…

A: Debt to equity ratio = Debt Market value / Equity Market value

Q: The equity beta of Fence Co is 0·9 and the company has issued 10 million ordinary shares. The market…

A: The question is related to Cost and Capital Asset Pricing Model. The Weighted Average Cost of…

Q: If Wild Widgets, Inc., were an all-equity company, it would have a beta of .90. The company has a…

A: Cost of Debt:Cost of Debt is the amount or rate which a company bears on the borrowings. It also…

Q: PTCL has the following capital structure, which it consider to be optimal : debt =25%, preferred…

A: Calculation of cost of debt, preferred stock and common stock: Excel workings:

Q: Determine the company’s WACC

A: WACC: WACC (weighted average cost of capital) is the cost of capital of the firm. It is composed of…

Q: a. If the Treasury bill rate is 3% and the market risk premium is estimated at 7%., what is ABC’s…

A: Information Provided: Coupon rate = 6% Semi-Annual Payments Face value = $1000 Term = 30 years Bonds…

Q: Low Fly Airline is expected to pay a dividend of $7 in the coming year. Dividends are expected to…

A: As per CAPM, Required return = risk free rate + beta * (market return - risk free rate) = 6% + 3.00…

Q: A company has its debt structured as a single zero-coupon bond that matures in 5 years. The face…

A: The Black Scholes model needs to be used to solve for this question. The existence of volatility and…

Q: Frank & Sons, a 100% equity financed firm, has a beta equal to 1.3. The firm’s stock is currently…

A: As per CAPM, Expected Return = Risk free Rate + beta * (Market return - risk free rate) Firm's cost…

Q: The market value of Fords' equity, preferred stock, and debt are $6 billion, $2 billion, and $11…

A: Weighted Average Cost of Capital (WACC) is the rate at which the company is willing to pay to its…

Q: Barbie's Boutique is interested in going to the market to raise additional capital. A year ago,…

A: Using CAPM Model

Q: Mackenzie Company has a price of $33 and will issue a dividend of $2.00 next year. It has a beta of…

A: Dividends are a part of net income that is paid to the shareholder of the company in the form of a…

Q: Daves Inc. recently hired you as a consultant to estimate the company's WACC. You have obtained the…

A: WACC = (Weight of debt * cost of debt) + (Weight of equity * Cost of equity)

Q: Daves Inc. recently hired you as a consultant to estimate the company’s WACC. You have obtained the…

A: Annual coupon= 8.00% Par value= $1,000 Market price= $1,050.00 Tax rate= 40% Risk-free rate= 4.50%…

Q: isters Ltd is planning to invest in a capital project, which will generate cash inflows of $15,000…

A: We need to use WACC as discount rate to calculate present value of cash inflowsPresent value…

Q: Acort Industries has 15 million shares outstanding and a current share price of $44 per share. It…

A: WACC: The WACC (weighted average cost of capital) is a financial measure that determines how much a…

Q: Portage Bay Enterprises has $4 million in excess cash, no debt, and is expected to have free cash…

A: Data given: Excess cash= $4 million Debt= nil Expected free cash flow next year = $ 14 million…

Q: Bruce Wayne Communications has a capital structure that consists of 70 percent common stock and 30…

A: The answer is stated below:

Q: The Globe Incorporated has EBIT of P20 million for the current year. On the firm balance sheet,…

A: The firm's value is the total market value of debt and the market value of equity components. Given…

Q: MikklesonMining stock is selling for $40 per share and has an expected dividend in the coming year…

A: Frist we need to calculate currant price of bond by using this equation Bond price =C*1-1(1+r)nr…

Q: Troj Services' CFO is interested in estimating the company's WACC and has collected the following…

A: The return an investor expects to receive from the market for the investment is called average…

Q: A firm has 10,000,000 shares of common stock outstanding, each with a market price of $15 per share.…

A: Beta = 1.9 Expected Return on Market portfolio = 10% Risk Free Rate = 4%

Q: Mikkleson Mining stock is selling for $40 per share and has an expected dividend in the coming year…

A: Current Dividend = $2 Growth Rate = 5% Discount Rate = 10%

Q: Titan Mining Corporation has 9 million shares of common share outstanding and 120,000 semiannual…

A: Given information: Number of common shares outstanding is 9 million and sells for $34 per share…

Q: Avery Corporation's recently hired you as a consultant to estimate WACC. You have obtained the…

A: MS-Excel --> Formulas --> Financials --> Rate Therefore, the pre-tax cost of debt is…

Q: what rate should the firm use to discount the project’s cash flows?

A:

Q: Titan Mining Corporation has 10 million shares of common stock outstanding and 400,000 bonds…

A: Number of common stocks = 10 million Number of bonds = 400000 Bond's coupon (C) = (5% of 1000) / 2 =…

Q: Mackenzie Company has a price of $31 and will issue a dividend of $2.00 next year. It has a beta of…

A: Equity refers to that portion of the capital that is funded by the owners of the company. The cost…

Q: The common stock of ABX, Inc. has a beta of 0.90. The Treasury bill rate is 4% and the market risk…

A: The capital budgeting is a technique that helps to analyze the profitability of the project and…

Q: ABC Incorporated’s stock is selling for $40 per share and has an expected dividend in the coming…

A: The computation of the price of the bond at the end of the 3rd year is as follows: The formulae…

Q: Mackenzie Company has a price of $38 and will issue a dividend of $2.00 next year. It has a beta of…

A: Current Price (Po) =$38 Dividend for next year (D1) = $2.00 Beta = 1.3 Risk Free Rate (Rf) = 5.3%…

Q: The market value of Fords' equity, preferred stock and debt are $8 billion, $2 billion, and $15…

A: Cost of Equity is calculated by Capital Asset Pricing Model. Cost of Equity Ke = Risk free rate +…

Q: Sheltech Real State company is currently paying dividnd of Tk 3.75 per share, which is expected to…

A: Dividend discount model- It is a method of valuing a company's stock price based on the logic that…

Q: Saeed Construction’s CFO has the following information to estimate the company’s weighted average…

A: Ms-Excel --> Formulas --> Financials --> Rate Therefore, the cost of debt is 9.11%.

Q: Preston Corp. is estimating its WACC. Its target capital structure is 20 percent debt, 20 percent…

A: Equity expense= Risk free rate+ Beta*Market risk premium = 3%+1.2*5% = 9% Preferred Inventory…

Q: A firm has 10,000,000 shares of common stock outstanding, each with a market price of $15.00 per…

A: According to the rule, we will answer the first three subparts for the remaining subparts, kindly…

Q: One-year estimates suggest that Mulligan Manufacturing (MM) has a 20% probability of being worth…

A: The cost of equity seems to be the return required by a firm to determine if an investment fulfills…

Q: Mackenzie Company has a price of $37 and will issue a dividend of $2.00 next year. It has a beta of…

A: Using CAPM

Please solve...

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

- The earnings, dividends, and stock price of Shelby Inc. are expected to grow at 8% per year in the future. Shelby's common stock sells for $28.50 per share, its last dividend was $2.50, and the company will pay a dividend of $2.70 at the end of the current year. If the firm's beta is 2.0, the risk-free rate is 5%, and the expected return on the market is 13%, then what would be the firm's cost of equity based on the CAPM approach? Round your answer to two decimal places. %The earnings, dividends, and stock price of Shelby Inc. are expected to grow at 8% per year in the future. Shelby's common stock sells for $28.50 per share, its last dividend was $2.50, and the company will pay a dividend of $2.70 at the end of the current year. If the firm's beta is 2.0, the risk-free rate is 5%, and the expected return on the market is 13%, then what would be the firm's cost of equity based on the CAPM approach? Round your answer to two decimal places. % If the firm's bonds earn a return of 11%, then what would be your estimate of rs using the over-own-bond-yield-plus-judgmental-risk-premium approach? Round your answer to two decimal places. (Hint: Use the midpoint of the risk premium range.) % On the basis of the results of parts a through c, what would be your estimate of Shelby's cost of equity? Assume Shelby values each approach equally. Round your answer to two decimal places. %The earnings, dividends, and stock price of Shelby Inc. are expected to grow at 8% per year in the future. Shelby's common stock sells for $30 per share, its last dividend was $1.50, and the company will pay a dividend of $1.62 at the end of the current year. Using the discounted cash flow approach, what is its cost of equity? Round your answer to two decimal places. % If the firm's beta is 1.8, the risk-free rate is 10%, and the expected return on the market is 12%, then what would be the firm's cost of equity based on the CAPM approach? Round your answer to two decimal places. % If the firm's bonds earn a return of 10%, then what would be your estimate of rs using the own-bond-yield-plus-judgmental-risk-premium approach? (Hint: Use the mid-point of the risk premium range.) Round your answer to two decimal places. % On the basis of the results of parts a–c, what would be your estimate of Shelby's cost of equity? Assume Shelby values each approach equally. Round your answer…

- Suppose the Machine Corp. has a capital structure of 80% equity and 20% debt with the following information: a Beta of 1.3, Market Risk Premium of 10%. Kamino's average long term debt pays a 10% annual coupon with ten years to maturity, currently selling for $800 (face value of $1,000). If Kamino's tax rate is 20% and the risk free rate is 2%, what is the Weighted Average Cost of Capital?The Carpetto’s stock currently sells for $23 per share, will pay a dividend of $2.14 at the end of the current year, and the dividend is expected to grow at 7 percent per year in the future. Using the DDM approach, what is its cost of common equity? If the firm’s beta is 1.6, the risk-free rate is 9 percent, and the average return on the market is 13 percent, what will be the firm’s cost of common equity using the CAPM approach? If the estimated cost of equity is not the same using the CAPM and DDM approaches, how we can decide on the proper value for cost of equity? Explain.National Corporation's stock is currently selling for P160.00 per share and the firm's dividends are expected to grow at 5 percent indefinitely. In addition, National Corporation's most recent dividend was P5.50. If the expected risk free rate of return is 3 percent, the expected market return is 8 percent, and National Corporation has a beta of 1.2, National Corporation's stock would be ________.

- Xila-Fone Corp. expects to earn $4.00 per share next year, with an expected payout of 30%. Investors expect the dividend to grow at a constant rate of 8% for the foreseeable future. The risk-free rate is 5%, and the beta that is 10% more volatile than the market as a whole, and the expected return on the market is 14%. What is the estimated price of the stock?Petmart recently hired Jim as a consultant to estimate the company’s WACC. Jim has obtained the following information. (1) The firm's noncallable bonds mature in 20 years, have an 8.00% annual coupon, a par value of $1,000, and a market price of $1,050.00. (2) The company’s tax rate is 40%. (3) The risk-free rate is 4.50%, the market risk premium is 5.50%, and the stock’s beta is 1.80. (4) The target capital structure consists of 45% debt and the balance is common equity. The firm uses CAPM to estimate the cost of common stock, and it does not expect to issue any new shares. What is its WACC?Saeed Construction’s CFO has the following information to estimate the company’s weighted average cost of capital:The company currently has 20-year, 8.5% semi-annual coupon bonds that currently sells for Rs.945.The company’s stock has a beta of 0.80.The market risk premium, RPm , equals 3%.The risk-free rate is 2.4% and market rate is 5.4%. The company’s growth (g) = 0%, stock price (P0) = Rs.50, current dividend (D0) = Rs.2 and additional/new equity flotation cost = 15%.The company has outstanding preferred stock that pays a Rs.2.00 annual dividend. The preferred stock sells for Rs.25 a share.The company’s tax rate is 40%. The company’s capital structure consists of 40% long-term debt, 40% common stock, and 20% preferred stock. Requirement: Calculate Component cost of debt, cost of equity, cost of preferred stock and weighted average cost of capital.

- Suppose Mechis Technologies has a capital structure of 40% equity and 60% debt with the following information: a Beta of 0.7, Market Risk Premium of 5%. Mechis's average long term debt pays a 5% annual coupon with fifteen years to maturity, currently selling for $980 (face value of $1,000). If Mechis's tax rate is 15% and the risk free rate is 3%, what is the Weighted Average Cost of Capital?Todd Mountain Development Corporation is expected to pay a dividend of $3 in the upcoming year. Dividends are expected to grow at the rate of 9% per year. The risk-free rate of return is 5%, and the expected return on the market portfolio is 20%. The stock of Todd Mountain Development Corporation has a beta of 0.60. Using the constant-growth DDM,calculate the intrinsic value of the stock.