Consider the following hypothetical income tax brackets for a single taxpayer. Assume for simplicity there are no exemptions or deductions. Income $0-$10,000 $10,000-$40,000 $40,000-$100,000 Over $100,000 Is this tax regressive, progressive, or proportional? The income tax is progressive Suppose Susan's income is $30,000. How much will she pay in income taxes? Susan will pay $ in income taxes. (Enter your response as an integer) Tax Rate 10% 20 35 50

Consider the following hypothetical income tax brackets for a single taxpayer. Assume for simplicity there are no exemptions or deductions. Income $0-$10,000 $10,000-$40,000 $40,000-$100,000 Over $100,000 Is this tax regressive, progressive, or proportional? The income tax is progressive Suppose Susan's income is $30,000. How much will she pay in income taxes? Susan will pay $ in income taxes. (Enter your response as an integer) Tax Rate 10% 20 35 50

Chapter3: Income Sources

Section: Chapter Questions

Problem 66P

Related questions

Question

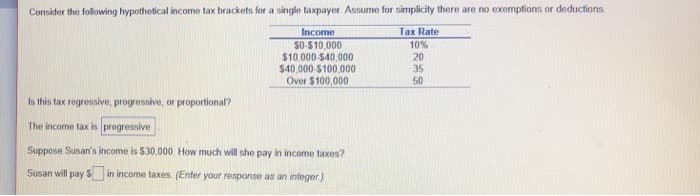

Transcribed Image Text:Consider the following hypothetical income tax brackets for a single taxpayer. Assume for simplicity there are no exemptions or deductions.

Income

$0-$10,000

$10,000-$40,000

$40,000-$100,000

Over $100,000

Is this tax regressive, progressive, or proportional?

The income tax is progressive

Suppose Susan's income is $30,000. How much will she pay in income taxes?

Susan will pay $ in income taxes. (Enter your response as an integer)

Tax Rate

10%

20

35

50

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT