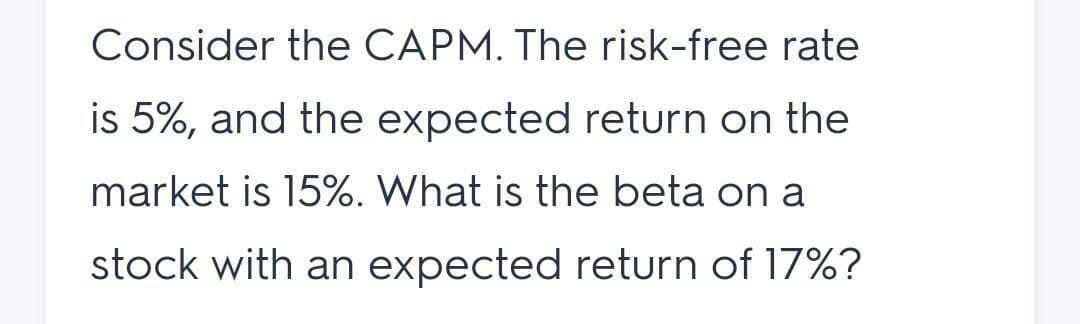

Consider the CAPM. The risk-free rate is 5%, and the expected return on the market is 15%. What is the beta on a stock with an expected return of 17%?

Q: The Treasury bill rate is 4%, and the expected return on the market portfolio is 12%. Using the…

A: Risk free rate = 4% Market return = 12% Beta of stock X = 1.5

Q: The risk-free rate is 3.4 percent and the market expected return is 11.9 percent. What is the…

A: The expected return of a stock can be found out using the CAPM formula. Given, Rf = Risk free…

Q: The company’s stock has a beta-coefficient of 1.5, and its market rate is 15%. With a risk-free rate…

A: Beta Coefficient is 1.5 Market rate is 15% Risk free rate is 8% Market rate increased by 1% To Find:…

Q: The expected return on Share Z is 17.50% with a beta of 1.90. If the risk-free rate is 8%, then what…

A: CAPM- Capital Assets pricing Model This Model explain the relationship between return of security…

Q: ASsume the following data for a stock: Beta 15, risk-free rate = 4 percent, market rate of return 12…

A:

Q: Assume that the risk-free rate is 6.5% and the required return on the market is 10%. What is the…

A: To calculate the required rate of return on a stock, we need to use capital asset pricing model…

Q: Assume that the risk-free rate is 3.5% and the expected return on the market is 10%. What is the…

A: Details given to us are : Risk free rate = 3.5% Expected return on market = 10% Beta = 0.7 We need…

Q: What is the beta of a firm whose equity has an expected return of 21.3 percent when the risk-free…

A: Using CAPM

Q: The expected return on the market is 15% and the risk-free rate of return is 5%. If the Beta of the…

A: In given question we need to compute the expected rate of return for stock using CAPM.

Q: Suppose the risk-free return is 4.1% and the market portfolio has an expected return of 9.3% and a…

A: In CAPM; Capital Asset Pricing Model, the expected return for a single stock is ascertained by…

Q: The expected return for a stock, calculated using the CAP M is 10.5%. The market free return is 9.5%…

A: In the given question we are require to calculate the risk free rate : We can calculate the risk…

Q: A stock has a beta of 0.60 the expected return on the market is 14percent and the risk free rate is…

A: An expected return on stock is the expectation of the shareholder about the amount of gain or loss…

Q: The risk-free rate of return is currently 0.02, whereas the market risk premium is 0.05. If the beta…

A: Given information: Risk free rate of return is 0.02 Market risk premium is 0.05 Beta value of stock…

Q: The current risk-free rate of return, rRF, is 2 percent and the market risk premium, RPM, is 8…

A: Risk free rate = 2% Marker risk premium = 8% Beta = 1.40

Q: Suppose the risk-free return is 4.2% and the market portfolio has an expected return of 11.4% and a…

A: Expected return = Risk free rate + beta * (market return -risk free rate )

Q: A stock has an expected return of 13.1 percent, its beta is 1.70 and the risk free premium rate is…

A: Risk market return is used in CAPM model to calculate expected return on the stock and it is also…

Q: The risk-free rate is 6% and the expected return on the market is 13%. What is the required rate of…

A: Given information is as follows: Risk free rate (Rf) = 6% Expected return on market (Rm) = 13% Beta…

Q: You are holding a stock which has a beta of 2.0 and is currently in equilibrium. The required return…

A: First we need to find out the risk free rate by using CAPM formula rs =Rf +β*(Rm -Rf) rs =Required…

Q: A stock has an expected return of 13.1 percent, a beta of 1.28, and the expected return on the…

A: Given details are : Expected return on stock = 13.1% Beta = 1.28 Expected market return (Rm) = 11%…

Q: Suppose MegaChip has a beta of 1.3, whereas Littlewing stock has a beta of .7. If the risk-free…

A: Given the following information: Beta of MegaChip: 1.3 Beta of Littlewing: 0.7 Risk free rate: 4%…

Q: According to the CAPM, what is the required rate of return for a stock with a beta of 0.7, when the…

A: To calculate the required rate of return we use the below formula Required rate of return = Risk…

Q: What is the expected return for a stock that has a beta of 1.4, if the risk-free rate is 5%, and the…

A: Capital Asset pricing model: This model is used to determine the required rate of return on the…

Q: What is the expected return on Verdoni’s stock?

A: The expected return is the return expected by the investors on their investment. It is the…

Q: Suppose Autodesk stock has a beta of 2.16, whereas Costco stock has a beta of 0.69. If the risk-free…

A: The expected return of the portfolio can be calculated by computing the Portfolio Beta and applying…

Q: what is the expected return on this stock

A: Capital Asset Pricing Model(CAPM) is a method used for finding the relationship between the…

Q: Given the following information, use the CAPM to calculate the beta of the stock. The required rate…

A: Capital Asset Pricing Model CAPM model shows the relationship between the expected return and risk…

Q: Assume that the risk-free rate is 7.5% and the required return on the market is 10%. What is the…

A: The question is based on the concept of the capital asset pricing model (CAPM), the model explains…

Q: Consider the CAPM. The risk-free rate is 6%, and the expected return on the market is 18%. What is…

A: In the given question we need to calculate the expected return on a stock using CAPM i.e. Capital…

Q: If the expected return on a stock is 6 per cent. Risk free rate of return is 2 per cent and market…

A: Capital asset pricing model (CAPM) formula: Expected return = Risk free rate + (Beta *(Market rate -…

Q: Suppose the risk-free return is 4.5% and the market portfolio has an expected return of 10.3% and a…

A: According to the market scenario, the stock prices are keep on changing with the changing market…

Q: If the risk free rate is 4 9%, the expected return on the market portfolio is 1296 and the beta of…

A: Financial management consists of directing, planning, organizing and controlling of financial…

Q: and the risk-free rate is 2.8 market be? 16. Using CAPM A stock has an expected return of 10.2…

A: The risk-free rate of return is the hypothetical rate of return on a risk-free investment. The…

Q: Find the Risk-Free Rate given the Expected Return on Stock Y is 20 %, the Expected Return on Market…

A: Expected return = Risk free rate + beta * (market return - risk free rate )

Q: The risk-free rate of return is 4 percent and the market risk premium is 8 percent. What is the…

A: In given question we need to compute the expected rate of return for stock.

Q: The risk-free rate of return is currently 0.02, whereas the market risk premium is 0.07. If the beta…

A: Capital Pricing Model (CAPM) is an investment theory that shows the relationship between the…

Q: Paycheck, Inc. has a beta of 1.02. If the market return is expected to be 16.90 percent and the…

A: Risk Premium: It characterizes to the additional return over the risk free rate that an investor…

Q: The expected return on the market is 15%, the risk-free rate is 8o/o, and the beta for Stock B is…

A: Given: The expected return = 15% = 0.15 Risk free rate = 8% = 0.08 Beta for stock = 0.8

Q: What is the expected return on a stock with a beta of .8, given a risk-free rate of 3.5% and an…

A: In this question we need to compute the expected return on stock. This question can be solved using…

Q: Suppose Autodesk stock has a beta of 2.10, whereas Costco stock has a beta of 0.72. If the risk-free…

A: Portfolio beta = weighted average beta of the stocks it consists

Q: Using CAPM A stock has an expected return of 10 percent, its beta is .70, and the risk-free rate is…

A: This question require us to compute the expected return on the market i.e. Rm

Q: JaiLai Cos. stock has a beta of 0.6, the current risk-free rate is 6.0 percent, and the expected…

A: The following information has ben provided in the question: Beta =0.6 Risk free rate =6% Expected…

Q: Two stocks, A and B, have beta coefficients of 0.8 and 1.4, respectively. If the expected return on…

A: The evaluation of the systematic risk or volatility of a stock or the portfolio as compared to the…

Q: If the risk free rate is 4 %, the expected return on the market portfolio is 129% and the beta of…

A: Financial management consists of directing, planning, organizing and controlling of financial…

Q: Using CAPM A stock has beta of 1.04, the expected return on the market is 10 percent, and the…

A: The expected return is the minimum required rate of return which an investor required from the…

Q: The risk-free rate of return is 4.8 percent and the market risk premium is 15 percent. What is the…

A: Risk free rate = 4.8% Market risk premium = 15% Beta = 1.80

Calculate Beta

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- If the risk-free rate is 7 percent, the expected return on the market is 10 percent, and the expected return on Security J is 13 percent, what is the beta of Security J?What is the expected risk-free rate of return if asset X, with a beta of 1.5, has an expected return of 20 percent, and the expected market return is 15 percent?Hastings Entertainment has a beta of 0.65. If the market return is expected to be 11 percent and the risk-free rate is 4 percent, what is Hastings' required return?

- Suppose the beta of PetrolCom is 0.75, the risk - free rate is 3 percent, and the market risk premium is II percent. Calculate the expected rate of return on PertrolCom.The Treasury bill rate at the time of estimation is 15% with a beta of 2.0 and the expected return on the market is 20%. What is the firm’s required rate of return ?Breckenridge, Inc., has a beta of 0.97. If the expected market return is 12.0 percent and the risk-free rate is 6.0 percent, what is the appropriate expected return of Breckenridge (using the CAPM)?

- What is the expected return for asset X if it has a beta of 1.5, the expected market return is 15 percent, and the expected risk-free rate is 5 percent?What is the required return for asset X if it has a beta of 1.5, the expected market return is 15 percent, and the expected risk-free rate is 5 percent?A company has a beta of .59. If the market return is expected to be 12.9 percent and the risk-free rate is 5.45 percent, what is the company's required return?

- Hastings Entertainment has a beta of 0.70. If the market return is expected to be 16.40 percent and the risk-free rate is 7.40 percent, what is Hastings’ required return? (Round your answer to 2 decimal places.) Hastings’ required return %Suppose CAPM holds. Pfizer has a beta of 0.7, the average return on the market is 12% per year and the risk free rate is 2%. What should be the expected return of Pfizer?Consider the following information: the risk-free rate is 2%, and the expected rate of return on the market portfolio is 10%. If you have a stock with a beta of +1.5, and you expect it to offer a rate of return of 15%, what should you do? If the Treasury bill rate is currently 1.5%, and the expected return to the market portfolio over the same period is 5%, determine the risk premium on the market. If the standard deviation of the return on the market is 7%, what is the equation of the Capital Market Line?