Complete the following without using Table 12.1. (Round the "Total amount" and "Total interest" to the nearest cent.) Principal Time (years) Rate of compound interest Compounded Periods Rate Total amount Total interest $575 1 4 % Quarterly %

Complete the following without using Table 12.1. (Round the "Total amount" and "Total interest" to the nearest cent.) Principal Time (years) Rate of compound interest Compounded Periods Rate Total amount Total interest $575 1 4 % Quarterly %

Financial & Managerial Accounting

13th Edition

ISBN:9781285866307

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter10: Current Liabilities And Payroll

Section: Chapter Questions

Problem 10.23EX

Related questions

Question

Complete the following without using Table 12.1. (Round the "Total amount" and "Total interest" to the nearest cent.)

| Principal |

Time (years) |

Rate of compound interest |

Compounded | Periods | Rate | Total amount | Total interest |

| $575 | 1 | 4 % | Quarterly | % |

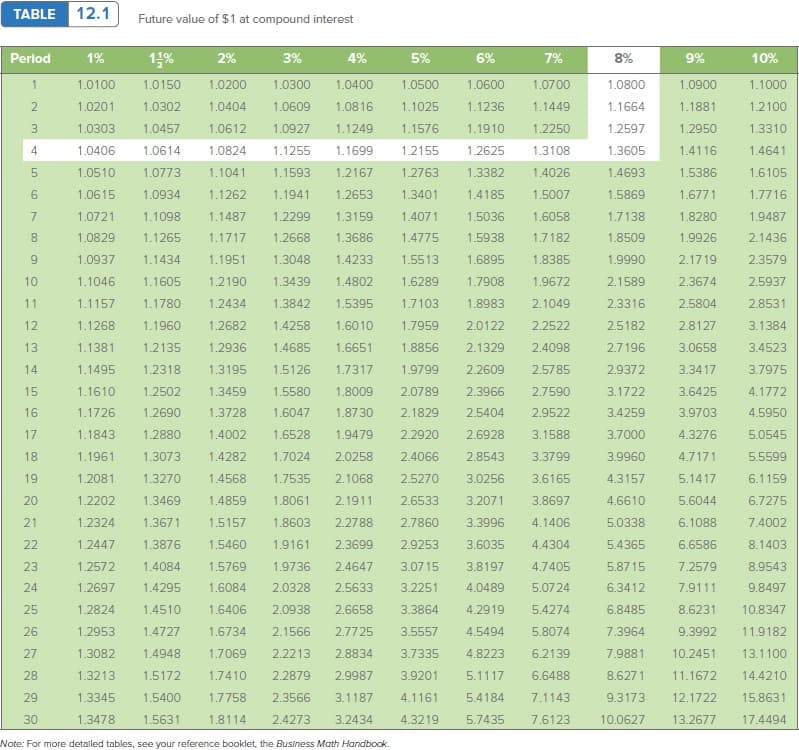

Transcribed Image Text:TABLE 12.1

Future value of $1 at compound interest

Perlod

1%

1%

2%

3%

4%

5%

6%

7%

8%

9%

10%

1.0200

1.07 00

1.0900

1.1000

1

1.0100

1.0150

1.0300

1.0400

1.0500

1.0600

1.0800

1.0201

1.0302

1.0404

1.0609

1.0816

1.1025

1.1236

1.1449

1.1664

1.1881

1.2100

1.0303

1.0457

1.0612

1.0927

1.1249

1.1576

1.1910

1.2250

1.2597

1.2950

1.3310

4

1.0406

1.0614

1.0824

1.1255

1.1699

1.2155

1.2625

1.3108

1.3605

1.4116

1.4641

1.0510

1.0773

1.1041

1.1593

1.2167

1.2763

1.3382

1.4026

1.4693

1.5386

1.6105

1.0615

1.0934

1.1262

1.1941

1.2653

1.3401

1.4185

1.5007

1.5869

1.6771

1.7716

1.0721

1.1098

1.1487

1.2299

1.3159

1.4071

1.5036

1.6058

1.7138

1.8280

1.9487

8.

1.0829

1.1265

1.1717

1.2668

1.3686

1.4775

1.5938

1.7182

1.8509

1.9926

2.1436

9.

1.0937

1.1434

1.1951

1.3048

1.4233

1.5513

1.6895

1.8385

1.9990

2.1719

2.3579

10

1.1046

1.1605

1.2190

1.3439

1.4802

1.6289

1.7908

1.9672

2.1589

2.3674

2.5937

11

1.1157

1.1780

1.2434

1.3842

1.5395

1.7103

1.8983

2.1049

2.3316

2.5804

2.8531

12

1.1268

1.1960

1.2682

1.4258

1.6010

1.7959

2.0122

2.2522

2.5182

2.8127

3.1384

13

1.1381

1.2135

1.2936

1.4685

1.6651

1.8856

2.1329

2.4098

2.7196

3.0658

3.4523

14

1.1495

1.2318

1.3195

1.5126

1.7317

1.9799

2.2609

2.5785

2.9372

3.3417

3.7975

15

1.1610

1.2502

1.3459

1.5580

1.8009

2.0789

2.3966

2.7590

3.1722

3.6425

4.1772

16

1.1726

1.2690

1.3728

1.6047

1.87 30

2.1829

2.5404

2.9522

3.4259

3.9703

4.5950

17

1.1843

1.2880

1.4002

1.6528

1.9479

2.2920

2.6928

3.1588

3.7000

4.3276

5.0545

18

1.1961

1.3073

1.4282

1.7024

2.0258

2.4066

2.8543

3.3799

3.9960

4.7171

5.5599

19

1.2081

1.3270

1.4568

1.7535

2.1068

2.5270

3.0256

3.6165

4.3157

5.1417

6.1159

20

1.2202

1.3469

1.4859

1.8061

2.1911

2.6533

3.2071

3.8697

4.6610

5.6044

6.7275

21

1.2324

1.3671

1.5157

1.8603

2.2788

2.7860

3.3996

4.1406

5.0338

6.1088

7.4002

22

1.2447

1.3876

1.5460

1.9161

2.3699

2.9253

3.6035

4.4304

5.4365

6.6586

8.1403

23

1.2572

1.4084

1.5769

1.9736

2.4647

3.07 15

3.8197

4.7405

5.8715

7.2579

8.9543

24

1.2697

1.4295

1.6084

2.0328

2.5633

3.2251

4.0489

5.0724

6.3412

7.9111

9.8497

25

1.2824

1.4510

1.6406

2.0938

2.6658

3.3864

4.2919

5.4274

6.8485

8.6231

10.8347

26

1.2953

1.4727

1.6734

2.1566

2.7725

3.5557

4.5494

5.8074

7.3964

9.3992

11.9182

27

1.3082

1.4948

1.7069

2.2213

2.8834

3.7335

4.8223

6.2139

7.9881

10.2451

13.1100

28

1.3213

1.5172

1.7410

2.2879

2.9987

3.9201

5.1117

6.6488

8.6271

11.1672

14.4210

29

1.3345

1.5400

1.7758

2.3566

3.1187

4.1161

5.4184

7.1143

9.3173

12.1722

15.8631

30

1.3478

1.5631

1.8114

2.4273

3.2434

4.3219

5.7435

7.6123

10.0627

13.2677

17.4494

Note: For more detalled tables, see your reference booklet, the Business Math Handbook.

CO

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,