Compute the amount that can be borrowed under each of the following circumstances: (PV of $1. EV of $1. PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided. Round your "Table value" to 4 decimal places.) 1. A promise to repay $90,000 seven years from now at an interest rate of 6%. 2. An agreement made on February 1, 2019, to make three separate payments of $20,000 on February 1 of 2020, 2021, and 2022. The annual interest rate is 10%.

Compute the amount that can be borrowed under each of the following circumstances: (PV of $1. EV of $1. PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided. Round your "Table value" to 4 decimal places.) 1. A promise to repay $90,000 seven years from now at an interest rate of 6%. 2. An agreement made on February 1, 2019, to make three separate payments of $20,000 on February 1 of 2020, 2021, and 2022. The annual interest rate is 10%.

Chapter4: Time Value Of Money

Section: Chapter Questions

Problem 1Q

Related questions

Question

Transcribed Image Text:_con=con&external_browser%=0&launchUrl%3https%253A%252F%252Flms.mheduc

inde

Appendix B homework i

Saved

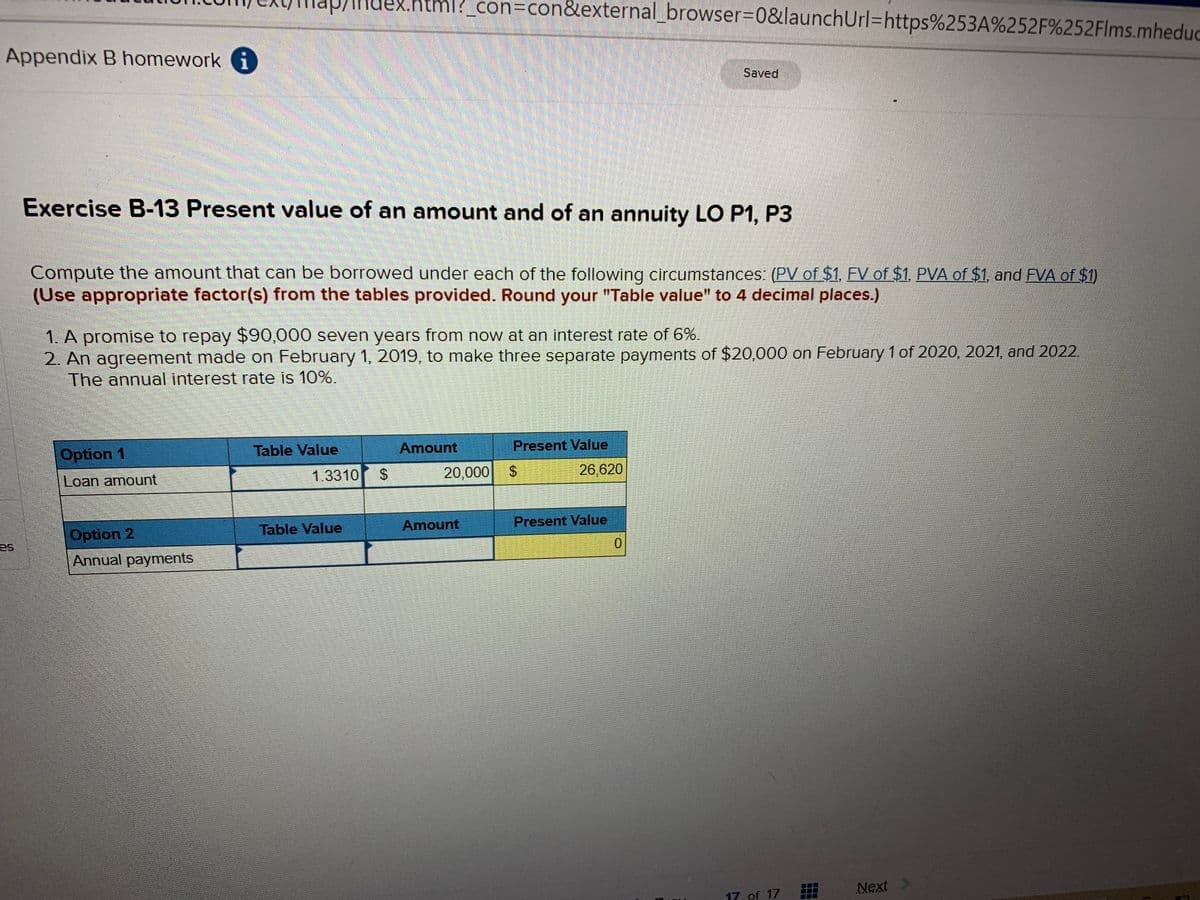

Exercise B-13 Present value of an amount and of an annuity LO P1, P3

Compute the amount that can be borrowed under each of the following circumstances: (PV of $1. FV of $1. PVA of $1, and FVA of $1)

(Use appropriate factor(s) from the tables provided. Round your "Table value" to 4 decimal places.)

1. A promise to repay $90,000 seven years from now at an interest rate of 6%.

2. An agreement made on February 1, 2019, to make three separate payments of $20,000 on February 1 of 2020, 2021, and 2022.

The annual interest rate is 10%.

Option 1

Table Value

Amount

Present Value

1.3310

20,000

26,620

Loan amount

Amount

Present Value

Table Value

Option 2

Annual payments

es

0.

Next >

17 of 17

%24

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you