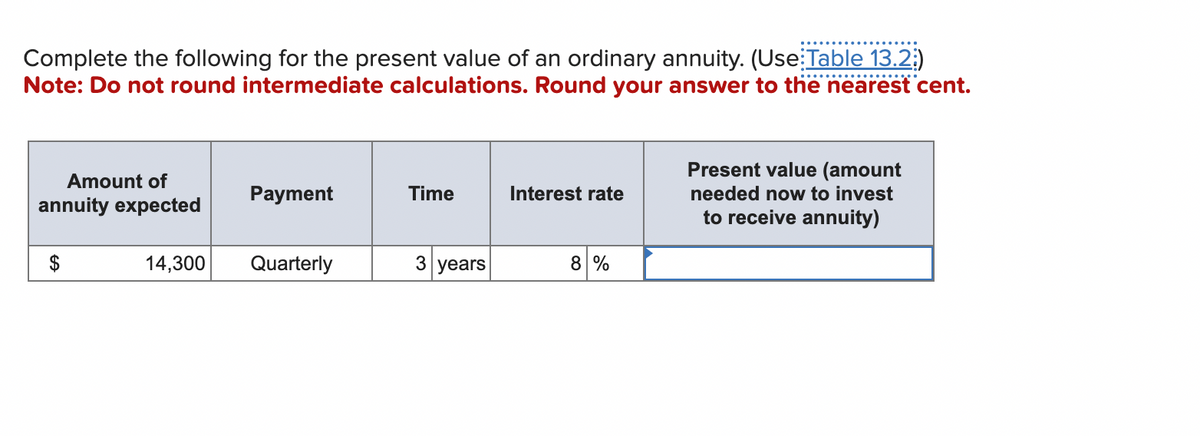

Complete the following for the present value of an ordinary annuity. (Use Table 13.2) Note: Do not round intermediate calculations. Round your answer to the nearest cent. Amount of annuity expected $ 14,300 Payment Quarterly Time 3 years Interest rate 8 % Present value (amount needed now to invest to receive annuity)

Complete the following for the present value of an ordinary annuity. (Use Table 13.2) Note: Do not round intermediate calculations. Round your answer to the nearest cent. Amount of annuity expected $ 14,300 Payment Quarterly Time 3 years Interest rate 8 % Present value (amount needed now to invest to receive annuity)

Essentials Of Investments

11th Edition

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Chapter1: Investments: Background And Issues

Section: Chapter Questions

Problem 1PS

Related questions

Question

Transcribed Image Text:Complete the following for the present value of an ordinary annuity. (Use Table 13.2)

Note: Do not round intermediate calculations. Round your answer to the nearest cent.

Amount of

annuity expected

14,300

Payment

Quarterly

Time

3 years

Interest rate

8 %

Present value (amount

needed now to invest

to receive annuity)

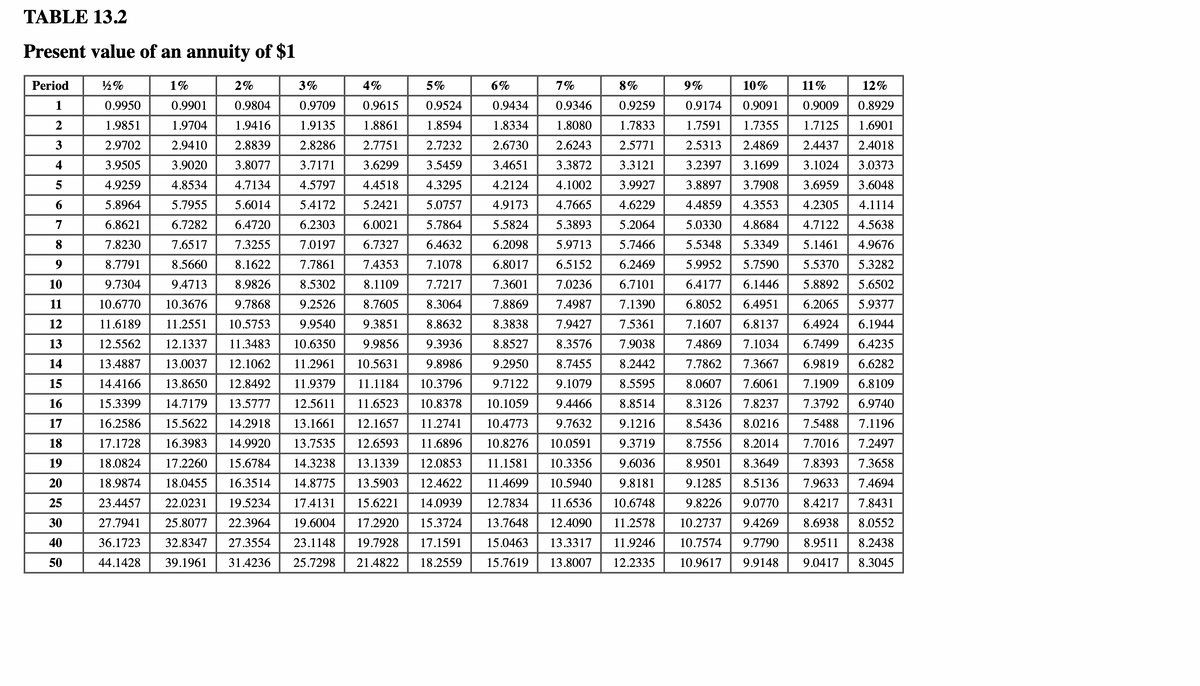

Transcribed Image Text:TABLE 13.2

Present value of an annuity of $1

½%

6%

7%

1%

0.9901

1.9704

2%

0.9804

3%

0.9709

4%

0.9615

0.9950

1.9851

1.9416

1.9135

1.8861

5%

0.9524

1.8594

2.7232

3.5459

4.3295

2.9702

2.9410 2.8839

2.7751

2.8286

3.7171

3.9505

3.9020

3.6299

4.9259

4.4518

3.8077

4.8534 4.7134 4.5797

5.7955 5.6014

6.7282 6.4720

5.8964

5.2421

6.8621

5.4172

6.2303

7.0197

6.0021

7.8230

7.6517 7.3255

8.7791

8.5660

7.7861

8.1622

8.9826

5.0757

5.7864

6.7327 6.4632

7.4353 7.1078

8.1109 7.7217

8.3064

8.8632

9.7304

9.4713

8.5302

10.6770 10.3676 9.7868

9.2526

8.7605

8%

0.9434 0.9346 0.9259

1.8334 1.8080 1.7833

2.6730 2.6243 2.5771

3.4651 3.3872 3.3121

4.2124 4.1002 3.9927

4.9173 4.7665 4.6229

5.5824 5.3893 5.2064

6.2098

5.9713 5.7466

6.8017 6.5152 6.2469

7.3601 7.0236 6.7101

7.8869 7.4987 7.1390

11.2551 10.5753

8.3838 7.9427 7.5361

12.1337

9.9856

8.8527 8.3576 7.9038

13.4887 13.0037 12.1062 11.2961 10.5631 9.8986

8.2442

14.4166 13.8650 12.8492 11.9379 11.1184 10.3796 9.7122 9.1079 8.5595

15.3399 14.7179 13.5777 12.5611 11.6523 10.8378 10.1059 9.4466 8.8514

16.2586 15.5622 14.2918 13.1661 12.1657 11.2741 10.4773 9.7632 9.1216

17.1728 16.3983 14.9920 13.7535 12.6593 11.6896 10.8276 10.0591 9.3719

18.0824 17.2260 15.6784 14.3238 13.1339 12.0853 11.1581 10.3356 9.6036

18.9874 18.0455 16.3514 14.8775 13.5903 12.4622 11.4699 10.5940 9.8181

23.4457 22.0231 19.5234 17.4131 15.6221 14.0939 12.7834 11.6536 10.6748

27.7941 25.8077 22.3964 19.6004 17.2920 15.3724 13.7648 12.4090 11.2578

36.1723 32.8347 27.3554 23.1148 19.7928 17.1591 15.0463 13.3317 11.9246

44.1428 39.1961 31.4236 25.7298 21.4822 18.2559 15.7619 13.8007 12.2335

11.6189

9.9540

9.3851

12.5562

11.3483 10.6350

9.3936

9.2950

8.7455

Period

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

25

30

40

50

9%

10% 11%

0.9174 0.9091 0.9009

12%

0.8929

1.6901

2.4018

1.7591 1.7355 1.7125

2.5313 2.4869 2.4437

3.2397 3.1699 3.1024 3.0373

3.8897 3.7908 3.6959 3.6048

4.4859 4.3553 4.2305 4.1114

5.0330 4.8684 4.7122 4.5638

5.5348 5.3349 5.1461 4.9676

5.9952 5.7590 5.5370 5.3282

6.4177 6.1446 5.8892 5.6502

6.8052 6.4951 6.2065 5.9377

7.1607 6.8137 6.4924 6.1944

6.4235

6.6282

7.4869 7.1034 6.7499

7.7862 7.3667 6.9819

8.0607 7.6061 7.1909 6.8109

8.3126 7.8237 7.3792 6.9740

8.5436 8.0216 7.5488 7.1196

8.7556 8.2014 7.7016 7.2497

8.9501 8.3649 7.8393 7.3658

9.1285 8.5136 7.9633 7.4694

9.8226 9.0770 8.4217 7.8431

10.2737 9.4269 8.6938 8.0552

10.7574 9.7790 8.9511 8.2438

10.9617 9.9148 9.0417

8.3045

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:

9780134897264

Author:

KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:

Pearson,

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i…

Finance

ISBN:

9780077861759

Author:

Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:

McGraw-Hill Education