Comprehensive Stockholders' Equity Transactions and Stockholders' Equity P4. Kraft Unlimited, Ic., was organized and authorized to issue 5,000 shares of $100 par value, 9 percent preferred stock and 50,000 shares of no par, $5 stated value com- mon stock on July 1, 2014. Stock-related transactions for Kraft Unlimited follow. Issued 10,000 shares of common stock at $11 per share. Issued 500 shares of common stock at $11 per share for services rendered in connection with the organization of the company. Issued 1,000 shares of preferred stock at par value for cash. Issued 2,500 shares of common stock for land on which the asking price was $35,000. Market value of the stock was $12. Management wishes to record July 1 1 10 the land at the market value of the stock. Aug. 2 Purchased 1,500 shares of its common stock at $13 per share. Declared a cash dividend for one month on the outstanding preferred stock and $0.02 per share on common stock outstanding, payable on August 22 to stockholders of record on August 12. 10 12 Date of record for cash dividends. 22 Paid cash dividends. REQUIRED 1. Prepare journal entries to record these transactions. 2. Prepare the stockholders' equity section of Kraft's balance sheet as it would appear on August 31, 2014. Net income for July was zero and August was $11,500.

Comprehensive Stockholders' Equity Transactions and Stockholders' Equity P4. Kraft Unlimited, Ic., was organized and authorized to issue 5,000 shares of $100 par value, 9 percent preferred stock and 50,000 shares of no par, $5 stated value com- mon stock on July 1, 2014. Stock-related transactions for Kraft Unlimited follow. Issued 10,000 shares of common stock at $11 per share. Issued 500 shares of common stock at $11 per share for services rendered in connection with the organization of the company. Issued 1,000 shares of preferred stock at par value for cash. Issued 2,500 shares of common stock for land on which the asking price was $35,000. Market value of the stock was $12. Management wishes to record July 1 1 10 the land at the market value of the stock. Aug. 2 Purchased 1,500 shares of its common stock at $13 per share. Declared a cash dividend for one month on the outstanding preferred stock and $0.02 per share on common stock outstanding, payable on August 22 to stockholders of record on August 12. 10 12 Date of record for cash dividends. 22 Paid cash dividends. REQUIRED 1. Prepare journal entries to record these transactions. 2. Prepare the stockholders' equity section of Kraft's balance sheet as it would appear on August 31, 2014. Net income for July was zero and August was $11,500.

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter11: Stockholders' Equity

Section: Chapter Questions

Problem 11.6E

Related questions

Question

100%

In Principles of Accounting

12th Edition

Belverd E. + 5 others

Publisher: Cengage Learning

ISBN: 9781133593102

Question 4P in Chapter 13 has not been answered yet. Could it please be answered.

Thank you very much.

Thank you very much.

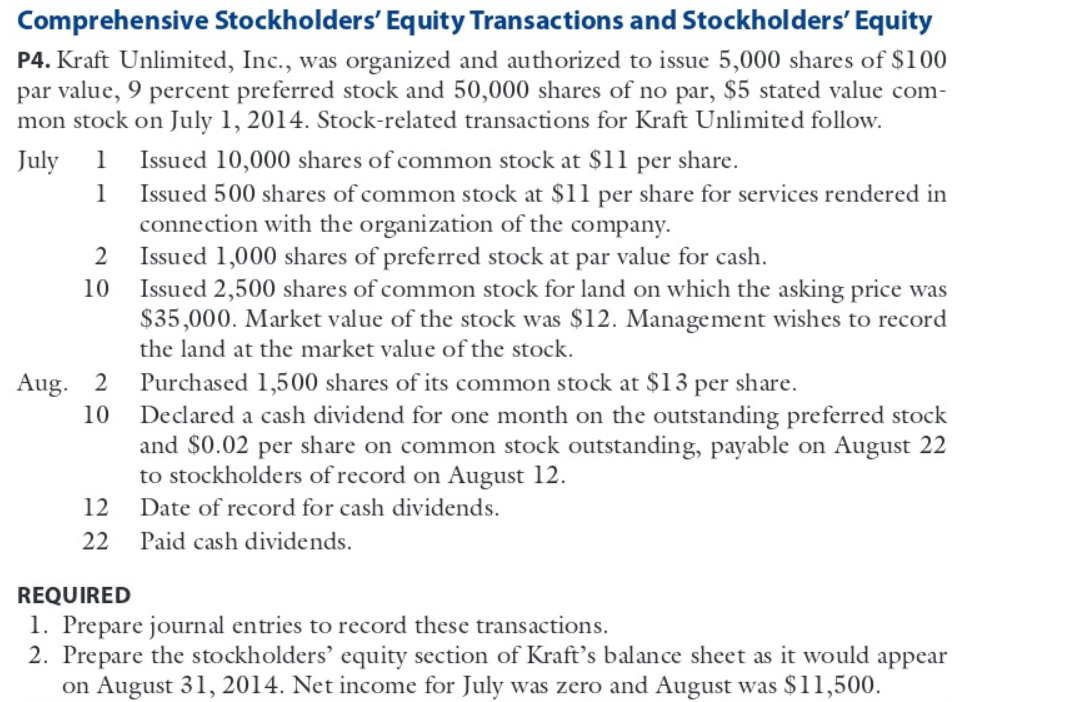

Transcribed Image Text:Comprehensive Stockholders' Equity Transactions and Stockholders' Equity

P4. Kraft Unlimited, Inc., was organized and authorized to issue 5,000 shares of $100

par value, 9 percent preferred stock and 50,000 shares of no par, $5 stated value com-

mon stock on July 1, 2014. Stock-related transactions for Kraft Unlimited follow.

Issued 10,000 shares of common stock at $11 per share.

Issued 500 shares of common stock at $11 per share for services rendered in

connection with the organization of the company.

Issued 1,000 shares of preferred stock at par value for cash.

Issued 2,500 shares of common stock for land on which the asking price was

$35,000. Market value of the stock was $12. Management wishes to record

July 1

1

10

the land at the market value of the stock.

Aug. 2 Purchased 1,500 shares of its common stock at $13 per share.

10

Declared a cash dividend for one month on the outstanding preferred stock

and $0.02 per share on common stock outstanding, payable on August 22

to stockholders of record on August 12.

12

Date of record for cash dividends.

22

Paid cash dividends.

REQUIRED

1. Prepare journal entries to record these transactions.

2. Prepare the stockholders' equity section of Kraft's balance sheet as it would appear

on August 31, 2014. Net income for July was zero and August was $11,500.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,