Compute the time needed for payback for the following example assuming the investment required an up-front capital outlay of $100,000 and the uneven annual cash flows for each year are provided in the table. If an amount is zero, enter For the time needed for payback, enter your answer to one decimal place, if less than one year (i.e. 0.2, 0.5, etc.). Unrecovered Investment Year Annual Cash Flow Time Needed for Payback (Beginning of year) 1 $100,000 $20,000 1 year 2 30,000 40,000 50,000

Compute the time needed for payback for the following example assuming the investment required an up-front capital outlay of $100,000 and the uneven annual cash flows for each year are provided in the table. If an amount is zero, enter For the time needed for payback, enter your answer to one decimal place, if less than one year (i.e. 0.2, 0.5, etc.). Unrecovered Investment Year Annual Cash Flow Time Needed for Payback (Beginning of year) 1 $100,000 $20,000 1 year 2 30,000 40,000 50,000

Chapter14: Multinational Capital Budgeting

Section: Chapter Questions

Problem 2IEE

Related questions

Question

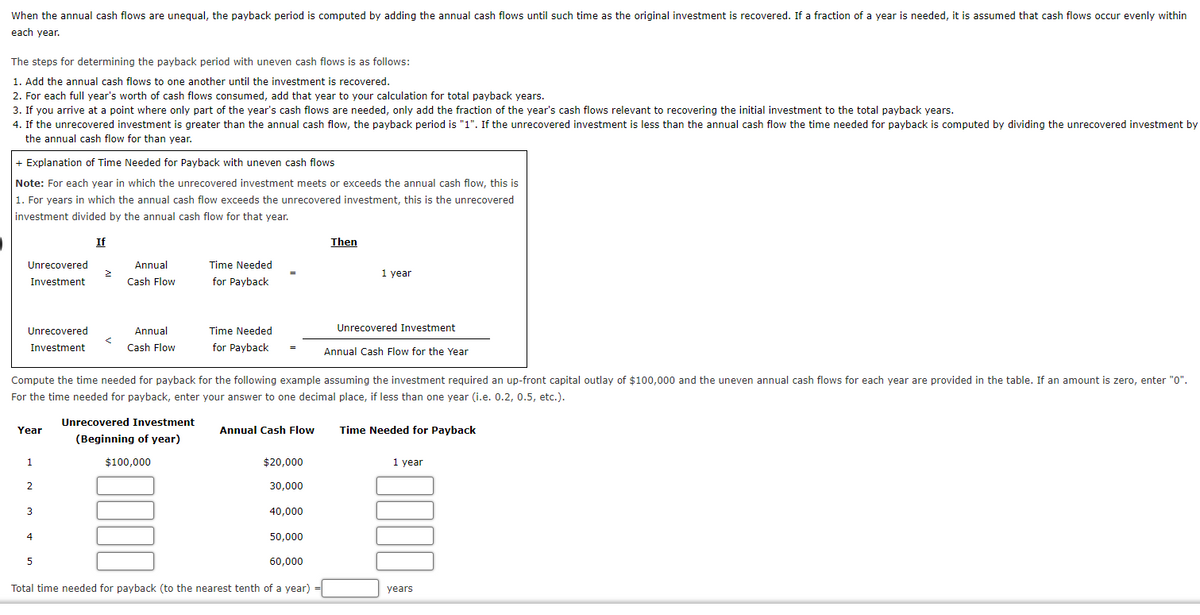

Transcribed Image Text:When the annual cash flows are unequal, the payback period is computed by adding the annual cash flows until such time as the original investment is recovered. If a fraction of a year is needed, it is assumed that cash flows occur evenly within

each year.

The steps for determining the payback period with uneven cash flows is as follows:

1. Add the annual cash flows to one another until the investment is recovered.

2. For each full year's worth of cash flows consumed, add that year to your calculation for total payback years.

3. If you arrive at a point where only part of the year's cash flows are needed, only add the fraction of the year's cash flows relevant to recovering the initial investment to the total payback years.

4. If the unrecovered investment is greater than the annual cash flow, the payback period is "1". If the unrecovered investment is less than the annual cash flow the time needed for payback is computed by dividing the unrecovered investment by

the annual cash flow for than year.

+ Explanation of Time Needed for Payback with uneven cash flows

Note: For each year in which the unrecovered investment meets or exceeds the annual cash flow, this is

1. For years in which the annual cash flow exceeds the unrecovered investment, this is the unrecovered

investment divided by the annual cash flow for that year.

If

Then

Unrecovered

Annual

Time Needed

1 year

Investment

Cash Flow

for Payback

Unrecovered

Annual

Time Needed

Unrecovered Investment

Investment

Cash Flow

for Payback

Annual Cash Flow for the Year

Compute the time needed for payback for the following example assuming the investment required an up-front capital outlay of $100,000 and the uneven annual cash flows for each year are provided in the table. If an amount is zero, enter "0".

For the time needed for payback, enter your answer to one decimal place, if less than one year (i.e. 0.2, 0.5, etc.).

Unrecovered Investment

Year

Annual Cash Flow

Time Needed for Payback

(Beginning of year)

1

$100,000

$20,000

1 year

2

30,000

3

40,000

4

50,000

5

60,000

Total time needed for payback (to the nearest tenth of a year)

years

Expert Solution

Step 1

The payback period is the time required by the company to recover its initial investment, it doesn't consider the present value of cash flows. The company usually wants the payback period to be less, so that profit can be earned.

Given,

An initial outlay is $100,000.

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning