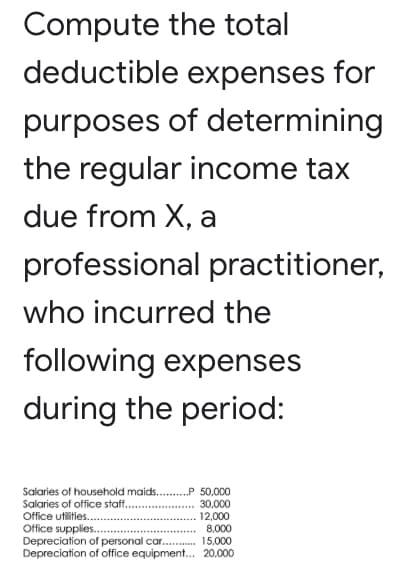

compute the total deductible expenses for purposes of determining che regular income tax due from X, a professional practitioner

Q: income statement

A: Investments in Equity shall be classified as Fair Value always. The question may arise as to whether…

Q: Which of the following is not an objective of the cash audit? determine that a. A long-term…

A: Objectives of Cash Audit One of the objectives for a cash audit is to verify that the recorded cash…

Q: 2. S1: The excess of allowable deductions over gross sales is net operating loss. S2: Net…

A: Net operating loss is the loss calculated as per the tax code and as per the tax code the net…

Q: Coke Company had 2 million shares of common stock outstanding all through 2020. On April 1, 2021, an…

A: Formula: Earnings per share = (Net income - Preferred dividend) / Weighted average outstanding…

Q: Determine the account and amount to be debited and the account and amount to be credited for the…

A: Depreciation: Depreciation means the reduction in the value of an asset over the life of the assets…

Q: On January 1, 2021, a business paid $6.400,000 for land with mineral deposits. Over the following…

A: The process of defining, assessing, and reporting transactions to regulatory authorities, tax…

Q: Which of the following is true? Non-deductible expense is deducted to financial income in computing…

A: Solution Concept Deferred tax asset or deferred tax liabilities shall be recognized when there is…

Q: 32.3A Show the journal entries needed to correct the following errors: (a) Purchases £1,410 on…

A: Rectification entry means where some error has been done in past and we need to rectify that errors.…

Q: 3. Maricel borrows P 10 000 with interest at 15% compounded monthly. How much should she pay at the…

A: Given data, Initial amount (p) = 10000 interest rate = 15% it is compounded monthly , so monthly…

Q: Required information Reporting Amounts on the Four Basic Financial Statements and Evaluating…

A: A shareholder, sometimes known as a shareholder, is a person, company, or organization who holds at…

Q: Nicanor retired at the end of 2022 after rendering 25 years of continuous services for ABC…

A: Introduction: 'Gross compensation' refers to the total of compensation and perks paid to or on terms…

Q: PROBLEM NO 1 Watusi Inc. began operations in January 2021 and reported the following results for…

A: Ordinary shares are shares in a company with individual owners who can vote at company events and…

Q: Ann files single and reports AGI of $40,000. This year she has incurred the following medical…

A: As per IRS, The medical expenses relating to knee surgery and over-the-counter drugs are not…

Q: Executive stock options: A.are options to buy shares at a specified exercise price within a…

A: Introduction:- Companies grant stock options to employees at a specified price. Main advantage of…

Q: or the year ended Dec. 31, 201X, CACA Co. reported pre-tax financial income of 9,500,000. Its…

A: Explanation of Concept Deferred Tax Assets / Deferred tax Liability : are to be calculated when…

Q: ABC corporation produces plastic bottles. Details of cost are given below: Standard unit quantity…

A: Materials price variance is the variance between standard cost of materials and actual cost of…

Q: RUE OR FALSE? The cumulative effect of change in accounting policy is shown in the income statemen

A: Solution Concept Accounting policy refers to the principles that is used in the presentation and…

Q: Compute the taxable income. A. Zero B. P4,000,000 C. P5,000,000 D. P29,000,000

A: The taxability of income of the nonstock nonprofit educational institutions depends upon whether the…

Q: True or False: While everyone seems to accept the idea that attention must be paid to organizational…

A: The correct answer for the above mentioned question is given in the following steps for your…

Q: CHAPTER 8 1. On a bank reconciliation, the amount of an unrecorded bank service charge should be: A.…

A: Hi student Since there are multiple questions, we will answer only first question.

Q: . A cash remittance from the branch to the home office is recorded by the home office as a. Debit…

A: Cash Remittance from branch to home Office is recorded by the Home office as Journal Entry will be…

Q: TRANSACTION IMr. U contributed 600,000 Obtain loan 400,000 3Purchased Inventory 200,000 cash basis…

A: Hi student Since there are multiple subparts, we will answer only first three subparts.

Q: Maurice, single, has wages of $215,114 and net investment income of $40,000 in 2021. His AGI (MAGI)…

A: As per Internal Revenue Service, the net investment tax rate on the net investment income for…

Q: Valiant Company reported the following analysis of current receivables at year-end: Trade accounts…

A: A key accounting concept is the buying and selling of things and services, with remuneration…

Q: Compare these two investments A: A USD 1,000,000 investment that earns USD 50,000 in interest. B: A…

A: Return on investment is a financial ratio that is calculated to evaluate the efficiency of an…

Q: X Corporation opted to deduct OSD. The following are the results of its operation: Net sales…

A: An OSD or Optional Standard Deduction is a standard deduction at the rate of 40% which taxpayers…

Q: resident foreign corporation received 900,000 dividends from a domestic corporation. How much final…

A: Solution Provision applicable The dividend received by A resident foreign corporation from a…

Q: Net income after tax is: The difference of financial income and total deferred income tax expense.…

A: Net income is the amount of money earned by an entity after deducting its outlays from the revenues.…

Q: 3. The freight on shipment of inventories from the home office to the branch that is paid by the…

A: Hi student Since there are multiple questions, we will answer only first question

Q: Cleone has a taxable income of P270,000 for the year 2019. Opted to use the graduated tax table.…

A: The tax due is also referred to as the tax payable on the taxable income. The tax liability depends…

Q: Chadwick Enterprises, Inc., operates several restaurants throughout the Midwest. Three of its…

A: Assets are the future benefit of the company that would have to be sacrificed in order to pay off…

Q: The rent expense of the lessee maybe composed of the following: I. Straight-line amortization…

A: Lease rent are the payment to the lessor against the right to use the asset of the lessor by the…

Q: Correcting the Trial Balance: Near the end of the year, Alpha received $2,000 cash in advance from a…

A: The adjustment entries are prepared to adjust the revenue and expenses of the current period.

Q: (b) Assume that Sheridan Company received the balance due from Grouper Co. on January 2 of the…

A: 2/10, n/30: Here, 2 represent the discount rate if payment is made within ten days. And if payment…

Q: The data shown were obtained from the financial records of Italian Exports, Inc., for March:…

A: The direct expenses of manufacturing the goods supplied by a business are referred to as the cost of…

Q: Whartside Mahutacturing estimates that its office employees will earn $56,000 next year and its…

A: Estimated premiums is a kind of worker's compensation insurance which depends on the various…

Q: Xyz ltd co. sold Land for $140,000 cash, purchased Equipment for $40,000 cash, and issued Bonds…

A: Cash flow from investing activity is a section of cash flow where all the transitions of cash…

Q: Maurice, single, has wages of $215,114 and net investment income of $40,000 in 2021. His AGI (MAGI)…

A: solution provision applicable for a person who is single and his MAGI is greater than $200,000 , net…

Q: On January 1, 2023, the city government provided Swerte Company a zero interest, P6,000,000 loan…

A: In this Question, this is a zero-coupon bond having no interest. Therefore in this, we will…

Q: n June 12, Music, Incorporated sells $4,000 of goods on account to a credit customer with credit…

A: Journal entries are the foremost reporting of the business transactions in the entity's account…

Q: Accounting BONUS MARK: A small manufacturing firm, 'G&N Ltd' makes whistles. During November 2,600…

A: The net income is calculated as difference between sales and total expenses.

Q: Cooper Inc. took physical inventory count at the end of 2020. On the day of physical count, there…

A: Generally there are two terms of Shipping: FOB SHIPPING FOB DESTINATION Under FOB SHIPPING,…

Q: . On December 31, 2021, JV Company purchased for P4,000,000 cash all of the outstanding ordinary…

A: The value of goodwill is calculated by reducing the carrying value of liabilities from the fair…

Q: 45. Mr. Gerry, hired as employee on July 1, 2019 received the following compensation for the year:…

A: If maximum value is to be achieved for both employers and employees, tax efficient incentive plans…

Q: For the calendar year 2021, ABC Corporation a retailer, has gross sales of PI.4 billion, cost of…

A: The amount of income tax due is the difference between the net income received and the amount paid…

Q: ABC Corporation will be converted into a publicly listed corporation. The original shareholders…

A: A crown jewels sale is a last-ditch approach used by a firm to avoid a hostile takeover or relieve…

Q: Mark Company quarries limestone, crushes it and sells it to be used in road building. Mark paid…

A: Depletion is a non-cash expense which is recorded in the books to reduce the cost value of assets.

Q: Natalie owns a condominium near Cocoa Beach in Florida. In 2021, she incurs the following expenses…

A: Income tax payable is an obligation for the tax payers to the government on the taxable income.…

Q: Sherwin Company uses straight line depreciation for its property, plant, and equipment, which,…

A: Depreciation expense on property, plant & equipment is credited to accumulated depreciation…

Q: Determine the adjusted BANK balance using the following data provided by Ilustre Company: Balance…

A: Bank reconciliation: It is a statement drawn up by the business to verify the cash book balance with…

Step by step

Solved in 2 steps

- ESTIMATING TAXABLE INCOME, TAX LIABILITY, AND POTENTIAL REFUND. Hannah Owens is 24 years old and single, lives in an apartment, and has no dependents. Last year she earned 55,000 as a sales assistant for Business Solutions: 3,910 of her wages was withheld for federal income taxes. In addition, she had interest income of 142. She takes the standard deduction. Calculate her taxable income, tax liability, and tax refund or tax owed for 2015.Here is another question: From here what should I put as the total income on a 1040 line 6 where it says, "total income, add lines 1 through 5. Add any amount from Schedule 1, line 22___________? Gross Income $325,000 Business Expenses $201,000 Records related to Sarah’s employment provide the following information. Salary $145,000 Unreimbursed travel expenses (including $200 of meals) $1600 Other pertinent information for the tax year includes the following. Capital gain/losses spot: Proceeds from sale of stock acquired on July 15, 2018 (cost of $12,000) and sold on August 1, 2018 $9,800 Proceeds from sale of stock acquired on September 18, 2017 (cost of $5,000), sold on October5, 2018 $3,800 Wages paid to full-time domestic worker for housekeeping and child supervision $10,000 Interest income received $7,000 Total itemized deductions (not including any potential deductions above) $27,900 Federal income tax withheld $31,850 Estimated payments of Federal income tax $20,000…You are provided with the following amounts for Janet Mattera for the current year: • Net employment income = $6,600 • Business A: Gross income = $21,000 • Business B: Gross income = $118,000 • Business A: Expenses (for income tax purposes) = $32,000 • Business B: Expenses (for income tax purposes) = $28,000 • Interest income = $1,500 • Taxable amount of dividends = $2,640 Based on the above, the total amount reported pursuant to ITA paragraph 3(a) in the computation of Janet Mattera's net income is:

- Daniel Simmons arrived at thefollowing tax information:Gross salary,$62,250Dividend income,$140Standarddeduction, $12,400Interest earnings,$75Adjustments toincome, $850 What amount would Daniel report astaxable income?A derived its income from its self-operated talpakan business. The details of his business for 2021 are as follows: Gross Receipts - P100,000.00 Operating Expenses - P50,000.00 Income taxes withheld in general - P10,000.00 Question: Assuming that the tax rate is 25%, what is the income tax payable of A? Group of answer choices P2,500.00 P12,500.00 P25,000.00 P15,000.00Mr. Reyes is both employed and self-employed. He had the following income receipts during the month: Gross compensation income P 120,000.00 Director's fees 80,000.00 Professional fees 200,000.00 Total gross income P 400,000.00 The total amount subject to business tax is?

- A VAT taxpayer had the following data on its operations for he month of January 2018:Sales, total invoice price P 592,480Purchases of goods, VAT not included:From VAT registered persons 100,000From nonVAT registered persons 8,000From persons subject to percentage taxes 10,000Salaries of employees 60,000Other operating expenses 12,000This is the first month of being liable to value added tax. Data in inventories at the beginning of the period bought from VAT registeredpersons follow:Inventory at cost P 44,800Inventory at realizable value 49,000Value added tax paid on beginning inventory 4,80016. How much is the input tax?17. How much is the value added tax payable?47. In preparing the 2021 Annual Income Tax Return of Nicanor, the following information were culled from his accounting records: Gross sales – Php 2,500,000 Cost of sales – Php 1,000,000 Salaries and wages – Php 100,000 Rent Expense – Php 100,000 Depreciation – Php 100,000 Utilities Expense – Php 100,000 Repairs and Maintenance – Php 100,000 Other income: Rental income – Php 1,000,000 Interest income from bank deposits in Bank of the Pelepens – Php 100,000 Dividends from ABC Corp., a DC – Php 100,000 Cash Prizes – Php 100,000 The duly filed 1st quarterly income tax return indicated that Nicanor opted 8% taxation. In addition, he provided…Janet Stevens began her tax business, Stevens Tax Service, on February 1, 2021. Below is the Chart of Accounts for the company:Acct # Account Title11 Cash12 Accounts receivable14 Supplies15 Prepaid Rent16 Prepaid Insurance18 Office Equipment19 Accumulated Depreciation21 Accounts Payable23 Unearned Fees31 Janet Stevens, Capital32 Janet Stevens, Drawing41 Fees Earned51 Salary Expense52 Rent Expense53 Supplies Expense54 Depreciation Expense55 Insurance Expense59 Miscellaneous ExpenseAfter closing the books at the end of March, Stevens Tax Service had the following post-closing trial balance:Stevens Tax ServicePost-Closing Trial BalanceMarch 31, 2021Acct # Account Title Debit Credit11 Cash 12,80012 Accounts Receivable 9,75014 Supplies 72515 Prepaid Rent 5,00016 Prepaid Insurance 2,25018 Office Equipment 10,50019 Accumulated Depreciation 70021 Accounts Payable 1,51023 Unearned Fees 1,80031 Janet Stevens, Capital 37,015Totals 41,025 41,0252During the month of April, 2021, Stevens Tax Service…

- A business paid out $12,450 in net wages to its employees. In respect of these wages, the followingamounts were shown in the statement of financial position.$Income tax payable 2,480National Insurance payable – employees' 1,350– employer's 1,500Pension payable for employees' contributions 900Employees' gross wages, before deductions, were ........................................1. In the third quarter of 2019, a taxpayer engaged in the sale of services whose annual gross receipts do not exceed P3M has the following data: Accounts receivable, beginning of quarter P 50,000; Sales during the quarter 100,000; Accounts receivable, end of quarter 75,000; Purchase of supplies, total invoice amount 11,200. The percentage tax due for the quarter is 2. In the third quarter of 2019, a taxpayer engaged in the sale of services whose annual gross receipts do not exceed P3M has the following data: Accounts receivable, beginning of quarter P 50,000; Sales during the quarter 100,000; Accounts receivable, end of quarter 75,000; Purchase of supplies, total invoice amount 11,200. Assuming the taxpayer is VAT-registered, the VAT payable is: