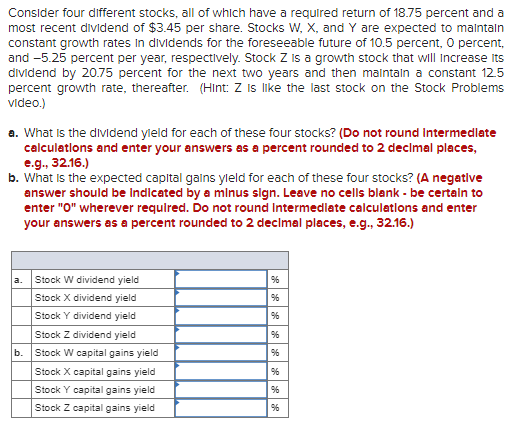

Consider four different stocks, all of which have a required return of 18.75 percent and a most recent dividend of $3.45 per share. Stocks W, X, and Y are expected to maintain constant growth rates in dividends for the foreseeable future of 10.5 percent, O percent, and -5.25 percent per year, respectively. Stock Z is a growth stock that will increase its dividend by 20.75 percent for the next two years and then maintain a constant 12.5 percent growth rate, thereafter. (Hint: Z is like the last stock on the Stock Problems video.) a. What is the dividend yield for each of these four stocks? (Do not round Intermedlate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) b. What is the expected capital gains yield for each of these four stocks? (A negative answer should be indicated by a minus sign. Leave no cells blank - be certain to enter "O" wherever required. Do not round Intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) a. Stock W dividend yield Stock X dividend yield Stock Y dividend yield Stock Z dividend yield b. 96 96 96 Stock W capital gains yield Stock X capital gains yield Stock Y capital gains yield Stock Z capital gains yield % 96 96 96 96

Consider four different stocks, all of which have a required return of 18.75 percent and a most recent dividend of $3.45 per share. Stocks W, X, and Y are expected to maintain constant growth rates in dividends for the foreseeable future of 10.5 percent, O percent, and -5.25 percent per year, respectively. Stock Z is a growth stock that will increase its dividend by 20.75 percent for the next two years and then maintain a constant 12.5 percent growth rate, thereafter. (Hint: Z is like the last stock on the Stock Problems video.) a. What is the dividend yield for each of these four stocks? (Do not round Intermedlate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) b. What is the expected capital gains yield for each of these four stocks? (A negative answer should be indicated by a minus sign. Leave no cells blank - be certain to enter "O" wherever required. Do not round Intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) a. Stock W dividend yield Stock X dividend yield Stock Y dividend yield Stock Z dividend yield b. 96 96 96 Stock W capital gains yield Stock X capital gains yield Stock Y capital gains yield Stock Z capital gains yield % 96 96 96 96

Chapter12: The Cost Of Capital

Section: Chapter Questions

Problem 23P

Related questions

Question

What is the dividend yield for each of these four stocks? What is the expected

Transcribed Image Text:Consider four different stocks, all of which have a required return of 18.75 percent and a

most recent dividend of $3.45 per share. Stocks W, X, and Y are expected to maintain

constant growth rates in dividends for the foreseeable future of 10.5 percent, O percent,

and -5.25 percent per year, respectively. Stock Z is a growth stock that will increase its

dividend by 20.75 percent for the next two years and then maintain a constant 12.5

percent growth rate, thereafter. (Hint: Z is like the last stock on the Stock Problems

video.)

a. What is the dividend yield for each of these four stocks? (Do not round Intermedlate

calculations and enter your answers as a percent rounded to 2 decimal places,

e.g., 32.16.)

b. What is the expected capital gains yield for each of these four stocks? (A negative

answer should be indicated by a minus sign. Leave no cells blank - be certain to

enter "O" wherever required. Do not round Intermediate calculations and enter

your answers as a percent rounded to 2 decimal places, e.g., 32.16.)

a.

Stock W dividend yield

Stock X dividend yield

Stock Y dividend yield

Stock Z dividend yield

b.

96

96

96

Stock W capital gains yield

Stock X capital gains yield

Stock Y capital gains yield

Stock Z capital gains yield

%

96

96

96

96

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning