Compute for the sale revenue to be recognized from the transaction above.

Business Its Legal Ethical & Global Environment

10th Edition

ISBN:9781305224414

Author:JENNINGS

Publisher:JENNINGS

Chapter12: Contracts And Sales:introduction And Formation

Section: Chapter Questions

Problem 9QAP

Related questions

Question

Topic: REVENUE FROM CONTRACTS WITH CUSTOMERS

Requirement: Compute for the sale revenue to be recognized from the transaction above.

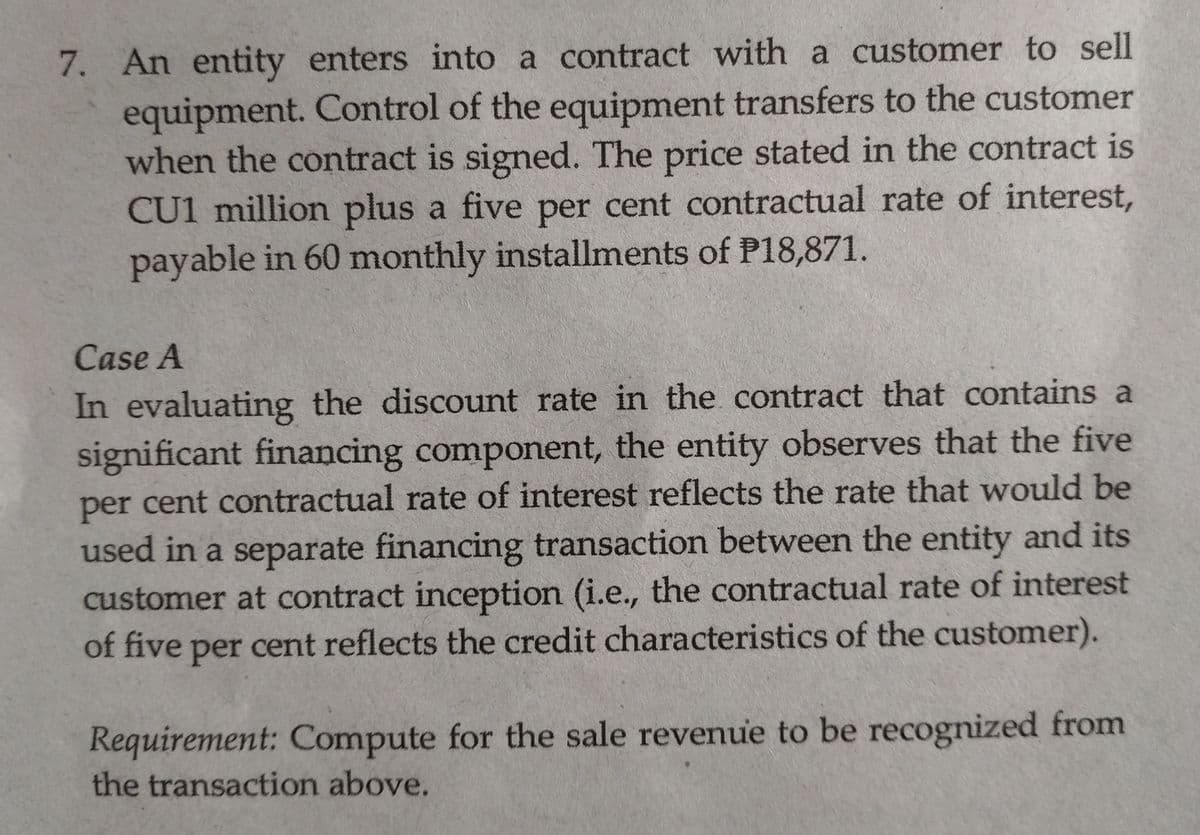

Transcribed Image Text:7. An entity enters into a contract with a customer to sell

equipment. Control of the equipment transfers to the customer

when the contract is signed. The price stated in the contract is

CU1 million plus a five per cent contractual rate of interest,

payable in 60 monthly installments of P18,871.

Case A

In evaluating the discount rate in the contract that contains a

significant financing component, the entity observes that the five

per cent contractual rate of interest reflects the rate that would be

used in a separate financing transaction between the entity and its

customer at contract inception (i.e., the contractual rate of interest

of five

per cent reflects the credit characteristics of the customer).

Requirement: Compute for the sale revenue to be recognized from

the transaction above.

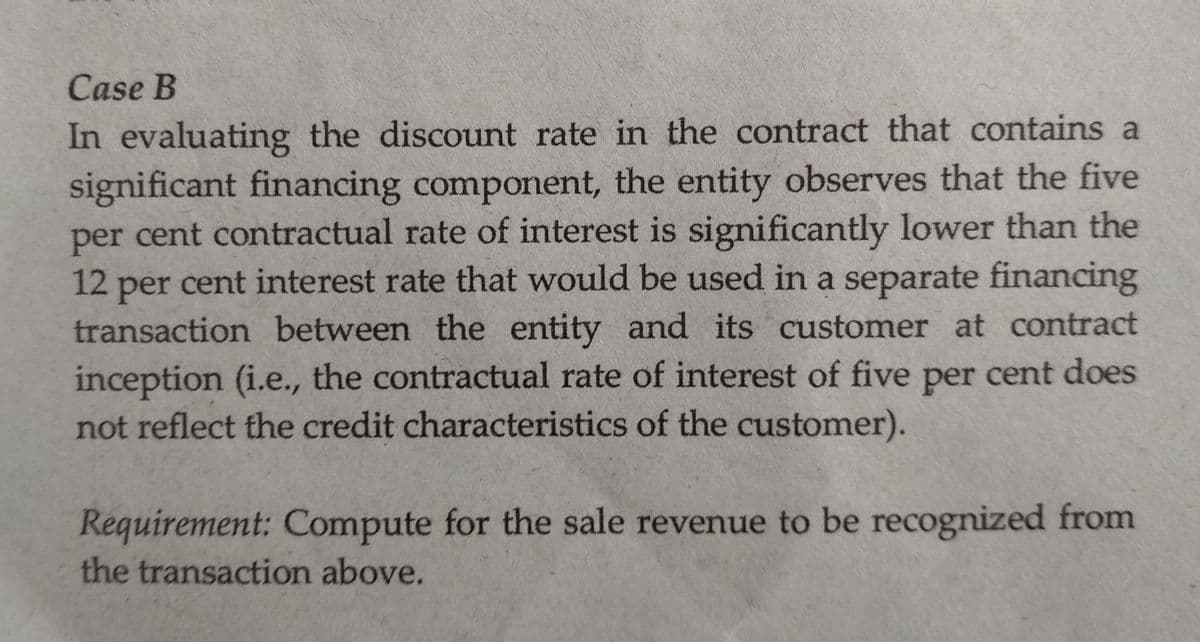

Transcribed Image Text:Case B

In evaluating the discount rate in the contract that contains a

significant financing component, the entity observes that the five

per cent contractual rate of interest is significantly lower than the

12 cent interest rate that would be used in a separate financing

per

transaction between the entity and its

inception (i.e., the contractual rate of interest of five per cent does

not reflect the credit characteristics of the customer).

customer at contract

Requirement: Compute for the sale revenue to be recognized from

the transaction above.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Business Its Legal Ethical & Global Environment

Accounting

ISBN:

9781305224414

Author:

JENNINGS

Publisher:

Cengage

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Business Its Legal Ethical & Global Environment

Accounting

ISBN:

9781305224414

Author:

JENNINGS

Publisher:

Cengage

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning