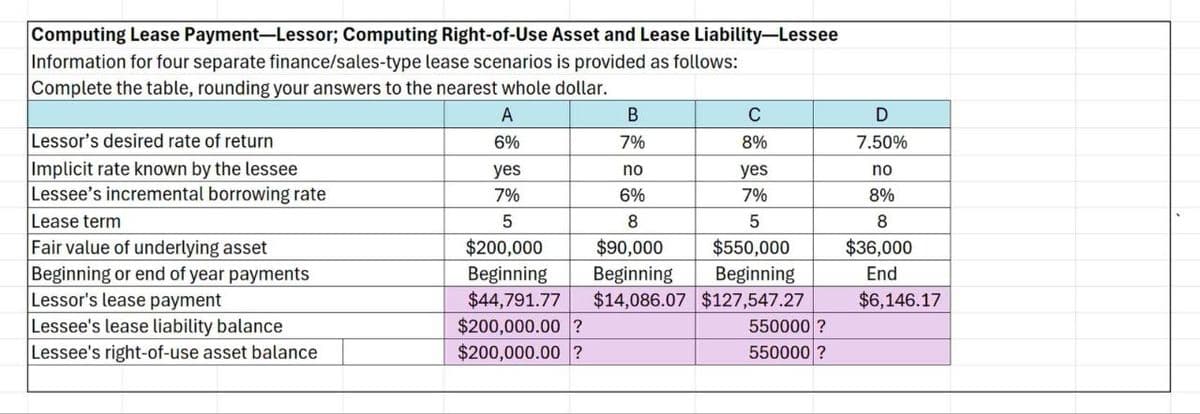

Computing Lease Payment-Lessor; Computing Right-of-Use Asset and Lease Liability-Lessee Information for four separate finance/sales-type lease scenarios is provided as follows: Complete the table, rounding your answers to the nearest whole dollar. A B C D Lessor's desired rate of return 6% 7% 8% 7.50% Implicit rate known by the lessee yes no yes no Lessee's incremental borrowing rate 7% 6% 7% 8% Lease term 5 8 5 8 Fair value of underlying asset $200,000 $90,000 $550,000 $36,000 Beginning or end of year payments Beginning Beginning Beginning End Lessor's lease payment $44,791.77 $14,086.07 $127,547.27 $6,146.17 Lessee's lease liability balance Lessee's right-of-use asset balance $200,000.00 ? $200,000.00? 550000? 550000?

Computing Lease Payment-Lessor; Computing Right-of-Use Asset and Lease Liability-Lessee Information for four separate finance/sales-type lease scenarios is provided as follows: Complete the table, rounding your answers to the nearest whole dollar. A B C D Lessor's desired rate of return 6% 7% 8% 7.50% Implicit rate known by the lessee yes no yes no Lessee's incremental borrowing rate 7% 6% 7% 8% Lease term 5 8 5 8 Fair value of underlying asset $200,000 $90,000 $550,000 $36,000 Beginning or end of year payments Beginning Beginning Beginning End Lessor's lease payment $44,791.77 $14,086.07 $127,547.27 $6,146.17 Lessee's lease liability balance Lessee's right-of-use asset balance $200,000.00 ? $200,000.00? 550000? 550000?

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter19: Lease Financing

Section: Chapter Questions

Problem 1Q: Define each of the following terms: a. Lessee; lessor b. Operating lease; financial lease;...

Related questions

Question

i need the answer quickly

Transcribed Image Text:Computing Lease Payment-Lessor; Computing Right-of-Use Asset and Lease Liability-Lessee

Information for four separate finance/sales-type lease scenarios is provided as follows:

Complete the table, rounding your answers to the nearest whole dollar.

A

B

C

D

Lessor's desired rate of return

6%

7%

8%

7.50%

Implicit rate known by the lessee

yes

no

yes

no

Lessee's incremental borrowing rate

7%

6%

7%

8%

Lease term

5

8

5

8

Fair value of underlying asset

$200,000

$90,000

$550,000

$36,000

Beginning or end of year payments

Beginning

Beginning

Beginning

Lessor's lease payment

$44,791.77 $14,086.07 $127,547.27

End

$6,146.17

Lessee's lease liability balance

$200,000.00 ?

550000?

Lessee's right-of-use asset balance

$200,000.00 ?

550000 ?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning