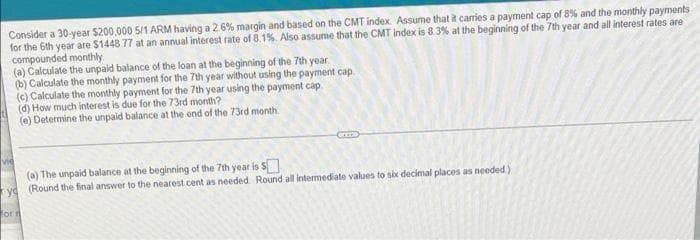

Consider a 30-year $200,000 5/1 ARM having a 2.6% margin and based on the CMT index Assume that it carries a payment cap of 8% and the monthly payments for the 6th year are $1448 77 at an annual interest rate of 8.1%. Also assume that the CMT index is 8.3% at the beginning of the 7th year and all interest rates are compounded monthly (a) Calculate the unpaid balance of the loan at the beginning of the 7th year (b) Calculate the monthly payment for the 7th year without using the payment cap (c) Calculate the monthly payment for the 7th year using the payment cap (d) How much interest is due for the 73rd month? (e) Determine the unpaid balance at the end of the 73rd month CITED (a) The unpaid balance at the beginning of the 7th year is S (Round the final answer to the nearest cent as needed Round all intermediate values to six decimal places as needed)

Consider a 30-year $200,000 5/1 ARM having a 2.6% margin and based on the CMT index Assume that it carries a payment cap of 8% and the monthly payments for the 6th year are $1448 77 at an annual interest rate of 8.1%. Also assume that the CMT index is 8.3% at the beginning of the 7th year and all interest rates are compounded monthly (a) Calculate the unpaid balance of the loan at the beginning of the 7th year (b) Calculate the monthly payment for the 7th year without using the payment cap (c) Calculate the monthly payment for the 7th year using the payment cap (d) How much interest is due for the 73rd month? (e) Determine the unpaid balance at the end of the 73rd month CITED (a) The unpaid balance at the beginning of the 7th year is S (Round the final answer to the nearest cent as needed Round all intermediate values to six decimal places as needed)

Chapter19: Lease And Intermediate-term Financing

Section: Chapter Questions

Problem 17P

Related questions

Question

13

Circle Answers Please.

Transcribed Image Text:Consider a 30-year $200,000 5/1 ARM having a 2.6% margin and based on the CMT index. Assume that it carries a payment cap of 8% and the monthly payments

for the 6th year are $1448 77 at an annual interest rate of 8.1%. Also assume that the CMT index is 8.3% at the beginning of the 7th year and all interest rates are

compounded monthly

(a) Calculate the unpaid balance of the loan at the beginning of the 7th year.

(b) Calculate the monthly payment for the 7th year without using the payment cap.

(c) Calculate the monthly payment for the 7th year using the payment cap

(d) How much interest is due for the 73rd month?

(e) Determine the unpaid balance at the end of the 73rd month.

vie

(a) The unpaid balance at the beginning of the 7th year is S

ve (Round the final answer to the nearest cent as needed Round all intermediate values to six decimal places as needed)

for rt

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College