Essentials Of Investments

11th Edition

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Chapter1: Investments: Background And Issues

Section: Chapter Questions

Problem 1PS

Related questions

Question

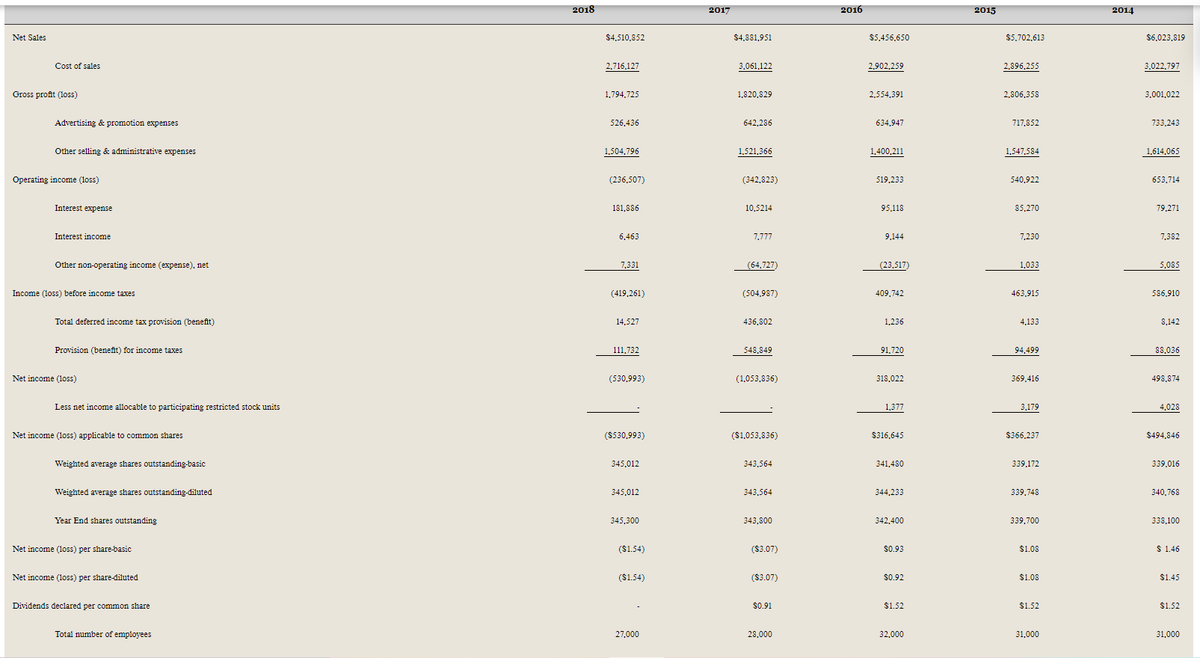

Conduct an analysis of Mattel’s financial statements. What is your assessment of the overall condition and strength of Mattel’s finances?

Transcribed Image Text:2018

2017

2016

2015

2014

Net Sales

$4,510,852

$4,881,951

$5,456,650

$5,702,613

$6,023,819

Cost of sales

2,716,127

3,061,122

2,902,259

2,896.255

3.022,797

Gross profit (loss)

1,794,725

1.820.829

2,554,391

2,806,358

3,001,022

Advertising & promotion expenses

526,436

642,286

634,947

717,852

733,243

Other selling & administrative expenses

1,504.796

1,521,366

1,400,211

1,547,584

1,614,065

Operating income (loss)

(236,507)

(342,823)

519,233

540,922

653,714

Interest expense

181,886

10,5214

95,118

85,270

79,271

Interest income

6,463

7,777

9,144

7,230

7,382

Other non-operating income (expense), net

7,331

(64,727)

(23,517)

1,033

5,085

Income (loss) before income taxes

(419,261)

(504,987)

409.742

463.915

586,910

Total deferred income tax provision (benefit)

14,527

436,802

1,236

4,133

8,142

Provision (beneft) for income taxes

111,732

548,849

91,720

94,499

88,036

Net income (loss)

(530,993)

(1.053,836)

318,022

369,416

498,874

Less net income allocable to participating restricted stock units

1,377

3,179

4,028

Net income (loss) applicable to common shares

(S530,993)

(S1,053,836)

$316,645

$366,237

$494,846

Weighted average shares outstanding-basic

345,012

343,564

341,480

339,172

339,016

Weighted average shares outstanding-diluted

345,012

343,564

344,233

339,748

340,768

Year End shares outstanding

345,300

343,800

342,400

339,700

338,100

Net income (loss) per share-basic

($1.54)

($3.07)

S0.93

$1.08

$ 1.46

Net income (loss) per share-diluted

($1.54)

($3.07)

$0.92

$1.08

$1.45

Dividends declared per common share

$0.91

$1.52

$1.52

$1.52

Total number of employees

27,000

28,000

32,000

31,000

31,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:

9780134897264

Author:

KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:

Pearson,

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i…

Finance

ISBN:

9780077861759

Author:

Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:

McGraw-Hill Education