completed the below table but wanted to make sure I got it correct. Can you please verify? Thank you [1] using common size on income statement : ABC Inc., Income Statement 2020 % 2019 % Sales $126,200 $100,000 Sale returns and allowances 2,426 2,000 Net sales $123,774 $ 98,000 Cost of goods sold 58,800 50,000 Gross profit $ 64,974 $ 48,000 Selling expenses 17,310 15,000 Depreciation expenses 500 500 Salary and wages expenses 5,000 4,000 Rent Expenses 7,000 7,000 Utilities expenses 964 500 Total operating expenses $ 30,774 $ 27,000 Income from operation $ 34,200 $ 21,000 Other Income 1,000 1,000 Income before income tax $ 35,000 $ 22,000 Income tax expenses 12,000 6,000 Net Income $ 23,000 $ 16,000 Interpretation on income statement by using common size analysi

Hello Tutor,

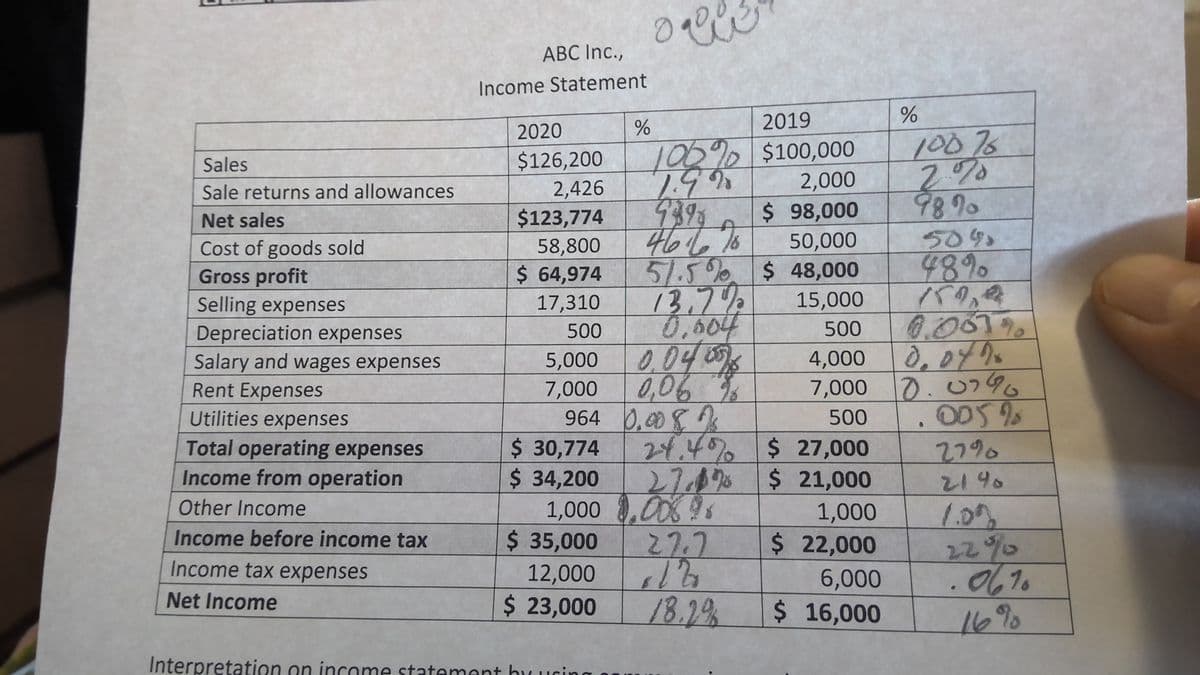

I completed the below table but wanted to make sure I got it correct. Can you please verify? Thank you

[1] using common size on income statement :

ABC Inc.,

Income Statement

|

|

2020 |

% |

2019 |

% |

|

Sales |

$126,200 |

|

$100,000 |

|

|

Sale returns and allowances |

2,426 |

|

2,000 |

|

|

Net sales |

$123,774 |

|

$ 98,000 |

|

|

Cost of goods sold |

58,800 |

|

50,000 |

|

|

Gross profit |

$ 64,974 |

|

$ 48,000 |

|

|

Selling expenses |

17,310 |

|

15,000 |

|

|

|

500 |

|

500 |

|

|

Salary and wages expenses |

5,000 |

|

4,000 |

|

|

Rent Expenses |

7,000 |

|

7,000 |

|

|

Utilities expenses |

964 |

|

500 |

|

|

Total operating expenses |

$ 30,774 |

|

$ 27,000 |

|

|

Income from operation |

$ 34,200 |

|

$ 21,000 |

|

|

Other Income |

1,000 |

|

1,000 |

|

|

Income before income tax |

$ 35,000 |

|

$ 22,000 |

|

|

Income tax expenses |

12,000 |

|

6,000 |

|

|

Net Income |

$ 23,000 |

|

$ 16,000 |

|

Interpretation on income statement by using common size analysis:

Step by step

Solved in 2 steps with 2 images