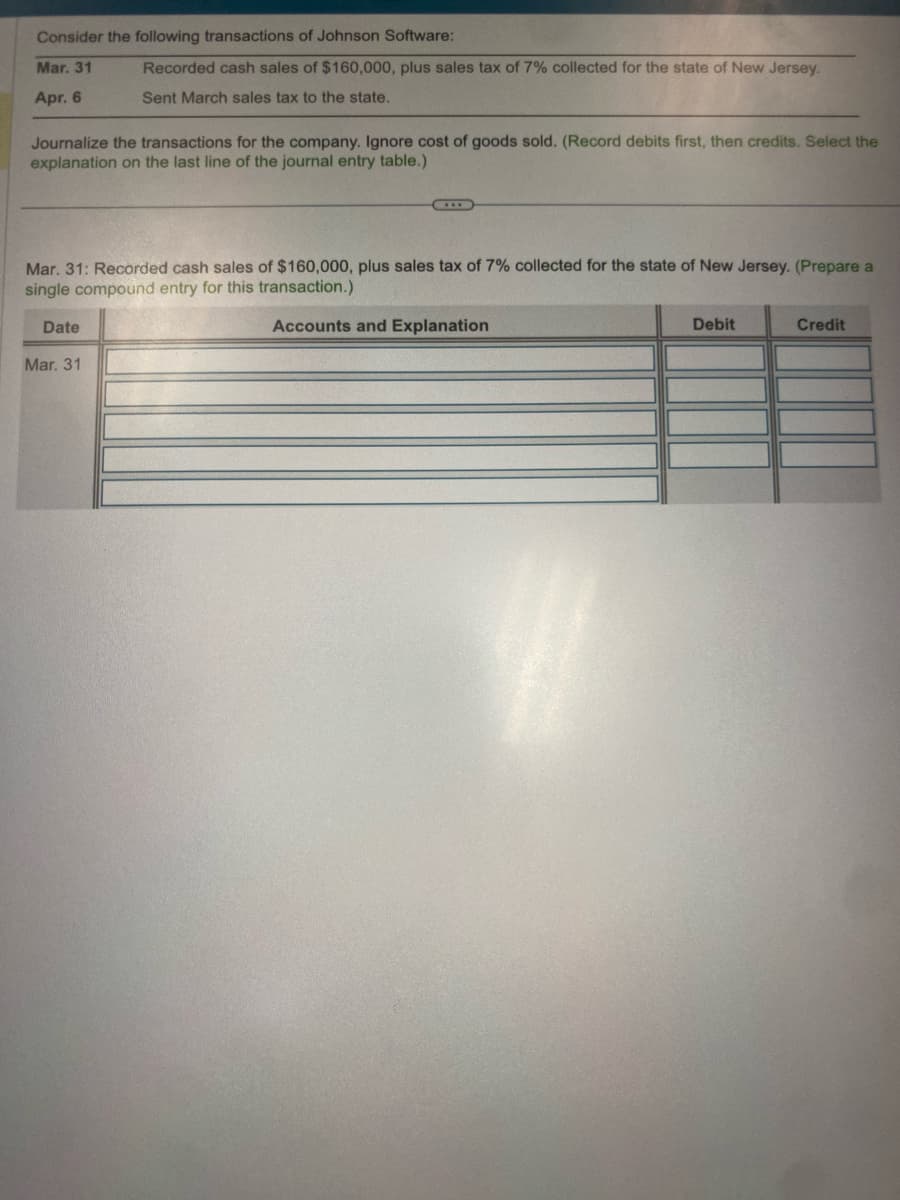

Consider the following transactions of Johnson Software: Mar. 31 Apr. 6 Recorded cash sales of $160,000, plus sales tax of 7% collected for the state of New Jersey. Sent March sales tax to the state. Journalize the transactions for the company. Ignore cost of goods sold. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Mar. 31: Recorded cash sales of $160,000, plus sales tax of 7% collected for the state of New Jersey. (Prepare a single compound entry for this transaction.) Date Accounts and Explanation Mar. 31 Debit Credit

Q: Hi! Please answer and show work :) Sam and Devon agree to go into business together selling…

A: In this case, the applicable section is Section 351 and as per this section services are not…

Q: The balance in the vehicles account in the ledger of Smeg Limited was R1 250 000 on 01 January 2023.…

A: Carrying value is calculated by adding the new vehicle cost in the balance of vehicle account and…

Q: Changing cash conversion cycle Cam each year, has an average payment perio of 68 days. The firm has…

A: The operating cycle consists of two key components: the average age of inventory and the average…

Q: Almaden Valley Variety Store uses the retail inventory method to estimate ending inventory and cost…

A: The cost-to-retail ratio evaluates how much of the retail price of a product is made up of costs.…

Q: Tilson Corporation has projected sales and production in units for the second quarter of the coming…

A: The cash disbursement schedule is prepared to estimate the cash payments during the period. The cash…

Q: Using Excel to Calculate Operating Cash Flows PROBLEM The comparative balance sheets for Gale…

A: Cash flow statement is the one which is prepared by the entity for the purpose of determining the…

Q: On January 1, 2020, AmerEx Transportation Company purchased a used aircraft at a cost of…

A: DEPRECIATION EXPENSE Depreciation is an account of expenditure which is used to allocate capital…

Q: Prepare the journal entries for materials and labor, based on the following: Raw materials…

A: The journal entries are prepared to record the transactions on regular basis. The direct costs…

Q: Shadee’s budgeted income statement for the months of May and June

A: A budgeted income statement refers to the calculation of net income expected in the coming time. The…

Q: Futura Company purchases the 65,000 starters that it installs in its standard line of farm tractors…

A: Answer:- Fixed cost meaning:- Fixed costs are those costs which do not change with the change in…

Q: On 31 March 2023 , Polokwane Traders received a statement from Messina Traders, a creditor. The…

A: A reconciliation statement reconciles the balances of two different sources of information. A bank…

Q: Handy Products signed a contract with Cooper Manufacturing to design, develop, and produce a…

A: “Since you have posted a question with multiple sub parts, we will provide the solution only to the…

Q: Buffalo BBQ Restaurant is trying to become more efficient in training its chefs. It is experimenting…

A: Average hours of employee training per chef=Total hours of employee trainingNumber of chefAverage…

Q: Jameson corporation recorded a lease at $300,000 on December 31,2019. Jameson's incremental…

A: The lease of an asset refers to the agreement between two parties i.e. lessor and lessee for the…

Q: b. What income, gains, losses, and deductions does Amy report on her income tax return? If an amount…

A: Taxable income is the part of gross income which is taxable by the government, calculated by adding…

Q: Question 2 Cranergy Products is a cranberry cooperative that operates two divisions, a harvesting…

A: INTRODUCTION:- This question deals with the concept of transfer pricing in the context of a…

Q: Silver Company makes a product that is very popular as a Mother's Day gift. Thus, peak sales occur…

A: Sales will be realized as follows: 20% in the month of sale; 60% in the following month and 20% in…

Q: Eagles Ltd. uses process costing in its Fabricating Department. At the beginning of October, it had…

A: Answer:- Formulas:- 1. Cost per equivalent unit for direct material = Total direct material cost /…

Q: Company H is determining their direct labor costs for next month. All factory workers are paid a…

A: Any labor who directly engaged in production process is known as direct labor. So direct labor is…

Q: Please do not provide answer in image formate, thank you. itchie Manufacturing Company makes a…

A: Break Even Point: At Break Even point There is no profit and loss. In this question we calculate…

Q: El Toro Corporation declared a common stock distribution to all shareholders of record on June 30,…

A: The stock dividend refers to the distribution of common shares to the shareholders. The dividend can…

Q: On January 1, 2020, AmerEx Transportation Company purchased a used aircraft at a cost of…

A: Depreciation is an account of expenditure which is used to allocate capital expenditure over the…

Q: Oct. 1 Oct. 1: Sold a six-month subscription (starting on November 1), collecting cash of $390, plus…

A: Journal entries are prepared by the company to record the non-economic and economic transactions in…

Q: The term inadequacy refers to: Multiple Choice The inability of a plant asset to meet its demands.…

A: Inadequacy: Inadequancy refers to state of being inadequate ( not sufficient).when we are not…

Q: Current assets for Clarke Inc. totalled $979,840, the current ratio was 1.60, and the company uses…

A: The current ratio is a financial statistic that assesses how well a firm is able to use its current…

Q: Equipment is acquired by issuing a note payable for $56,000 and a making a down payment of $28,000.…

A: INVESTING ACTIVITIES Cash Receipt or Payment that relates to acquisition or Disposal of Long term…

Q: Part 1 is incorrect. Could you try the problem ag

A: Profitability index is a financial tool which tells us whether an investment should be accepted or…

Q: Camila Company has set the following standard cost per unit for direct materials and direct labor.…

A: Variance means difference in cost .In standard costing ,it means deviations from standard. Material…

Q: Using the following data, estin 8% decrease in the average of operating assets as the base. Sales…

A: Net income is the income generated from an investment after deducting all the expenses, including…

Q: The Square Foot Grill, Incorporated issued $240,000 of 10-year, 7 percent bonds on January 1, Year…

A: When the bonds are issued the book value may be different from the face value. If the bonds are…

Q: Current assets for Clarke Inc. totalled $1,12 2.00, and the company uses the periodic the following…

A: Dividends do not affect current assets, but they decrease retained earnings, which is a part of…

Q: The following balances were taken from the books of Babsy Ltd at March 31, 2022: Motor vehicle…

A: The total amount of money or assets that a business's owners or shareholders have invested in it is…

Q: Instructions: Click the buttons above the graphing window to show either production functions or…

A: The branch of accounting known as cost accounting is used by manufacturing companies to assess the…

Q: Hilton Holdings has provided the following information regarding its expected activities from July…

A: A financial statement called a planned cash flow statement displays the anticipated inflows and…

Q: b. Company B has current assets of $234,000, total assets of $459,000, and equity of $100,000. The…

A: Non-current liabilities are a company's commitments that are not projected to be paid off within the…

Q: ges and fringe benefits ent's salary and fringe benefits e salaries and fringe benefits Time Charges…

A: To calculate the profit margin per hour on labor, the total revenue earned from labour will be…

Q: K A Celty Airline jet costs $28,000,000 and is expected to fly 200,000,000 miles during its 12-year…

A: Cost = $28,000,000 Salvage value = $0 Life = 200,000,000 miles Actual miles driven in Year 1 =…

Q: b. Prepare an income statement according to the variable costing concept. Gallatin County Motors…

A: ABSORPTION COSTING Absorption Costing is a Cost managerial Accounting method in which All Cost…

Q: 1. Prepare journal entries for each of the transactions through December 20 2. Prepare any adjusting…

A: A journal is made to record all business transactions. All the financial transactions are recorded…

Q: Ocean Blue Publishing completed the following transactions for one subscriber during 2021: (Click…

A: Answer:- Journal entry meaning:- A journal entry is basically a record of the financial…

Q: Phoenix Company reports the following fixed budget. It is based on an expected production and sales…

A: The flexible budget performance report is prepared to compare the actual and flexible budget costs…

Q: Calculate Company Y's total asset turnover based on the following information for the current year:…

A: Asset turnover is the measure that helps the entity in determining the efficiency of company in…

Q: On December 31, 2024, when the market interest rate is 14%, McMann Realty issues $800,000 of 11.25%,…

A: A firm or group may issue bonds payable as a form of long-term debt to raise capital from investors.…

Q: 1. Show computations of price and efficiency variances for direct materials and direct manufacturing…

A: I solve this question in two ways Variance analysis can be defined as the calculation of the…

Q: n stock, 80,100 shares at $1 par $ 80,100 Paid-in capital—excess of par 168,210 Retained…

A: Event Account title Debit Credit 1 Common stock a/c Dr. $1,100 Paid in capital in excess of…

Q: Required information [The following information applies to the questions displayed below.]…

A: Inventory: It is the goods and material a business hold to sell. There are two methods for recording…

Q: Trevino Company makes and sells products with variable costs of $24 each. Trevino incurs annual…

A: Variable costs are those costs which changes along with change in activity level. Fixed costs are…

Q: Calculate the purchase price of the bond using A-2 and A-4 Tables, a financial calculator or Excel…

A: Given in the question: Bond Face Value = $1,140,000 Bond Issue Date = January 1, 2023 Bond Maturity…

Q: Pratt Company acquired all of the outstanding shares of Spider, Inc., on December 31, 2021, for…

A: It is the single balance sheet in which the financial positions of both the parent and subsidiary…

Q: Please Solve With details and

A: The gross estate is valued at the time of death of a person. it includes all valuable property owned…

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

- The following transactions were completed by Hammond Auto Supply during January, which is the first month of this fiscal year. Terms of sale are 2/10, n/30. The balances of the accounts as of January 1 have been recorded in the general ledger in your Working Papers or in CengageNow. Hammond Auto Supply does not track cash sales by customer. If you are using the form-based approach with QuickBooks or general ledger, select Cash Sales as the customer for all cash sales transactions. Required 1. Record the transactions for January using a sales journal, page 73; a purchases journal, page 56; a cash receipts journal, page 38; a cash payments journal, page 45; and a general journal, page 100. Assume the periodic inventory method is used. 2. Post daily all entries involving customer accounts to the accounts receivable ledger. 3. Post daily all entries involving creditor accounts to the accounts payable ledger. 4. Post daily those entries involving the Other Accounts columns and the general journal to the general ledger. Write the owners name in the Capital and Drawing accounts. 5. Add the columns of the special journals and prove the equality of the debit and credit totals on scratch paper. 6. Post the appropriate totals of the special journals to the general ledger. 7. Prepare a trial balance. 8. Prepare a schedule of accounts receivable and a schedule of accounts payable. Do the totals equal the balances of the related controlling accounts?Screpcap Co. had the following transactions during the first week of June: June 1Purchased merchandise on account from Acme Supply, 2,700, plus freight charges of 160. 1Issued Check No. 219 to Denver Wholesalers for merchandise purchased on account, 720, less 1% discount. 1Sold merchandise on account to F. Colby, 246, plus 5% state sales tax plus 2% city sales tax. June 2Received cash on account from N. Dunlop, 315. 2Made cash sale of 413 plus 5% state sales tax plus 2% city sales tax. 2Purchased merchandise on account from Permon Co., 3,200, plus freight charges of 190. 3Sold merchandise on account to F. Ayres, 211, plus 5% state sales tax plus 2% city sales tax. 3Issued Check No. 220 to Ellis Co. for merchandise purchased on account, 847, less 1% discount. 3Received cash on account from F. Graves, 463. 4Issued Check No. 221 to Penguin Warehouse for merchandise purchased on account, 950, less 1% discount. 4Sold merchandise on account to K. Stanga, 318, plus 5% state sales tax plus 2% city sales tax. 4Purchased merchandise on account from Mason Milling, 1,630, plus freight charges of 90. 4Received cash on account from O. Alston, 381. 5Made cash sale of 319 plus 5% state sales tax plus 2% city sales tax. 5Issued Check No. 222 to Acme Supply for merchandise purchased on account, 980, less 1% discount. Required 1. Record the transactions in a general journal. 2. Assuming these are the types of transactions Screpcap Co. experiences on a regular basis, design the following special journals for Screpcap: (a) Sales journal (b) Cash receipts journal (c) Purchases journal (d) Cash payments journalThe following transactions were completed by Yang Restaurant Equipment during January, the first month of this fiscal year. Terms of sale are 2/10, n/30. The balances of the accounts as of January 1 have been recorded in the general ledger in your Working Papers or in CengageNow. Yang Restaurant Equipment does not track cash sales by customer. If you are using the form-based approach with QuickBooks or general ledger, select Cash Sales as the customer for all cash sales transactions. Required 1. Record the transactions for January using a general journal, page 1. Assume the periodic inventory method is used. If using QuickBooks, record transactions using either the journal entry method or the forms-based approach, as directed by your instructor. The chart of accounts is as follows: 2. Post daily all entries involving customer accounts to the accounts receivable ledger. 3. Post daily all entries involving creditor accounts to the accounts payable ledger. 4. Post daily the general journal entries to the general ledger. Write the owners name in the Capital and Drawing accounts. 5. Prepare a trial balance. 6. Prepare a schedule of accounts receivable (A/R Aging Detail report in QuickBooks) and a schedule of accounts payable (A/P Aging Detail report in QuickBooks). Do the totals equal the balances of the related controlling accounts? If using QuickBooks or general ledger, ignore Steps 2, 3, and 4.

- The following transactions were completed by Yang Restaurant Equipment during January, the first month of this fiscal year. Terms of sale are 2/10, n/30. The balances of the accounts as of January 1 have been recorded in the general ledger in your Working Papers or in CengageNow. Yang Restaurant Equipment does not track cash sales by customer. If you are using the form-based approach with QuickBooks or general ledger, select Cash Sales as the customer for all cash sales transactions. Required 1. Record the transactions for January using a sales journal, page 91; a purchases journal, page 74; a cash receipts journal, page 56; a cash payments journal, page 63; and a general journal, page 119. Assume the periodic inventory method is used. 2. Post daily all entries involving customer accounts to the accounts receivable ledger. 3. Post daily all entries involving creditor accounts to the accounts payable ledger. 4. Post daily those entries involving the Other Accounts columns and the general journal to the general ledger. Write the owners name in the Capital and Drawing accounts. 5. Add the columns of the special journals and prove the equality of the debit and credit totals on scratch paper. 6. Post the appropriate totals of the special journals to the general ledger. 7. Prepare a trial balance. 8. Prepare a schedule of accounts receivable and a schedule of accounts payable. Do the totals equal the balances of the related controlling accounts?The following transactions were completed by Hammond Auto Supply during January, which is the first month of this fiscal year. Terms of sale are 2/10, n/30. The balances of the accounts as of January 1 have been recorded in the general ledger in your Working Papers or in CengageNow. Hammond Auto Supply does not track cash sales by customer. Jan. 2Issued Ck. No. 6981 to JSS Management Company for monthly rent, 775. 2J. Hammond, the owner, invested an additional 3,500 in the business. 4Bought merchandise on account from Valencia and Company, invoice no. A691, 2,930; terms 2/10, n/30; dated January 2. 4Received check from Vega Appliance for 980 in payment of 1,000 invoice less discount. 4Sold merchandise on account to L. Paul, invoice no. 6483, 850. 6Received check from Petty, Inc., 637, in payment of 650 invoice less discount. 7Issued Ck. No. 6982, 588, to Fischer and Son, in payment of invoice no. C1272 for 600 less discount. 7Bought supplies on account from Doyle Office Supply, invoice no. 1906B, 108; terms net 30 days. 7Sold merchandise on account to Ellison and Clay, invoice no. 6484, 787. 9Issued credit memo no. 43 to L. Paul, 54, for merchandise returned. 11Cash sales for January 1 through January 10, 4,863.20. 11Issued Ck. No. 6983, 2,871.40, to Valencia and Company, in payment of 2,930 invoice less discount. 14Sold merchandise on account to Vega Appliance, invoice no. 6485, 2,050. Jan. 18Bought merchandise on account from Costa Products, invoice no. 7281D, 4,854; terms 2/10, n/60; dated January 16; FOB shipping point, freight prepaid and added to the invoice, 147 (total 5,001). 21Issued Ck. No. 6984, 194, to M. Miller for miscellaneous expenses not recorded previously. 21Cash sales for January 11 through January 20, 4,591. 23Issued Ck. No. 6985 to Forbes Freight, 96, for freight charges on merchandise purchased on January 4. 23Received credit memo no. 163, 376, from Costa Products for merchandise returned. 29Sold merchandise on account to Bruce Supply, invoice no. 6486, 1,835. 31Cash sales for January 21 through January 31, 4,428. 31Issued Ck. No. 6986, 53, to M. Miller for miscellaneous expenses not recorded previously. 31Recorded payroll entry from the payroll register: total salaries, 6,200; employees federal income tax withheld, 872; FICA Social Security tax withheld, 384.40, FICA Medicare tax withheld, 89.90. 31Recorded the payroll taxes: Social Security tax, 384.40, FICA Medicare tax, 89.90; state unemployment tax, 334.80; federal unemployment tax, 37.20. 31Issued Ck. No. 6987, 4,853.70, for salaries for the month. 31J. Hammond, the owner, withdrew 1,000 for personal use, Ck. No. 6988. Required 1. Record the transactions for January using a sales journal, page 73; a purchases journal, page 56; a cash receipts journal, page 38; a cash payments journal, page 45; and a general journal, page 100. Assume the periodic inventory method is used. 2. Post daily all entries involving customer accounts to the accounts receivable ledger. 3. Post daily all entries involving creditor accounts to the accounts payable ledger. 4. Post daily those entries involving the Other Accounts columns and the general journal to the general ledger. Write the owners name in the Capital and Drawing accounts. 5. Add the columns of the special journals and prove the equality of the debit and credit totals. 6. Post the appropriate totals of the special journals to the general ledger. 7. Prepare a trial balance. 8. Prepare a schedule of accounts receivable and a schedule of accounts payable. Do the totals equal the balances of the related controlling accounts?The following transactions were completed by Hammond Auto Supply during January, which is the first month of this fiscal year. Terms of sale are 2/10, n/30. The balances of the accounts as of January 1 have been recorded in the general ledger in your Working Papers or in CengageNow. Hammond Auto Supply does not track cash sales by customer. Jan. 2Issued Ck. No. 6981 to JSS Management Company for monthly rent, 775. 2J. Hammond, the owner, invested an additional 3,500 in the business. 4Bought merchandise on account from Valencia and Company, invoice no. A691, 2,930; terms 2/10, n/30; dated January 2. 4Received check from Vega Appliance for 980 in payment of 1,000 invoice less discount. 4Sold merchandise on account to L. Paul, invoice no. 6483, 850. 6Received check from Petty, Inc., 637, in payment of 650 invoice less discount. 7Issued Ck. No. 6982, 588, to Fischer and Son, in payment of invoice no. C1272 for 600 less discount. 7Bought supplies on account from Doyle Office Supply, invoice no. 1906B, 108; terms net 30 days. 7Sold merchandise on account to Ellison and Clay, invoice no. 6484, 787. 9Issued credit memo no. 43 to L. Paul, 54, for merchandise returned. 11Cash sales for January 1 through January 10, 4,863.20. 11Issued Ck. No. 6983, 2,871.40, to Valencia and Company, in payment of 2,930 invoice less discount. 14Sold merchandise on account to Vega Appliance, invoice no. 6485, 2,050. Jan. 18Bought merchandise on account from Costa Products, invoice no. 7281D, 4,854; terms 2/10, n/60; dated January 16; FOB shipping point, freight prepaid and added to the invoice, 147 (total 5,001). 21Issued Ck. No. 6984, 194, to M. Miller for miscellaneous expenses not recorded previously. 21Cash sales for January 11 through January 20, 4,591. 23Issued Ck. No. 6985 to Forbes Freight, 96, for freight charges on merchandise purchased on January 4. 23Received credit memo no. 163, 376, from Costa Products for merchandise returned. 29Sold merchandise on account to Bruce Supply, invoice no. 6486, 1,835. 31Cash sales for January 21 through January 31, 4,428. 31Issued Ck. No. 6986, 53, to M. Miller for miscellaneous expenses not recorded previously. 31Recorded payroll entry from the payroll register: total salaries, 6,200; employees federal income tax withheld, 872; FICA Social Security tax withheld, 384.40, FICA Medicare tax withheld, 89.90. 31Recorded the payroll taxes: Social Security tax, 384.40, FICA Medicare tax, 89.90; state unemployment tax, 334.80; federal unemployment tax, 37.20. 31Issued Ck. No. 6987, 4,853.70, for salaries for the month. 31J. Hammond, the owner, withdrew 1,000 for personal use, Ck. No. 6988. Required 1. Record the transactions in the general journal for January. If you are using Working Papers, start with page 1 in the journal. Assume the periodic inventory method is used. The chart of accounts is as follows: 2. Post daily all entries involving customer accounts to the accounts receivable ledger. 3. Post daily all entries involving creditor accounts to the accounts payable ledger. 4. Post daily the general journal entries to the general ledger. Write the owners name in the Capital and Drawing accounts. 5. Prepare a trial balance. 6. Prepare a schedule of accounts receivable and a schedule of accounts payable. Do the totals equal the balances of the related controlling accounts?

- Prepare journal entries for the following sales and cash receipts transactions. (a) Merchandise is sold on account for 300 plus 3% sales tax, with 2/10, n/30 cash discount terms. (b) Part of the merchandise sold in transaction (a) for 70 plus sales tax is returned for credit. (c) The balance on account for the merchandise sold in transaction (a) is paid in cash within the discount period.The following transactions were completed by Nelsons Hardware, a retailer, during September. Terms on sales on account are 1/10, n/30, FOB shipping point. Sept. 4Received cash from M. Alex in payment of August 25 invoice of 275, less cash discount. 7Issued Ck. No. 8175, 915.75, to Top Tools, Inc., for invoice. no. 2256, recorded previously for 925, less cash discount of 9.25. 10Sold merchandise in the amount of 175 on a credit card. Sales tax on this sale is 8%. The credit card fee the bank deducted for this transaction is 5. 11Issued Ck. No. 8176, 653.40, to Snap Tools, Inc. for invoice no. 726, recorded previously on account for 660. A trade discount of 15% was applied at the time of purchase, and Snap Tools, Inc.s credit terms are 1/10, n/45. 15Received 95 cash in payment of August 20 invoice from N. Johnson. No cash discount applied. 19Received 1,165 cash in payment of a 1,100 note receivable and interest of 65. 22Voided Ck. No. 8177 due to error. 26Received and paid telephone bill, 62; Ck. No. 8178, payable to Southern Telephone Company. 30Paid wages recorded previously for the month, 3,266, Ck. No. 8179. Required 1. Journalize the transactions for September in the cash receipts journal, the general journal (for the transaction on Sept. 10th), or the cash payments journal as appropriate. Assume the periodic inventory method is used. 2. If you are using Working Papers, total and rule the journals. Prove the equality of debit and credit totals.Bell Florists sells flowers on a retail basis. Most of the sales are for cash; however, a few steady customers have credit accounts. Bells sales staff fills out a sales slip for each sale. There is a state retail sales tax of 5 percent, which is collected by the retailer and submitted to the state. The balances of the accounts as of March 1 have been recorded in the general ledger in your Working Papers or in CengageNow. The following represent Bell Florists charge sales for March: Mar. 4Sold potted plant on account to C. Morales, sales slip no. 242, 27, plus sales tax of 1.35, total 28.35. 6Sold floral arrangement on account to R. Dixon, sales slip no. 267, 54, plus sales tax of 2.70, total 56.70. 12Sold corsage on account to B. Cox, sales slip no. 279, 16, plus sales tax of 0.80, total 16.80. 16Sold wreath on account to All-Star Legion, sales slip no. 296, 104, plus sales tax of 5.20, total 109.20. 18Sold floral arrangements on account to Tucker Funeral Home, sales slip no. 314, 260, plus sales tax of 13, total 273. 21Tucker Funeral Home complained about a wrinkled ribbon on the floral arrangement. Bell Florists allowed a 30 credit plus sales tax of 1.50, credit memo no. 27. 23Sold flower arrangements on account to Price Savings and Loan Association for its fifth anniversary, sales slip no. 337, 180, plus sales tax of 9, total 189. 24Allowed Price Savings and Loan Association credit, 25, plus sales tax of 1.25, because of a few withered blossoms in floral arrangements, credit memo no. 28. Required 1. Record these transactions in the general journal. 2. Post the amounts from the general journal to the general ledger and accounts receivable ledger: Accounts Receivable 113, Sales Tax Payable 214, Sales 411, Sales Returns and Allowances 412. 3. Prepare a schedule of accounts receivable and compare its total with the balance of the Accounts Receivable controlling account.