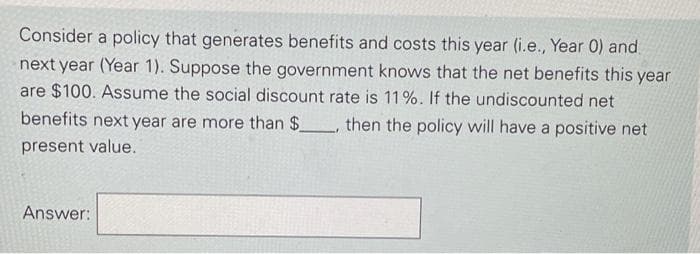

Consider a policy that generates benefits and costs this year (i.e., Year 0) and. next year (Year 1). Suppose the government knows that the net benefits this year are $100. Assume the social discount rate is 11%. If the undiscounted net benefits next year are more than $ , then the policy will have a positive net present value. Answer:

Consider a policy that generates benefits and costs this year (i.e., Year 0) and. next year (Year 1). Suppose the government knows that the net benefits this year are $100. Assume the social discount rate is 11%. If the undiscounted net benefits next year are more than $ , then the policy will have a positive net present value. Answer:

Chapter11: Capital Budgeting Decisions

Section: Chapter Questions

Problem 16EA: Project B cost $5,000 and will generate after-tax net cash inflows of $500 in year one, $1,200 in...

Related questions

Question

Transcribed Image Text:Consider a policy that generates benefits and costs this year (i.e., Year 0) and.

next year (Year 1). Suppose the government knows that the net benefits this year

are $100. Assume the social discount rate is 11%. If the undiscounted net

benefits next year are more than $_, then the policy will have a positive net

present value.

Answer:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning