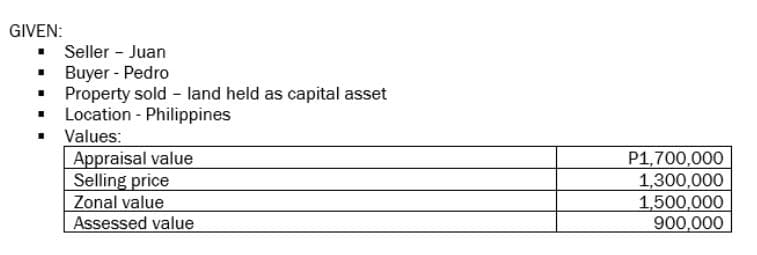

Compute the Documentary stamp tax

Q: 1. Record the journal entries that occurred during the month of December. 2. Prepare an unadiusted…

A: Closing Entries - Closing entries are required to close the temporary accounts after making…

Q: January 1, 2019 SOS company invested 2,400,000 $ for75% of RAT company, in that date the fair value…

A: Elimination entries refer to adjustments made to a parent company's financial statements to remove…

Q: An audit includes a number of letters between the auditors and the company such as the report to…

A: Auditors are the professionals who check each detail furnished by the client through his/her…

Q: Calculate the total, fixed, and variable predetermined manufacturing overhead rates. (Round answers…

A: An accounting technique for allocating overhead costs to goods and services is the predetermined…

Q: Sunland Pharmaceuticals is evaluating its Vioxx division, an investment centre. The division has a…

A: The return on investment is used to estimate the earning rate on the basis of average operating…

Q: here are three types of ledgers; general ledger, payables ledger, and receivables ledger. Discuss…

A: Ledgers are important components of an organization's accounting system, used to record and…

Q: OBUTJX493 Corporation's operational data are below: Sales are budgeted at $ 260,000 for November,…

A: Purchasing is the process of systematically acquiring products and services on behalf of the body…

Q: Planning Budget the Month Ended May 31 for Budgeted diving-hours (9) Revenue ($390,000) Expenses!…

A: The master budget is the budget which is fixed and can not be changed. The flexible budget can be…

Q: A company applies overhead using machine hours. Additional information follows. Standard variable…

A: The Variance is an analysis of difference between the actual result and budgeted result for an…

Q: Prepare the journal entries required to record the above transactions on the books of Cheyenne Ltd.…

A: A basic accounting record known as a journal entry is used to track and record financial…

Q: The following information is located in the production department of Mindy Co First Quarter 14,300…

A: Lets understand the basics.Management prepare budget in order to estimate future profit and loss for…

Q: When determining whether a liability exists, the intentions or actions of management do not need to…

A: Liability refers to the legal responsibility or obligation that an individual, association, or…

Q: Pertinent information for two alternatives A and B is shown below. If i=10 % / year and the…

A: It is the amount of reduction in the value of a tangible fixed asset due to tear and wear,…

Q: What is the amount and character of gain she recognizes from end of the year distributions in each…

A: “Since you have posted a question with multiple sub parts, we will provide the solution only to the…

Q: Dunn, Inc. uses the accrual method of accounting for financial reporting purposes and appropriately…

A: The deferred tax laibility can be defined as the taxes that are owed but these taxes are not due…

Q: Juan Dela Cruz generated annual compensation income of P615,000. Statutory payments are as follows:…

A: "Gross taxable compensation" refers to the total amount of money you earn from your job before any…

Q: Determine the missing amounts for each of the following: asset = Liability + owners equity…

A: Basic Accounting Equation is given as under:Assets = Equity + Liabilities Meaning, total assets of…

Q: Determine the amount of the dividends received deduction in each of the following instances. In all…

A: Dividend received deduction seems a tax provision that allows some corporations to deduct a…

Q: XY is a domestic corporation. The taxable period is 2020 year gross income deductions 2016…

A: When a business experiences a net operating loss (NOL) in a specific tax year and is allowed by tax…

Q: Critically identify the possible causes of the labour and material variances based on obtained…

A: Material usage variance means when actual quantity of material used is more than standard quantity…

Q: TRUE OR FALSE Because the taxation year of an individual must be based on the calendar year, all…

A: The due date, as it relates to tax filing, is the deadline by which people or businesses must file…

Q: Prepare a well-written analysis of each financial statement using appropriate business/accounting…

A: Vertical Analysis is one of the form of financial statement analysis.Under this method, each line…

Q: P 16-1 Partnership income allocation—Statement of partnership capital Ell, Far, and Gar are…

A: A successful partnership may provide the partners with a number of benefits, such as the sharing of…

Q: Before preparing financial statements for the current year, the chief accountant for Cullumber Ltd.…

A: A journal entry is a form of accounting entry that is used to report a business transaction in a…

Q: Partner A received the following in a nonliquidating distribution: Basis FMV Cash $20,000 $20,000…

A: An asset base is the underlying value of the total assets that form the constituent of the value to…

Q: Many companies request that their auditors provide them with other services, such as tax or…

A: Auditing is a systematic and independent examination of financial information, records, statements,…

Q: 1. Which of the following accurately reflects Thai accounting? The government has final approval on…

A: Accounting refers to the process of gathering, measuring, classifying, analysing, summarising,…

Q: The following information is made available involving the defined benefit pension plan of Princess…

A: A company's commitment to pay future pension payments to its employees is represented by the sum…

Q: On January 1, 2018, Sanderson Variety Store adopted the dollar-value LIFO retail inventory method.…

A: Companies, like those in the retail sector, use the LIFO (Last-In, First-Out) retail method to…

Q: Cliff, Jay, and Henry are partners who share profits and losses in the ratio of 40:30:30,…

A: It is an agreement between two or more parties to conduct the business and share the profits and…

Q: The Ace Battery Company has forecast its sales in units as follows: January 1,700 May February 1,550…

A: Production budget is the budget which is prepared to estimate the number of units to be produced for…

Q: Suppose a husband wants to take his wife on a trip three years from now to Europe to celebrate their…

A: Time value of money is one of the important concept of finance. As per this concept, a sum of amount…

Q: Can Lucia defer revenues and accrue as many expenses as possible and still be ethical?

A: Lets understand the basics.Adjusting entries at the year end required to make to record correct…

Q: Grove Audio is considering the introduction of a new model of wireless speakers with the following…

A: Since you have posted a question multiple sub-parts, as per the guidelines only the first three…

Q: A debit entry will: Group of answer choices increase an asset, increase a liability, and decrease…

A: In accounting, all assets and expenses will normally have debit balance. Increase in assets and…

Q: Wright Co., organized on January 2, 2021, had pretax accounting income of $960,000 and taxable…

A: Balance sheet is the financial statement that reports the financial position of an entity during a…

Q: An investment banking firm that handles, for a fee, the issuance of a corporation's stocks or bonds…

A: An issuance of new securities to investors is known as an issue, and it is done with the intention…

Q: Question 9 of 10. Which of these corporations is eligible to make an S corporation election?…

A:

Q: What note disclosures are specific to nonprofits or government entities, and why are they needed? In…

A: Note Disclosures are an essential part of financial reporting for both nonprofits and government…

Q: a. Is the bank reconciliation a journal, a ledger, an account, or a financial statement? If it is…

A: The bank reconciliation is a statement that is prepared to match the accounting book cash balance…

Q: At her death, Chow owned 55% of the stock in Finch Corporation, with the balance held by family…

A: Answer:- Goodwill meaning:- An intangible asset called goodwill is used to account for the excessive…

Q: Professor John Morton has just been appointed chairperson of the Finance Department at Westland…

A: Businesses should precisely determine the entire cost of their goods in order to set prices for…

Q: Zanuatu, an island nation, does not have regulations precluding the use of nonpublic information.…

A: The "Code of Ethics" is a set of principles or rules that govern the behavior and conduct of…

Q: a. What is Lisa's realized and recognized gain or loss? is recognized. b. What is Alfred's…

A: Lisa sold the property to related party (her son). Lisa realised loss of $27,780 ($111,120-1,38,900)…

Q: Units, beginning work in process Units started Units completed Units, ending work in process Cost of…

A: EQUIVALENT UNITS OF PRODUCTION Equivalent Production is represents the production of a process in…

Q: An energy production company has the following information regarding the acquisition of new…

A: Basic cost asset(B) should be the cost of the asset itself, including any associated costs such as…

Q: The Gourmand Cooking School runs short cooking courses at its small campus. Management has…

A: The revenue and spending variance is the difference between the actual results and flexible budget…

Q: 9 Plans Company uses the retail inventory method. The following information is available for the…

A: "Since you have asked multiple questions, the first question was answered for you. If you want the…

Q: A firm has a target debt equity ratio of 0.9 The cost of debt is 75% and the cost of equity is…

A: Net present value is used in capital budgeting to analyze the profitability of a project. NPV is the…

Q: Using the perpetual inventory method and the information provided, what is the weighted-average cost…

A: SolutionIt is a weighted average cost method.In this metod, the cost of goods avialable for sale is…

Compute the Documentary stamp tax.

Step by step

Solved in 3 steps

- On 1 June 20X0, an entity based in Country A with a functional currency of CUbuys an investment property in Country B with local currency FCU forFCU500,000. The fair value of the investment property is reliably measurable inFCU without undue cost or effort on an ongoing basis. Consequently, inaccordance with Section 16 Investment Property, the entity measures itsinvestment property, after initial recognition, at fair value through profit or loss.The entity has a year-end of 31 December.The spot exchange rates and fair values of the investment property (FVIP) are asfollows: 1 June 20X0: CU1 = FCU1.1 and FVIP = FCU500,000 31 December 20X0: CU1 = FCU1.05 and FVIP = FCU520,000 31 December 20X1: CU1 = FCU1.2 and FVIP = FCU540,000On 1 April 20X2 the investment property is sold for FCU570,000 when theexchange rate is CU1 = FCU1.1. Required:i. Make Journal Entries for each of these transactions recognizing the purchase ofinvestment property. ii. Show a journal entry Derecognizing it after…How much should be recorded as the purchase price of theindividual PPE items: For items 6 to 10, identify the amount to be include as Land 6. Cost of option to the land – P20,000 7. Legal fees and other expenditures for establishing clean title– P100,000 8. Mortgage assumed: Total mortgage – P2,000,000,Remaining mortgage as of acquisition date – P 500,000 9. Real property tax not paid by seller and assumed by theentity, P50,000 due January of current year. Buyer‐entityacquired the land on April 30 of the current year. 10. Special assessment paid to the government – P300,000 11. Fence and landscaping – P500,000Calculate the assessed value of the following pieces of property:Assessment rate Market Value Assessed Value 80% $210,000 ?????

- Calculate the assessed value of the piece of property: Assessment rate Market value Assessed value 80% $210,000a. X (44 years old) transfers the following assets- 1.Rural agricultural land situated in Gujrat (date of transfer April 20,2020, sale consideration: Rs.20,00,000, purchase consideration: Rs. 25,000, year of acquisition: 2003-04,) 2.Commercial land situated in the municipal limits of Kanpur (date of transfer: May 20,2020, sale consideration: Rs.15,00,000; year of acquisition: 2004-05; indexed cost of acquisition: Rs.5,60,000) 3.Gold jewellery on June 2,2020 for Rs.30,00,000, cost of acquisition: Rs.4,00,000, year of acquisition: 2008-09 Use appropriate CII in all cases b.X (32 years) is resident in India. Find out the net income and tax liability for the information given below for the assessment year 2021-22-Winning from horse race: Rs. 20,000; short term capital gain (STT paid): Rs.4,00,000; bank interest: Rs.2,33,000; public provident fund contribution: Rs.1,50,000.An entity accounted for land using the revaluation model. On October 1,2020, the entity classified a land as held for sale. At that date, the carrying amount of the land was P5,000,000 and the balance in the revaluation surplus was P1,500,000. At the same date, the fair value of the land was estimated at P5,500,000. The estimated cost of disposal is PI 00,000. On December 31,2020, the fair value less cost of disposal of the land did not change. On October 1,2021, the land was sold for P7,000,000.What is the impairment loss in 2020

- How much is the cost of the qualifying asset on initial recognition? * 15,045,000 13,010,000 14,970,900 14,920,000An entity accounted for land using the revaluation model. On October 1, 2020, the entity classified the land as held for sale. At that date, the carrying amount of the land was P5,000,000 and the balance in the revaluation surplus was P1,500,000. At the same date, the fair value of the land was estimated at P5,500,000. The estimated cost of disposal is P100,000. On December 31, 2020, the fair value less cost of disposal of the land did not change. On October 1, 2021, the land was sold for P7,000,000.What amount of OCI is classified to retained earnings in 2021? *An entity accounted for land using the revaluation model. On October 1, 2020, the entity classified the land as held for sale. At that date, the carrying amount of the land was P5,000,000 and the balance in the revaluation surplus was P1,500,000. At the same date, the fair value of the land was estimated at P5,500,000. The estimated cost of disposal is P100,000. On December 31, 2020, the fair value less cost of disposal of the land did not change. On October 1, 2021, the land was sold for P7,000,000.What amount of OCI is classified to retained earnings in 2021? * 1,500,000 2,000,000 500,000 Zero

- A non-U.S. corporation investor held a real estate asset (a parcel of land) that that was purchased for $100,000,000 for 10 years and will sell it for $130,000,000. The investor gain on the sale of the asset is considered to in a business that is effectively connected to a U.S. trade or business (ECI). a. Compute the tax on the sale assuming that the investor held the asset directly (consider both ECI and branch profits tax) b. Compute the tax to the investor if held through US corporation (consider both entity level tax and FDAP tax on the distributions) with no treaty rates and a plan of liquidation in the year of sale USE IRS,USA AND CPA REGULATIONSSale of house and lot as vacation house costing 1M, sold for 3M with FMV of 5M. Proceeds amounting to 4M are used in acquiring a principal residence within the period set by law. What is the CGT? PhilippinesQuestion 1 Focus Eye Bhd has adopted the revaluation model and the following information is related to its freehold land. Cost as at 31 Dec 2015 Fair value as at 31 Dec 2015 Fair Value as at 31 Dec 2016 Freehold land X RM1,000,000 RM1,200,000 RM900,000 Freehold Land Y RM1,100,000 RM800,000 RM1,200,000 Required: Show the journal entries to record the surplus or deficit on revaluation for the year ended 31 December 2015 and 2016. Show the extract of the statement of profit or loss and other comprehensive income for the year ended 31 December 2015 and 2016.