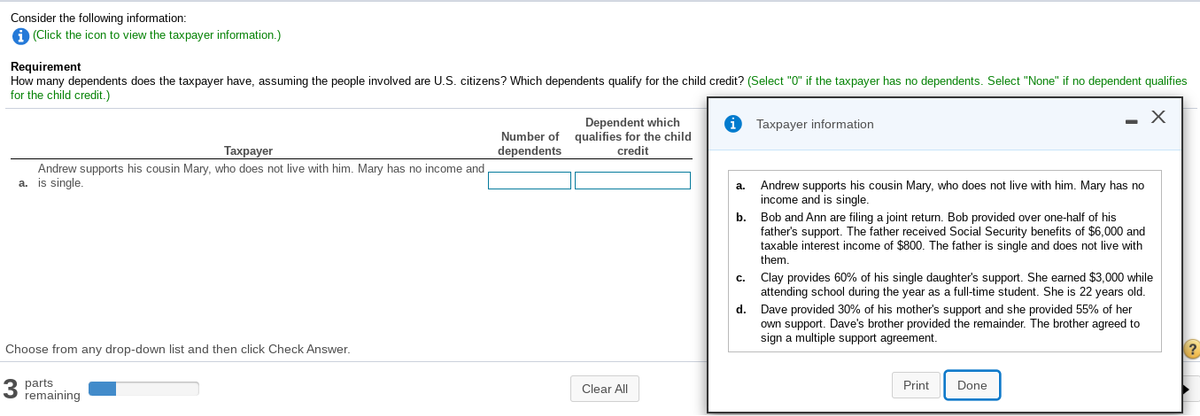

Consider the following information: A (Click the icon to view the taxpayer information.) Requirement How many dependents does the taxpayer have, assuming the people involved are U.S. citizens? Which dependents qualify for the child credit? (Select "0" if the taxpayer has no dependents. Select "None" if no dependent qualifies for the child credit.) Dependent which Taxpayer information Number of qualifies for the child Тахраyer dependents credit Andrew supports his cousin Mary, who does not live with him. Mary has no income and a. is single. Andrew supports his cousin Mary, who does not live with him. Mary has no income and is single. b. Bob and Ann are filing a joint return. Bob provided over one-half of his father's support. The father received Social Security benefits of $6,000 and taxable interest income of $800. The father is single and does not live with them. a. Clay provides 60% of his single daughter's support. She earned $3,000 while attending school during the year as a full-time student. She is 22 years old. c. d. Dave provided 30% of his mother's support and she provided 55% of her own support. Dave's brother provided the remainder. The brother agreed to sign a multiple support agreement. Choose from any drop-down list and then click Check Answer. 3 parts remaining Clear All Print Done

Consider the following information: A (Click the icon to view the taxpayer information.) Requirement How many dependents does the taxpayer have, assuming the people involved are U.S. citizens? Which dependents qualify for the child credit? (Select "0" if the taxpayer has no dependents. Select "None" if no dependent qualifies for the child credit.) Dependent which Taxpayer information Number of qualifies for the child Тахраyer dependents credit Andrew supports his cousin Mary, who does not live with him. Mary has no income and a. is single. Andrew supports his cousin Mary, who does not live with him. Mary has no income and is single. b. Bob and Ann are filing a joint return. Bob provided over one-half of his father's support. The father received Social Security benefits of $6,000 and taxable interest income of $800. The father is single and does not live with them. a. Clay provides 60% of his single daughter's support. She earned $3,000 while attending school during the year as a full-time student. She is 22 years old. c. d. Dave provided 30% of his mother's support and she provided 55% of her own support. Dave's brother provided the remainder. The brother agreed to sign a multiple support agreement. Choose from any drop-down list and then click Check Answer. 3 parts remaining Clear All Print Done

Chapter1: The Individual Income Tax Return

Section: Chapter Questions

Problem 21P

Related questions

Question

Transcribed Image Text:Consider the following information:

A (Click the icon to view the taxpayer information.)

Requirement

How many dependents does the taxpayer have, assuming the people involved are U.S. citizens? Which dependents qualify for the child credit? (Select "0" if the taxpayer has no dependents. Select "None" if no dependent qualifies

for the child credit.)

Dependent which

qualifies for the child

credit

Taxpayer information

Number of

Тахрayer

dependents

Andrew supports his cousin Mary, who does not live with him. Mary has no income and

a. is single.

Andrew supports his cousin Mary, who does not live with him. Mary has no

income and is single.

a.

b.

Bob and Ann are filing a joint return. Bob provided over one-half of his

father's support. The father received Social Security benefits of $6,000 and

taxable interest income of $800. The father is single and does not live with

them.

c. Clay provides 60% of his single daughter's support. She earned $3,000 while

attending school during the year as a full-time student. She is 22 years old.

d. Dave provided 30% of his mother's support and she provided 55% of her

own support. Dave's brother provided the remainder. The brother agreed to

sign a multiple support agreement.

Choose from any drop-down list and then click Check Answer.

3 parts

remaining

Clear All

Print

Done

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT