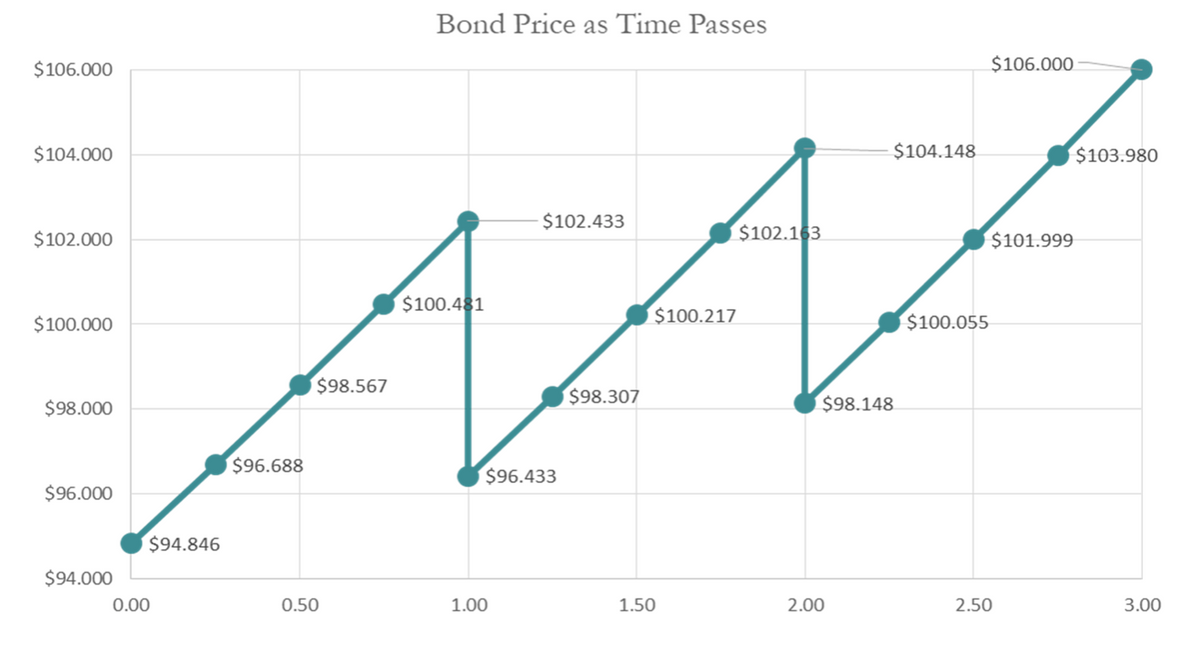

Consider the following figure which shows the relationship between a three-year bond’s price (vertical axis) and the passage of time (measured in years - horizontal axis). Which of the following statements are consistent with the figure above? Group of answer choices A. This bond pays a coupon of $6. B. This pattern of prices is consistent with a bond whose yield to maturity is below the bond’s coupon rate. C. None of the other statements are correct. D. This bond pays coupons on a quarterly basis.

Consider the following figure which shows the relationship between a three-year bond’s price (vertical axis) and the passage of time (measured in years - horizontal axis). Which of the following statements are consistent with the figure above? Group of answer choices A. This bond pays a coupon of $6. B. This pattern of prices is consistent with a bond whose yield to maturity is below the bond’s coupon rate. C. None of the other statements are correct. D. This bond pays coupons on a quarterly basis.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

ChapterA2: Investments

Section: Chapter Questions

Problem 10MCQ

Related questions

Question

Consider the following figure which shows the relationship between a three-year

Which of the following statements are consistent with the figure above?

Group of answer choices

A. This bond pays a coupon of $6.

B. This pattern of prices is consistent with a bond whose yield to maturity is below the bond’s coupon rate.

C. None of the other statements are correct.

D. This bond pays coupons on a quarterly basis.

Transcribed Image Text:Bond Price as Time Passes

$106.000

$106.000

VAZ

$104.000

$104.148

$103.980

$102.433

$102.000

$102.163

$101.999

$100.481

$100.000

$100.217

$100.055

$98.567

$98.307

$98.148

$98.000

$96.688

$96.433

$96.000

$94.846

$94.000

0.00

0.50

1.00

1.50

2.00

2.50

3.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning