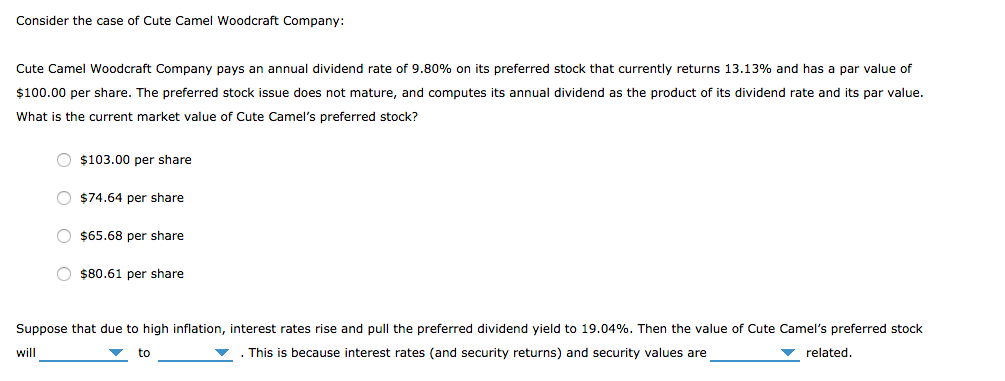

Consider the case of Cute Camel Woodcraft Company: Cute Camel Woodcraft Company pays an annual dividend rate of 9.80% on its preferred stock that currently returns 13.13% and has a par value of $100.00 per share. The preferred stock issue does not mature, and computes its annual dividend as the product of its dividend rate and its par value. What is the current market value of Cute Camel's preferred stock? O $103.00 per share O $74.64 per share O $65.68 per share $80.61 per share Suppose that due to high inflation, interest rates rise and pull the preferred dividend yield to 19.04%. Then the value of Cute Camel's preferred stock will to This is because interest rates (and security returns) and security values are related.

Consider the case of Cute Camel Woodcraft Company: Cute Camel Woodcraft Company pays an annual dividend rate of 9.80% on its preferred stock that currently returns 13.13% and has a par value of $100.00 per share. The preferred stock issue does not mature, and computes its annual dividend as the product of its dividend rate and its par value. What is the current market value of Cute Camel's preferred stock? O $103.00 per share O $74.64 per share O $65.68 per share $80.61 per share Suppose that due to high inflation, interest rates rise and pull the preferred dividend yield to 19.04%. Then the value of Cute Camel's preferred stock will to This is because interest rates (and security returns) and security values are related.

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter8: Basic Stock Valuation

Section: Chapter Questions

Problem 14P

Related questions

Question

Transcribed Image Text:Consider the case of Cute Camel Woodcraft Company:

Cute Camel Woodcraft Company pays an annual dividend rate of 9.80% on its preferred stock that currently returns 13.13% and has a par value of

$100.00 per share. The preferred stock issue does not mature, and computes its annual dividend as the product of its dividend rate and its par value.

What is the current market value of Cute Camel's preferred stock?

O $103.00 per share

O $74.64 per share

O $65.68 per share

$80.61 per share

Suppose that due to high inflation, interest rates rise and pull the preferred dividend yield to 19.04%. Then the value of Cute Camel's preferred stock

will

to

This is because interest rates (and security returns) and security values are

related.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub