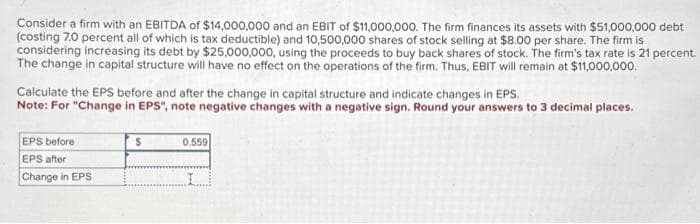

Consider a firm with an EBITDA of $14,000,000 and an EBIT of $11,000,000. The firm finances its assets with $51,000,000 debt (costing 7.0 percent all of which is tax deductible) and 10,500,000 shares of stock selling at $8.00 per share. The firm is considering increasing its debt by $25,000,000, using the proceeds to buy back shares of stock. The firm's tax rate is 21 percent. The change in capital structure will have no effect on the operations of the firm. Thus, EBIT will remain at $11,000,000. Calculate the EPS before and after the change in capital structure and indicate changes in EPS. Note: For "Change in EPS", note negative changes with a negative sign. Round your answers to 3 decimal places. EPS before EPS after Change in EPS $ 0.559

Consider a firm with an EBITDA of $14,000,000 and an EBIT of $11,000,000. The firm finances its assets with $51,000,000 debt (costing 7.0 percent all of which is tax deductible) and 10,500,000 shares of stock selling at $8.00 per share. The firm is considering increasing its debt by $25,000,000, using the proceeds to buy back shares of stock. The firm's tax rate is 21 percent. The change in capital structure will have no effect on the operations of the firm. Thus, EBIT will remain at $11,000,000. Calculate the EPS before and after the change in capital structure and indicate changes in EPS. Note: For "Change in EPS", note negative changes with a negative sign. Round your answers to 3 decimal places. EPS before EPS after Change in EPS $ 0.559

Chapter15: Dividend Policy

Section: Chapter Questions

Problem 13P

Related questions

Question

Transcribed Image Text:Consider a firm with an EBITDA of $14,000,000 and an EBIT of $11,000,000. The firm finances its assets with $51,000,000 debt

(costing 7.0 percent all of which is tax deductible) and 10,500,000 shares of stock selling at $8.00 per share. The firm is

considering increasing its debt by $25,000,000, using the proceeds to buy back shares of stock. The firm's tax rate is 21 percent.

The change in capital structure will have no effect on the operations of the firm. Thus, EBIT will remain at $11,000,000.

Calculate the EPS before and after the change in capital structure and indicate changes in EPS.

Note: For "Change in EPS", note negative changes with a negative sign. Round your answers to 3 decimal places.

EPS before

EPS after

Change in EPS

$

0.559

I

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 4 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning