Consider a bank with the following balance sheet (M means million): Assets Value Duration of the Asset Convexity of the Asset 5yr bond bought at a yield of 3.4%(lending money) $550M 4.562 12.026 12yr bond bought at a yield of 4%(lending money) $800M 9.453 53.565 Liabilities Value Duration of the Liability Convexity of the Liability 2yr bond sold at a yield of 2.4%(borrowing money) $300M 1.941 2.384 4yr bond sold at a yield of 2.8%(borrowing money) $500M 3.759 8.206 Calculate the equity (total asset – total liability) to asset ratio of the bank

Consider a bank with the following balance sheet (M means million): Assets Value Duration of the Asset Convexity of the Asset 5yr bond bought at a yield of 3.4%(lending money) $550M 4.562 12.026 12yr bond bought at a yield of 4%(lending money) $800M 9.453 53.565 Liabilities Value Duration of the Liability Convexity of the Liability 2yr bond sold at a yield of 2.4%(borrowing money) $300M 1.941 2.384 4yr bond sold at a yield of 2.8%(borrowing money) $500M 3.759 8.206 Calculate the equity (total asset – total liability) to asset ratio of the bank

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter12: Fainancial Statement Analysis

Section: Chapter Questions

Problem 18MCQ

Related questions

Question

Consider a bank with the following balance sheet (M means million):

|

Assets |

Value |

Duration of the Asset |

Convexity of the Asset |

|

5yr bond bought at a yield of 3.4%(lending money) |

$550M |

4.562

|

12.026 |

|

12yr bond bought at a yield of 4%(lending money) |

$800M |

9.453

|

53.565

|

|

Liabilities |

Value |

Duration of the Liability |

Convexity of the Liability |

|

2yr bond sold at a yield of 2.4%(borrowing money) |

$300M |

1.941 |

2.384 |

|

4yr bond sold at a yield of 2.8%(borrowing money) |

$500M |

3.759 |

8.206 |

Calculate the equity (total asset – total liability) to asset ratio of the bank

Expert Solution

Step 1

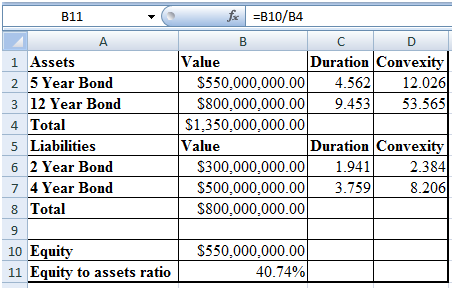

The equity to assets ratio is a ratio that tells that how much company is financed with equity capital.

Step 2

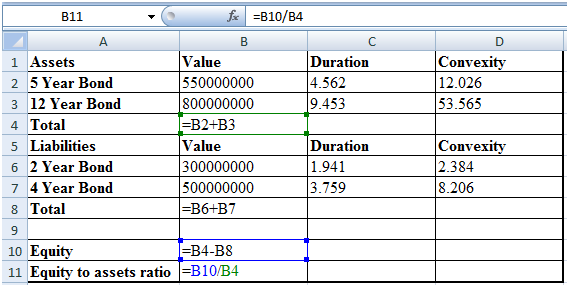

The computation of the equity to assets ratio is as follows:

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning