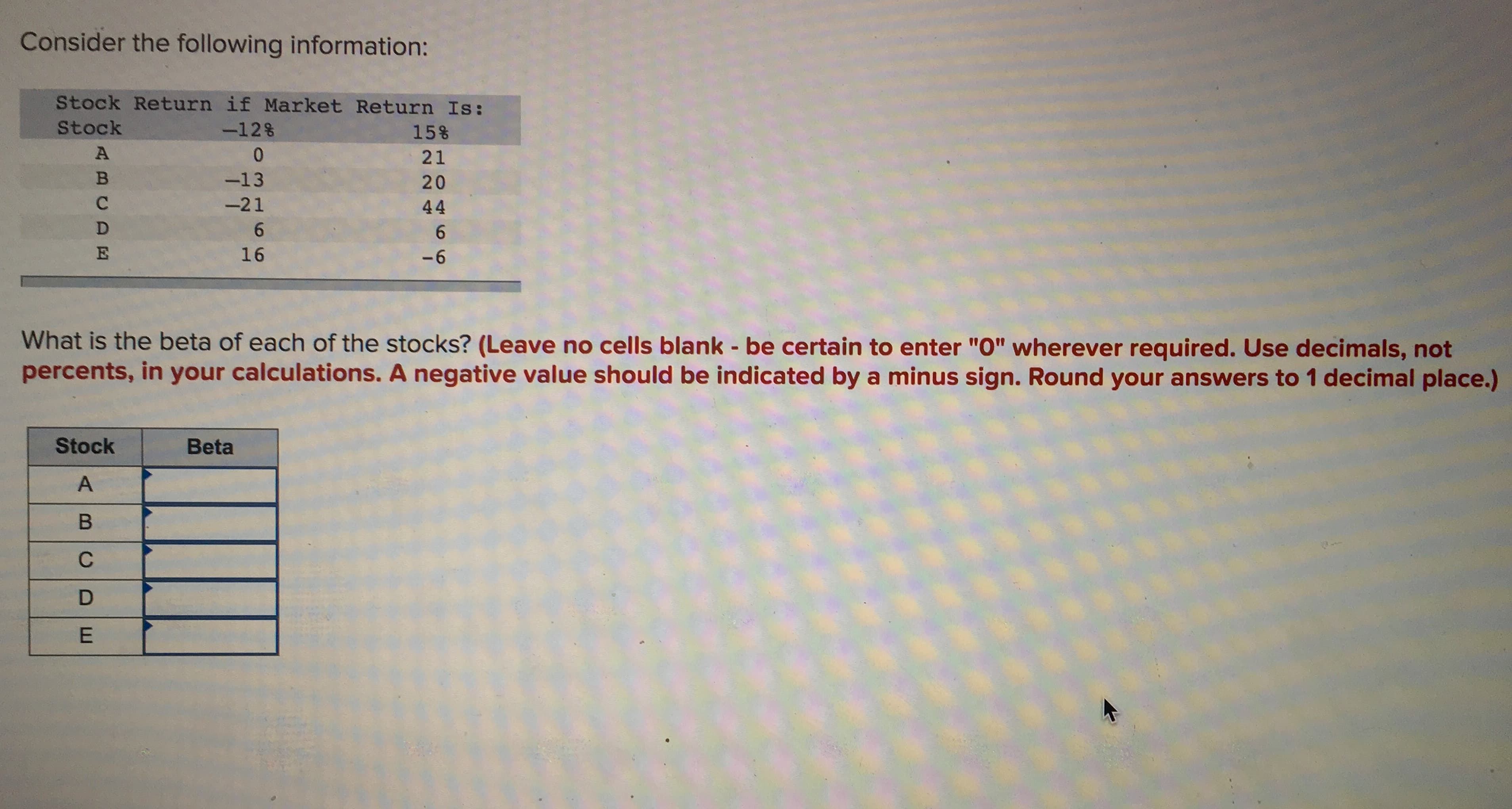

Consider the following information: Stock Return if Market Return Is: Stock -128 15% A 0 21 B -13 20 -21 44 D 6 6 16 -6 What is the beta of each of the stocks? (Leave no cells blank - be certain to enter "O" wherever required. Use decimals, not percents, in your calculations. A negative value should be indicated by a minus sign. Round your answers to 1 decimal place.) Stock Beta B C D E A LLI

Q: A stock has a required return of 10%, the risk-free rate is 6%, and the market risk premium is 3%.…

A: Formula: Required return=Risk free rate+Beta×Risk premium

Q: A stock has an expected return of 12.4%, the risk-free rate is 6.5%, and the market risk premium is…

A: In the given problem we require to calculate the Beta of the stock using following details: Expected…

Q: A stock has an expected return of 13%, its beta is 0.79, and the risk-free rate is 5%. What must the…

A: We require to calculate the expected return on the market in this question using following details:…

Q: AA Corporation's stock has a beta of 0.4. The risk-free rate is 6%, and the expected return on the…

A: Rate of return is the return on investment to the investor.

Q: What is the CAPM required return for Stock Z, in decimal form? Round your answer to 4 decimal places…

A:

Q: A stock has a beta of 1.38, the expected return on the market is 10 percent, and the risk- free rate…

A: Expected return using CAPM model can be calculated using following formula :- Expected return = Risk…

Q: A stock has a beta of 1.88. The risk free rate is 1.775% and the market risk premium is 5%. What is…

A: The Capital Asset Pricing Model (CAPM) is a mathematical model that describes the relationship…

Q: A stock has a beta of 1.15, the expected return on the market is 11.0%, and the risk-free rate is…

A: Under CAPM, the market variants that could affect the stock price are taken into consideration. It…

Q: Given the following information, determine the beta coefficient for Stock L that is consistent with…

A: Given: Required returnr=8%Risk free raterRF=3%Market returnrM=12%

Q: A stock has a beta of 1.22, the expected return on the market is 12 percent, and the risk- free rate…

A: given, beta = 1.22 expected market return ( rm) = 12% risk free rate ( rf) = 4%

Q: A stock has a Beta of 1.0. The risk-free rate is 4.7%, and the Market Risk Premium is estimated at…

A: Stock beta =1.0 Risk. Free rate =4.70% Market risk premium =7.40% Market risk premium = market…

Q: A stock has a beta of 1.32, the expected return on the market is 10 percent, and the risk-free rate…

A: A stock is a financial instrument issued by a corporation to obtain equity funds. The required rate…

Q: What is the reward-to-risk ratio for Stock X, in decimal form? Round your answer to 4 decimal places…

A: The reward-to-risk ratio is the reward an investor can earn, for every dollar he or she risks. The…

Q: A stock has a beta of 1.75, the expected return on the market is 15%, and the risk- free rate is 5%.…

A: In the given question we require to calculate the expected return on stock: According to Capital…

Q: What is the required rate of return on AA's stock?

A: Required rate of return (RRR) is the least required rate at which an investor will agree to invest…

Q: Consider the following information: Stock Return if Market Return Is: Stock –10% 10% A 0 11 B…

A: Beta means that how the return on equity is related to the return on overall market return. This…

Q: What is the required rate of return on AA's stock?

A: Required Rate of Return: It is the minimum rate acceptable by the investor for owning the stock of…

Q: A stock has a beta of 1.10, the expected return on the market is 12 percent, and the risk-free rate…

A: Given that the expected return on the market is 12%, risk free rate is 3.6% and the beta is 1.10, we…

Q: A stock has a beta of 1.1, the expected return on the market is 10.4 percent, and the risk-free rate…

A: Expected return = Risk free rate+Beta*(Market return-Risk free rate) Where Risk free rate = 4.75%…

Q: A stock has a beta of 1.38, the expected return on the market is 10%, and the risk- free rate is 5%.…

A: Following details are given in the question : Beta of stock = 1.38 Expected return on the market =…

Q: A stock has a beta of 1.55, the expected return on the market is 8%, and the risk-free rate is 15%.…

A: In the given question we are require to calculate the Expected return We can calculate the expected…

Q: AA Corporation's stock has a beta of 0.4. The risk-free rate is 2%, and the expected return on the…

A: Required rate of return = risk free rate +beta * (market return - risk free rate)

Q: A stock has a beta of 1.15, the expected return on the market is 10.9 percent, and the risk-free…

A: In given question we need to compute the expected rate of return for stock

Q: A stock has an expected return of 12.4 percent, the risk-free rate is 6.5 percent, and the market…

A: According to CAPM : beta of stock = ( expected return - risk free rate)/market risk premium

Q: The following three stocks are available in the market: E(R) β Stock A 10.9 % 1.18…

A: Given the following information Expected return of Stock A: 10.9%Beta of Stock A: 1.18 Expected…

Q: A stock has an expected return of 15.6 percent, the risk-free rate is 6.2 percent, and the market…

A: Information Provided: Expected Return = 15.6% Risk-free rate = 6.2% Market Risk Premium = 7.7%

Q: A certain stock has a beta of 1.2. If the risk-free rate of return is 4.5 percent and the market…

A: Risk-free return = 4.5% Market risk premium = 8% a) Beta = 1.2 b) Beta = 1.08 CAPM formula: Expected…

Q: What is the reward-to-risk ratio for Stock X, in decimal form? Round your answer to 4 decimal places…

A:

Q: A stock has an expected return of 11.4%, the risk-free rate is 5.5%, and the market risk premium is…

A: In the given question we are require to calculate the Beta: We can calculate the Beta using Capital…

Q: The following three stocks are available in the market: E(R) Beta Stock A 11.3% 1.22 Stock B…

A: Given the following information Expected return of Stock A: 11.3%Beta of Stock A: 1.22 Expected…

Q: Suppose that you would like to create composite indexes from three stocks: stk1, stk2, stk3. Their…

A: Return = [ ( P1*Q1 - P0*Q0 ) / P0*Q0 ]

Q: The Beta for Stock Q is _____. Do not round intermediate work, but round your final answer to 2…

A:

Q: wo stock prices for six days are given below. Price A Price B 25 55 27 59 30 64 28 62 26 58…

A: The standard deviation is a tool that helps to measure the variation between the average data and…

Q: A stock has a required return of 7%, the risk-free rate is 6%, and the market risk premium is 4%.…

A: Required return = 7% Risk free rate = 6% Market risk premium = 4%

Q: A stock has a beta of 1.2, the expected return on the market is 9 percent, and the risk-free rate is…

A: We need to use CAPM to calculate expected return Expected return =Risk free rate +Beta(Market return…

Q: A stock has an expected return of 11.85 percent, its beta is 1.08, and the risk-free rate is 3.9…

A: Investors have different options to make investments, and the motive behind investments is to…

Q: Assume that the risk-free rate is 2.5% and the market risk premium is 8%. What is the required…

A: Risk Free Rate = 2.5% Market Risk Premium = 8%

Q: A stock has a beta of 0.81, the expected return on the market is 11%, and the risk- free rate is…

A: Following details are given in the question : Beta of stock = 0.81 Expected return on the market =…

Q: A stock has an expected return of 15.4 percent, the risk-free rate is 6.1 percent, and the market…

A: Expected return (Er) = 0.154 Risk free rate (Rf) = 0.061 Market risk premium (Mp) = 0.079 Beta (b) =…

Q: A stock has a beta of 1.4 and an expected return of 12.7 percent. If the risk-free rate is 4.9…

A: Following details are given to us in the question : Beta = 1.4 Expected Return (ER) = 12.7% Risk…

Q: Consider the following table, which gives a security analyst's expected return on two stocks in two…

A: Beta is a measure of risk on the particular stock compared to the whole market or portfolio. Beta…

Q: Wildhorse Industries common stock has a beta of 1.8. If the market risk-free rate is 4.6 percent and…

A: Cost of common stock = Risk free rate + beta * (market return - risk free rate)

Q: A stock has an expected return of 14.5 percent, the risk-free rate is 5.65 percent, and the market…

A: Equation of CAPM (capital asset pricing model) equation can be used to find the beta of the stock:…

Q: A stock has a beta of 1.14, the expected return on the market is 10.8 percent, and the risk- free…

A: The expected return of the stock can be calculated with the help of CAPM equation

Q: A stock has a beta of 1.04, the expected return on the market is 10 percent, and the risk- free rate…

A: Cost of equity: It can be defined as the rate of return that is provided by the company to its…

Q: Given the following information, determine the beta coefficient for Stock J that is consistent with…

A: In the given question question we require to calculate the beta coefficient for Stock J from the…

Q: The reward-to-risk ratio for Stock X, in decimal form, is ______. Round your answer to 3 decimal…

A:

Trending now

This is a popular solution!

Step by step

Solved in 7 steps with 7 images

- Consider the following information: Stock Return if Market Return Is: Stock –10% 10% A 0 11 B –11 15 C –31 24 D 12 14 E 19 -6 What is the beta of each of the stocks?(Leave no cells blank - be certain to enter "0" wherever required. Use decimals, not percents, in your calculations. A negative value should be indicated by a minus sign. Round your answers to 1 decimal place.)Suppose that the index model for stocks A and B is estimated from excess returns with the following results: RA = 3.2% + 1.10RM + eA RB = –1.4% + 1.2RM + eB σM = 30%; R-squareA = 0.28; R-squareB = 0.12 What is the standard deviation of each stock? (Do not round intermediate calculations. Round your answers to 2 decimal places.)What is the reward-to-risk ratio for Stock X, in decimal form? Round your answer to 4 decimal places (example: if your answer is .03579, you should enter .0358). Margin of error for correct responses: +/- .0005. expected return (implied by market price) Beta Stock X 9.6% 1.55 S&P500 12% ? T-bills 4% ?

- Suppose that the index model for stocks A and B is estimated from excess returns with the following results: RA = 3.8% + 1.25RM + eA RB = –1.8% + 1.60RM + eB σM = 18%; R-squareA = 0.24; R-squareB = 0.18 What are the covariance and correlation coefficient between the two stocks? (Do not round intermediate calculations. Calculate using numbers in decimal form, not percentages. Round your answers to 4 decimal places.)For the next question, consider the two stocks, A and B, in the following table. Pt represents price at time t, and Qt represents shares outstanding at time t. P0 Q0 P1 Q1 A 50 100 45 100 B 30 200 34 200 Calculate the rate of return on a price-weighted index of the two stocks for between t = 0 and t = 1. Assume the divisor value is 2. Enter your answer as a decimal, rounded to four decimal places (e.g, 0.0123).Suppose that the index model for stocks A and B is estimated from excess returns with the following results: RA= 5.0% + 1.30RM + eA RB= -2.0% + 1.6RM + eB sigmaM= 20% ; R-squareA= 0.20 ; R-squareB= 0.12 What is the standard deviation of each stock (write as percentage, rounded to 2 decimal places)?

- Suppose that you would like to create composite indexes from three stocks: stk1, stk2, stk3. Their stock prices (Pt) and total shares outstanding (Qt) from day 0 to day 1 are shown as follows: stk3 splits two-for-one in day 1. P0 Q0 P1 Q1 stk1 40 100 50 100 stk2 50 200 50 200 stk3 60 150 50 300 Which answer is the closest value to the rate of return on an equal-weighted index of the three stocks? A. 20% B. 25% C. 30% D. 35%Suppose that you would like to create composite indexes from three stocks: stk1, stk2, stk3. Their stock prices (Pt) and total shares outstanding (Qt) from day 0 to day 1 are shown as follows: stk3 splits two-for-one in day 1. P0 Q0 P1 Q1 stk1 40 100 50 100 stk2 50 200 50 200 stk3 60 150 50 300 Which answer is the closest value to the rate of return on a value-weighted index of the three stocks? A. 20% B. 25% C. 30% D. 35%The reward-to-risk ratio for Stock X, in decimal form, is ______. Round your answer to 3 decimal places (example: if your answer is .04567, you should enter .046). Margin of error for correct responses: +/- .002. expected return (implied by market price) Beta Stock X 9.7% 0.87 S&P500 10% ? T-bonds 3% ?

- A certain stock has a beta of 1.3. If the risk-free rate of return is 3.9 percent and the market risk premium is 7.4 percent, what is the expected return of the stock? What is the expected return of a stock with a beta of 1.21? (Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.)A stock has had the following year-end prices and dividends: Year Price Dividend 1 $ 64.43 — 2 71.30 $ .62 3 77.10 .67 4 63.37 .73 5 73.31 .82 6 80.75 .89 What are the arithmetic and geometric returns for the stock? (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) Arithmetic average return % Geometric average return %If Stock I is correctly priced right now, its Beta must be ______ . Round your answer to 2 decimal places (example: if your answer is 1.2357, you should enter 1.24). Margin of error for correct responses: +/- .02. expected return (implied by market price) Beta Stock I 12.4% ?? S&P500 11% T-bonds 4%