What is the total amount that was disclosed as compensation to key management personnel for the parent company of LBP Co. in 2014?

What is the total amount that was disclosed as compensation to key management personnel for the parent company of LBP Co. in 2014?

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter3: Taxes On The Financial Statements

Section: Chapter Questions

Problem 3BD

Related questions

Question

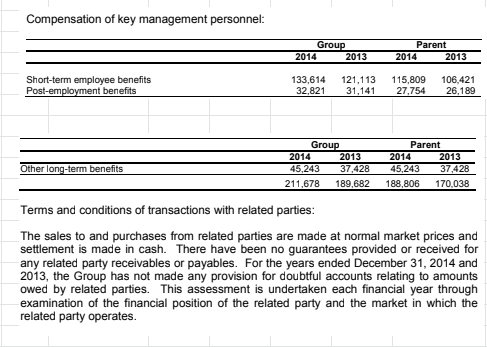

What is the total amount that was disclosed as compensation to key management personnel for the parent company of LBP Co. in 2014?

a. 211678

b. 189682

c. 188806

d. 170038

Transcribed Image Text:Compensation of key management personnel:

Group

Parent

2013

2014

2013

2014

Short-term employee benefits

Post-employment benefits

133,614

32,821

121,113

31,141

115,809

27,754

106,421

26,189

Group

2013

2014

45,243

37,428

Parent

2014

2013

45,243

Other long-term benefits

37,428

211,678

189,682

188,806

170,038

Terms and conditions of transactions with related parties:

The sales to and purchases from related parties are made at normal market prices and

settlement is made in cash. There have been no guarantees provided or received for

any related party receivables or payables. For the years ended December 31, 2014 and

2013, the Group has not made any provision for doubtful accounts relating to amounts

owed by related parties. This assessment is undertaken each financial year through

examination of the financial position of the related party and the market in which the

related party operates.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you