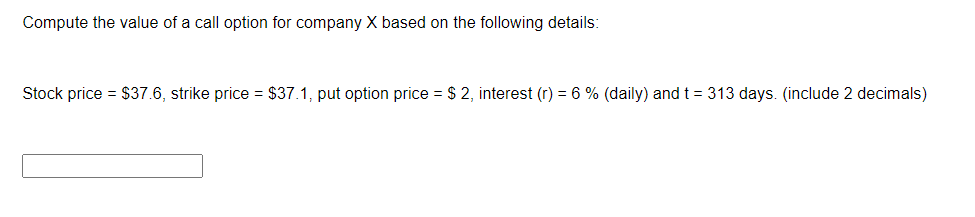

Compute the value of a call option for company X based on the following details: Stock price = $37.6, strike price = $37.1, put option price = $ 2, interest (r) = 6% (daily) and t = 313 days. (include 2 decimals)

Q: (a) If you build the condominium units today, how many condominium units will you build? What is the…

A: Investment decisions refer to the process of evaluating and selecting capital allocation…

Q: Karen Kay, a portfolio manager at Collins Asset Management, is using the capital asset pricing model…

A: The objective of the question is to calculate the expected return and alpha for each stock using the…

Q: A stock just paid a dividend of $1.36. The dividend is expected to grow at 27.85% for three years…

A: The objective of the question is to calculate the value of a stock given the dividend, growth rates,…

Q: You just borrowed $15,000 from a finance company to start a business. If you are required to repay…

A: The expected real rate of interest is the rate of interest that an investor expects to receive after…

Q: C) a decrease of $12 D) an increase of $60,000 20. In a particular year a certain investment project…

A: Revenue = $200,000Expenses = $100,000Depreciation = $50,000Interest = $10,000Tax rate = 21%

Q: What is the expected value of the company if the low-volatility project is undertaken? The…

A: EconomyProbabilityLow-VolatilityHigh-VolatilityLow-VolatilityHigh-VolatilityProject PayoffProject…

Q: A series of equal cash $50 that is deposited at the end of each month will last for 20 years. How…

A: Annual interest rate compounded monthly = 6%Monthly rate of interest r = 6%/12=0.5%Monthly deposits…

Q: A stock you are interested in paid a dividend of $1 last year. The anticipated growth rate in…

A: Implied volatility is a critical metric in financial markets, particularly in options trading,…

Q: Initial equipment cost=$100,000 Market value at the end of 6 years = $6,000 Use MACRS…

A: Cashflow:Cashflow is a financial metric that represents the movement of money in and out of a…

Q: Let the current spot rate be $1.25/€, and assume that one month from now the spot rate will be…

A: Options and futures are financial instruments that derive their value from an underlying asset,…

Q: Consider the financial statements for the REIT given below. Assume that the net revenue includes a…

A: FFO refers to the fund from operations. The FFO multiple can be computed using the below formula.

Q: Calculate the impact of undertaking multilateral netting by Kenduri Co and its three subsidiary…

A: Exchange rate cash flows refer to the financial inflows and outflows that result from fluctuations…

Q: A business has: Net sales of $6,404,300; Cost of goods sold of $4,720,870; Accounts receivable of…

A: Accounts Receivable Days is a metric used to evaluate the time it takes for the company to collect…

Q: 6. Tim wants to buy an apartment that costs $750,000 with an 85% LTV mortgage. Tim got a 30-year,…

A: The internal rate of return (IRR) is a performance metric for investments or projects. The yearly…

Q: What can be used to calculate a firm's cost of debt? Multiple Choice O O Yield to maturity on the…

A: The cost of debt is the effective rate that a company pays on its borrowed funds. It is often…

Q: what is mutual funds?

A: The objective of the question is to understand the concept of mutual funds in finance.

Q: A borrower takes out a 30-year adjustable rate mortgage loan for $200,000 with monthly payments.…

A: Mortgage loans are paid by equal monthly payments and these monthly payments carry the payments for…

Q: An actuary invests 1000 at the end of each year for 30 years. The investments will earn interest at…

A: Calculate the interest earned on the investment each year:Interest earned in year Interest earned…

Q: A new project will cost $80,000 initially and will last for 7 years, at which time its salvage value…

A: The question is based on the concept of sensitivity analysis of capital budgeting. The analysis…

Q: A Treasury bond has a face value of $100, a maturity of 20 years, a coupon of 4%, and pays the…

A: The objective of this question is to calculate the yield of a Treasury bond given its face value,…

Q: 17. A 6-month note for $18,200, with interest at 8% is issued on April 1, 2018. Find present value…

A: I know you want both the answer But please try to understand as per guideline if more than one…

Q: Lowell Inc.has $5 million in inventory, $2 million in accounts receivable, and 1.5 million in…

A: Cash conversion cycle is an important financial ratio. This ratio shows the amount of time that a…

Q: QUESTION 4 Based on your risk assessment, your required rate of return is 9 percent for a callable…

A: The yearly return an investor might anticipate receiving if they hold a callable bond until the…

Q: All of the following statements about life insurance company investments are true EXCEPT income from…

A: The objective of this question is to identify the statement that is not true about life insurance…

Q: 2,000. a. How many years would she have to be incident free in order to justify the higher…

A: a. Number of Years for Break-Even:Savings per year: Annual premium discount = 9% * $2,000 =…

Q: i will 5 upvotes urgent You just got a new job and are offered several contracts from which to…

A: Time value of money explains that the value of money today is more than the value of money which is…

Q: What do you understand by crowdfunding?

A: Crowdfunding is a funding method that leverages online platforms to gather small amounts of money…

Q: The following table shows risk and return measures for Coca-Cola and Intel. Stock Expected Return…

A: ParticularsExpected returnStandard deviationCoca-Cola13.60%15.40%Intel15%23%Correlation…

Q: You purchased 50 shares of Z stock in January 2022 for $40 per share. Each year you received a cash…

A: Purchase price=$40Selling price=$60Dividend=$0.75Brokerage=3% on both sides

Q: On January 1, 2024, Pharoah issued $5,700,000, 4% bonds. Interest is payable semi-annually on June…

A: Value of bond issued = $5,700,000Coupon rate = 4%Compounding = Semi-annuallyMaturity = 10 yearsYield…

Q: You need a 25-year, fixed-rate mortgage to buy a new home for $240,000. Your mortgage bank will lend…

A: A balloon payment refers to a large lump sum payment that is due at the end of a loan term. Unlike a…

Q: Automotive Excellence Inc. borrowed $16,000.00 on April 16 with an interest rate of 4.9% per annum.…

A: An interest rate is the cost of borrowing money or the return on investment for lending money,…

Q: 1. Suppose you have n risky assets you can combine in a portfolio. Each risky asset has an expected…

A: For calculating expected return where a portfolio of 2 of risky assets has equal weights where…

Q: 4. You are planning your retirement in 15 years. You currently have $125,000 in a bond account and…

A: Retirement refers to the period in a person's life when they cease working and typically withdraw…

Q: You want to purchase a car 4 years from now, and you plan to save $4,500 per year, beginning…

A: Annuity refers to a regular stream of cash flows which occurs over a definite period. If it occurs…

Q: A 22-year old college graduate just got a job in Nashville. She is considering buying a house with a…

A: A house mortgage is a financial arrangement that enables individuals to purchase homes without…

Q: CoffeeStop primarily sells coffee. It recently introduced a premium coffee-flavoured liquor. Suppose…

A: The risk-free rate of return refers to the theoretical rate of return of an investment with zero…

Q: Suppose that in 2020, the rate of inflation in Denmark was 0.6%, and the rate of inflation in the…

A: Inflation is an economic phenomenon characterized by a sustained increase in the general price level…

Q: Lowell Company is considering adding a robotic paint sprayer to the production line. The prayer's…

A: Free cash flow is that amount which is earned by the investor from the project. It is the net amount…

Q: You enter into a five-to-eight-month forward rate agreement with a firm. You agree to lend the firm…

A: Variables in the question:Principal=$5,000,000Lending rate= 2.5% per annumContinuously compounded…

Q: 13. You decide you'd like to buy a Nissan Leaf electric car, but you don't have enough money. You…

A: Down payment=$2000Price of car=28140Interest rate=8%Monthly payment=$340.31

Q: Sachs Brands's defined benefit pension plan specifies annual retirement benefits equal to 1.3% x…

A: The project beneficiary approach involves identifying and quantifying the positive outcomes of a…

Q: Stocks and bonds are traded in separate markets, and interest rates are set in bond (debt) markets.…

A: Stocks and bonds are two types of financial instruments that represent ownership or a claim on…

Q: Michelle borrows P5,000 for 6 years at 8% rate. At the end of 6 years, she decided to renew the loan…

A: "Lump sum due" typically refers to a single, one-time payment that is owed or due at a specified…

Q: To help with a down payment on a home, Rita is going to invest. Assuming an interest rate of 1.67%…

A: Present value, also known as present discounted value, is a financial concept that refers to the…

Q: company borrowed money from a local bank. The note the company signed requires five annual…

A: The periodic payment is the payment made at a regular interval to repay a loan or debt. Generally,…

Q: You are considering two payment options on a $500,000 20-year mortgage having an interest rate of…

A: Mortgage refers to the contract between borrower and the lender of the amount. The borrower owes…

Q: 2. Company A exported 20 metric tons of Good X to Japan. The goods were packed in cartons each…

A: The objective of the question is to calculate the unit FOB (Free on Board) Shanghai price for the…

Q: Bad Company has a new 4-year project that will have annual sales of 8,400 units. The price per unit…

A: Operating cash flow is the amount which is earned by the investor from the project. It is the net…

Q: Soggy Bottom, Inc. has received a term sheet from WeBeFunding Ventures for a $4,000,000 investment.…

A: Convertible treasury notes are the ones which can be converted into shares at a predetermined event…

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

- Suppose that both a call option and a put option have been written on a stock with an exerciseprice of $40. The current stock price is $42, and the call and put premiums are $3 and $0.75,respectively. Calculate the profit to positions of both the short call and the long put with an expiration day stock price of $43.Turn back to Figure 20.1 , which lists prices of various IBM options. Use the data in the figure tocalculate the payoff and the profits for investments in each of the following January expirationoptions, assuming that the stock price on the expiration date is $125.a. Call option, X 5 $120.b. Put option, X 5 $120.c. Call option, X 5 $125.d. Put option, X 5 $125.e. Call option, X 5 $130.f. Put option, X 5 $130.Use the data in the figure 20.1 and calculate thepayoff and the profits for investments in each ofthe following January expiration options, assumingthat the stock price on the expiration date is $125.a. Call option, X=$120b. Put option, X=$120c. Call option, X=$125d. Put option, X=$125e. Call option, X=$130f. Put option, X=$130

- The price of a stock is $44 per share, and the October put with an exercise price of $45 is selling for $3. The intrinsic value of the option is:The Black-Scholes model is used to value call options on the stock of National Co. The following information was identified:· The share price is P43.· The option matures in 6 months· The risk-free rate is 2%.· Price of the option is at P43.What is the exponent of “e” for in computing the value of the call option using the Black-Scholes model?You shorted a call option on Intuit stock with a strike price of $38. When you sold (wrote) the option, you received $3. The option will expire in exactly three months' time. a. If the stock is trading at $49 in three months, what will your payoff be? What will your profit be? b. If the stock is trading at $35 in three months, what will your payoff be? What will your profit be? c. Draw a payoff diagram showing the payoff at expiration as a function of the stock price at expiration. d. Redo c, but instead of showing payoffs, show profits. Question content area bottom Part 1 a. The payoff of the short is $ short is $ enter your response here. enter your response here, and the profit of the. Please step by step answer.

- The stocks of Cee Mobile Limited is currently trading at $73 each. The call option on the company’s stock has an exercise price of $70, with fifty (50) days remaining to expiration. It is assumed that the yield on treasury bills is currently 2%, while the volatility of the stock price is estimated as being 35%. a. Using the Black-Scholes-Merton (BSM) model, calculate the value of the Call option, given the above parameters. Show all relevant workings. b. Of the value computed, how much is the intrinsic value and the time value of the Call option? c. Using the BSM model and the information given above, calculate the value of the Put option on the stock, with a similar strike price and days to expiration.You have been given the following information on Claiborne Industries: Current stock price = $32 Option’s exercise price = $32 d1 = 0.1735 d2 = 0.02735 N(d)1 = 0.56960 N(d)2 = 0.51091 Time until expiration of option = 3 months, or 0.25 of a year Risk-free rate = 6% Variance of stock price = 0.09 Using the Black-Scholes Option Pricing Model, what would be the option’s value? Round intermediate calculations to 6 decimal places. Round your answer to two decimal places. $You are given the following information about the stock of Company ABC: Share price $80 risk free rate of interest is 6%, time to expiration is 6 months, annualised standard deviationis 0.5 and exercise price is $85. Calculate the appropriate call value of the stock according to the Black-Scholes option pricing formula. (Show your workings in full) Calculate an appropriate put premium. (Show your workings in full)

- The Black-Scholes model is used by Bulldogs Inc. to value call options on the stock of National Inc. The following information was determined by the analyst:· The share price is P30.· The price of the option is at P32.· The risk-free rate is 3%.· The option matures in 6 monthsIn the formula of the current value of the call option under the Black-Scholes model, what is the exponent of “e” be? -0.015 0.15 0.25 -0.055Which of the following call options on XYZ stock is most valuable? 1. Strike price = $ 40, 3 months to expiration 2. Strike price = $ 40, 3 months to expiration 3. Strike price = $ 50, 6 months to expiration 4. Strike price = $ 50, 6 months to expirationA stock priced at $65 has three-month calls and puts with an exercise price of $55 available. The calls have a premium of $3.91, and the puts cost $1.6. The risk-free rate is 1.6%. If the put options are mispriced, what is the profit per option assuming no transaction costs? Bring out 4 decimal places