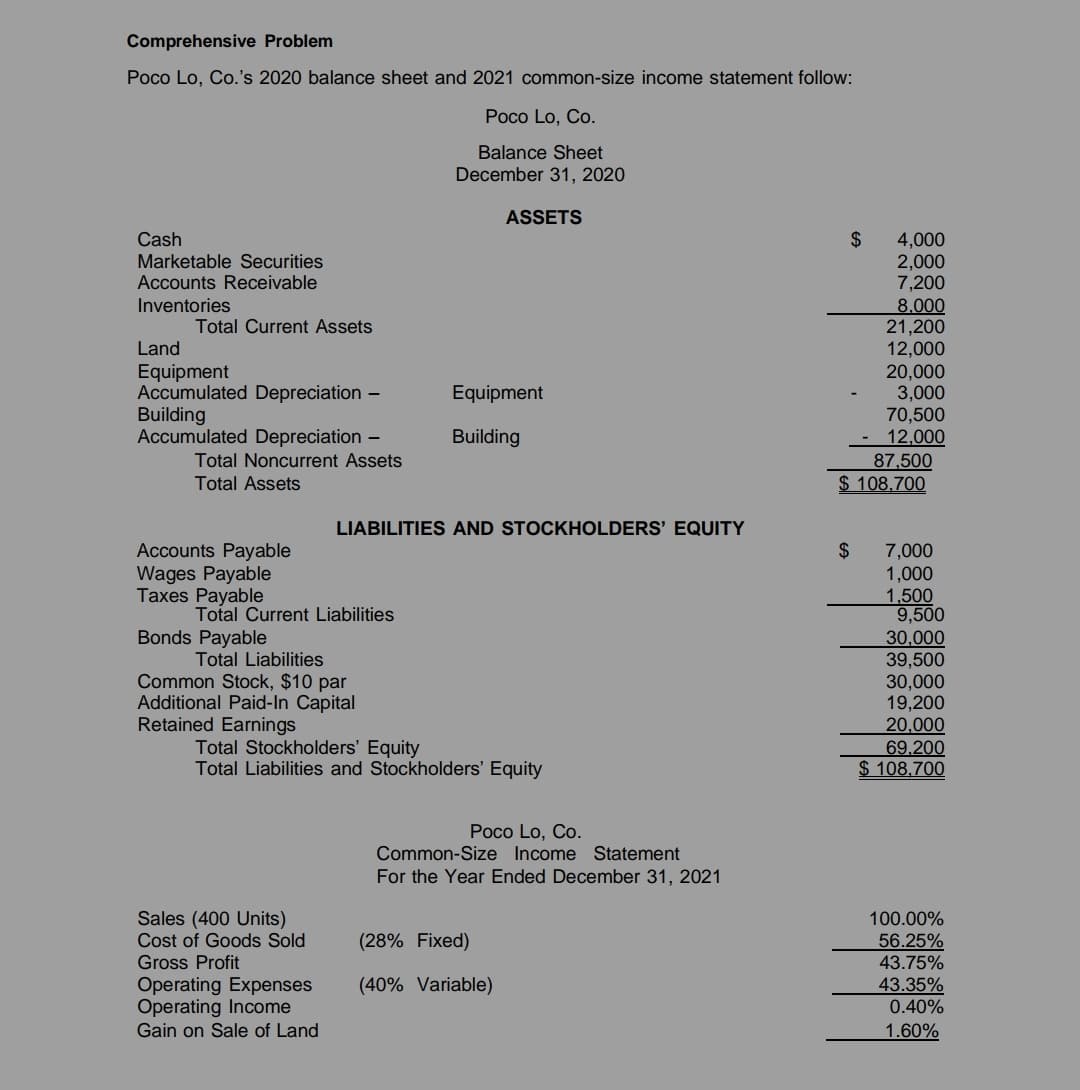

Comprehensive Problem Poco Lo, Co.'s 2020 balance sheet and 2021 common-size income statement follow: Poco Lo, Co. Balance Sheet December 31, 2020 ASSETS 4,000 2,000 7,200 8.000 21,200 12,000 20,000 3,000 70,500 12,000 87,500 $ 108.700 2$ Cash Marketable Securities Accounts Receivable Inventories Total Current Assets Land Equipment Accumulated Depreciation - Building Accumulated Depreciation - Equipment Building Total Noncurrent Assets Total Assets LIABILITIES AND STOCKHOLDERS' EQUITY Accounts Payable Wages Payable Taxes Payable 2$ 7,000 1,000 1,500 9,500 30,000 39,500 30,000 19,200 20,000 69.200 $ 108.700 Total Current Liabilities Bonds Payable Total Liabilities Common Stock, $10 par Additional Paid-In Capital Retained Earnings Total Stockholders' Equity Total Liabilities and Stockholders' Equity Poco Lo, Co. Common-Size Income Statement For the Year Ended December 31, 2021 Sales (400 Units) Cost of Goods Sold Gross Profit Operating Expenses Operating Income Gain on Sale of Land 100.00% (28% Fixed) 56.25% 43.75% (40% Variable) 43.35% 0.40% 1.60%

Comprehensive Problem Poco Lo, Co.'s 2020 balance sheet and 2021 common-size income statement follow: Poco Lo, Co. Balance Sheet December 31, 2020 ASSETS 4,000 2,000 7,200 8.000 21,200 12,000 20,000 3,000 70,500 12,000 87,500 $ 108.700 2$ Cash Marketable Securities Accounts Receivable Inventories Total Current Assets Land Equipment Accumulated Depreciation - Building Accumulated Depreciation - Equipment Building Total Noncurrent Assets Total Assets LIABILITIES AND STOCKHOLDERS' EQUITY Accounts Payable Wages Payable Taxes Payable 2$ 7,000 1,000 1,500 9,500 30,000 39,500 30,000 19,200 20,000 69.200 $ 108.700 Total Current Liabilities Bonds Payable Total Liabilities Common Stock, $10 par Additional Paid-In Capital Retained Earnings Total Stockholders' Equity Total Liabilities and Stockholders' Equity Poco Lo, Co. Common-Size Income Statement For the Year Ended December 31, 2021 Sales (400 Units) Cost of Goods Sold Gross Profit Operating Expenses Operating Income Gain on Sale of Land 100.00% (28% Fixed) 56.25% 43.75% (40% Variable) 43.35% 0.40% 1.60%

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter9: Long-term Liabilities

Section: Chapter Questions

Problem 103.1C: Leverage Cook Corporation issued financial statements at December 31, 2019, that include the...

Related questions

Question

what should have been

the Cash Flow Provided By (Used In) FinancingActivities for 2021 if the gross profit of the company for the year 2021 equals $39,375? (Round to the nearest 2 decimal places)

Transcribed Image Text:Comprehensive Problem

Poco Lo, Co.'s 2020 balance sheet and 2021 common-size income statement follow:

Poco Lo, Co.

Balance Sheet

December 31, 2020

ASSETS

Cash

2$

4,000

2,000

7,200

8.000

21,200

12,000

20,000

3,000

70,500

12,000

87,500

$ 108,700

Marketable Securities

Accounts Receivable

Inventories

Total Current Assets

Land

Equipment

Accumulated Depreciation -

Building

Accumulated Depreciation –

Equipment

Building

Total Noncurrent Assets

Total Assets

LIABILITIES AND STOCKHOLDERS' EQUITY

Accounts Payable

Wages Payable

Taxes Payable

2$

7,000

1,000

1,500

9,500

30,000

39,500

Total Current Liabilities

Bonds Payable

Total Liabilities

Common Stock, $10 par

Additional Paid-In Capital

Retained Earnings

30,000

19,200

20,000

69.200

$ 108,700

Total Stockholders' Equity

Total Liabilities and Stockholders' Equity

Poco Lo, Co.

Common-Size Income Statement

For the Year Ended December 31, 2021

Sales (400 Units)

100.00%

Cost of Goods Sold

(28% Fixed)

56.25%

Gross Profit

Operating Expenses

Operating Income

43.75%

43.35%

0.40%

(40% Variable)

Gain on Sale of Land

1.60%

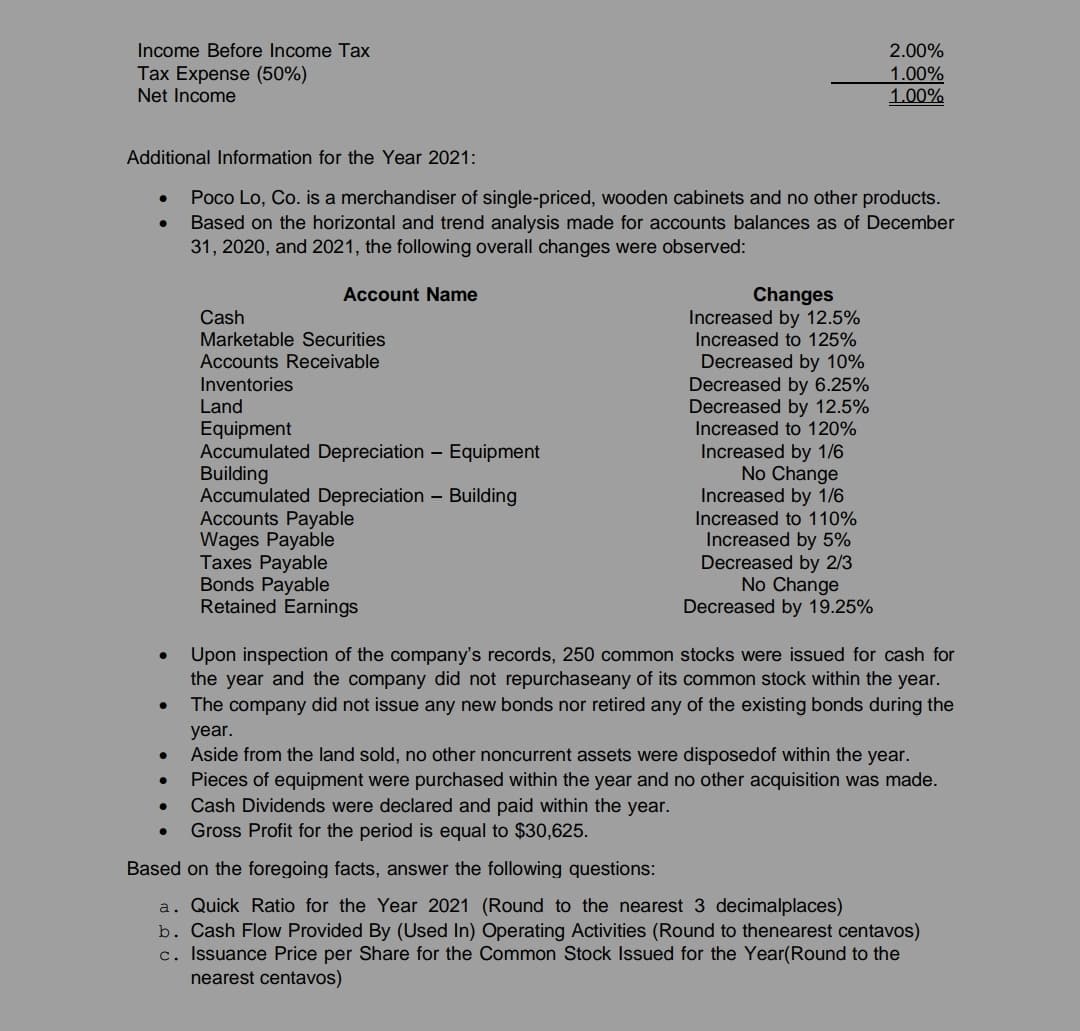

Transcribed Image Text:Income Before Income Tax

2.00%

Tax Expense (50%)

Net Income

1.00%

1.00%

Additional Information for the Year 2021:

Poco Lo, Co. is a merchandiser of single-priced, wooden cabinets and no other products.

Based on the horizontal and trend analysis made for accounts balances as of December

31, 2020, and 2021, the following overall changes were observed:

Account Name

Changes

Increased by 12.5%

Increased to 125%

Cash

Marketable Securities

Decreased by 10%

Decreased by 6.25%

Decreased by 12.5%

Increased to 120%

Accounts Receivable

Inventories

Land

Equipment

Accumulated Depreciation – Equipment

Building

Accumulated Depreciation – Building

Accounts Payable

Wages Payable

Taxes Payable

Bonds Payable

Retained Earnings

Increased by 1/6

No Change

Increased by 1/6

Increased to 110%

Increased by 5%

Decreased by 2/3

No Change

Decreased by 19.25%

Upon inspection of the company's records, 250 common stocks were issued for cash for

the year and the company did not repurchaseany of its common stock within the year.

The company did not issue any new bonds nor retired any of the existing bonds during the

year.

Aside from the land sold, no other noncurrent assets were disposedof within the year.

Pieces of equipment were purchased within the year and no other acquisition was made.

Cash Dividends were declared and paid within the year.

Gross Profit for the period is equal to $30,625.

Based on the foregoing facts, answer the following questions:

a. Quick Ratio for the Year 2021 (Round to the nearest 3 decimalplaces)

b. Cash Flow Provided By (Used In) Operating Activities (Round to thenearest centavos)

c. Issuance Price per Share for the Common Stock Issued for the Year(Round to the

nearest centavos)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning