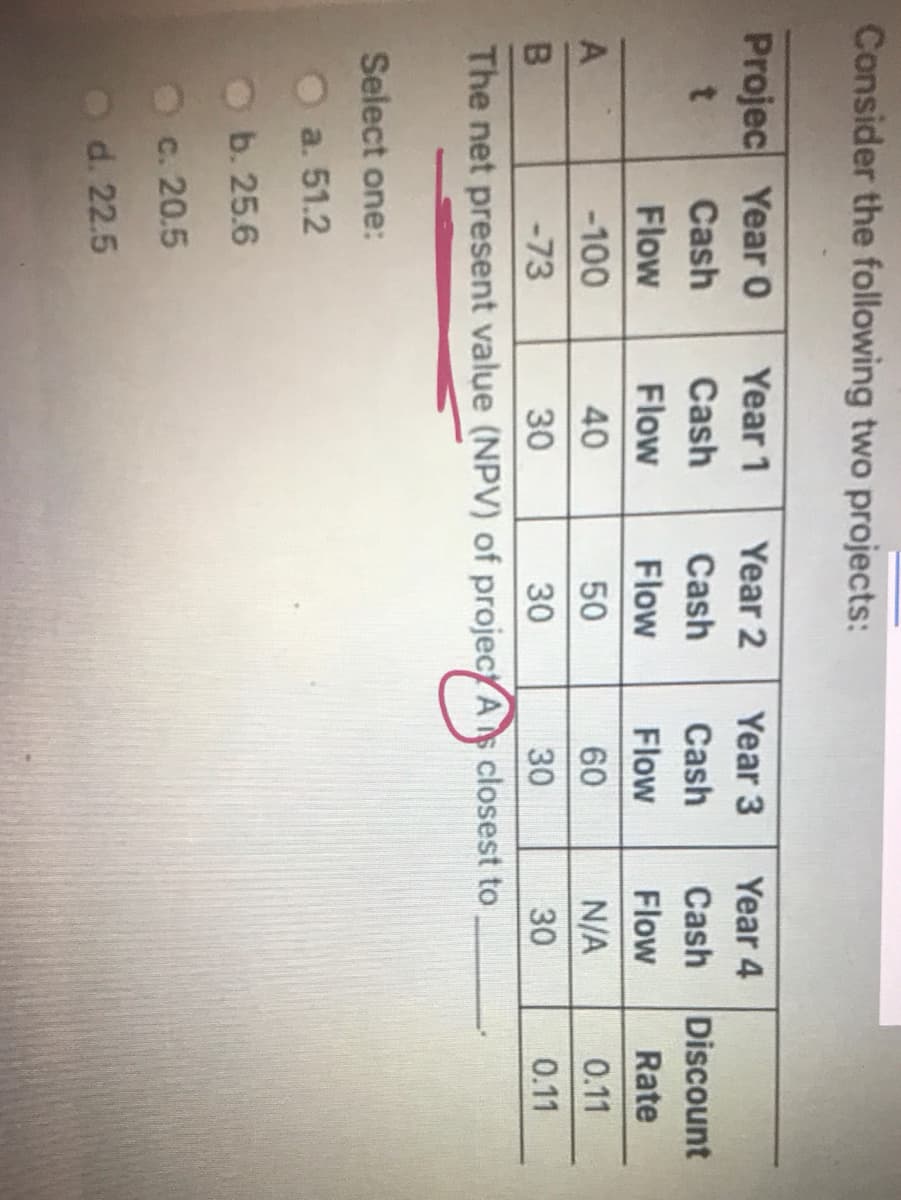

Consider the following two projects: Projec Year 0 Year 1 Year 2 Year 3 Year 4 Cash Cash Cash Cash Cash Discount Flow Flow Flow Flow Flow Rate -100 40 50 60 N/A 0.11 -73 30 30 30 30 0.11 The net present value (NPV) of projectAs closest to Select one: a. 51.2 b. 25.6 c. 20.5 Od. 22.5

Q: Consider the following two projects: Year 2 Cash Flow Cash Flow Cash Flow Cash Flow Cash Flow Year 1…

A: NPV (Net Present Value) is one of the important technique of capital budgeting decisions which aims…

Q: Question The following economical indictors are referring to types of project (A and B). Answer the…

A: Investment Appraisal: It is the analysis to consider profitability , affordability and strategic…

Q: Consider a project with the following cash flows: Year Cash Flow - 8000 1 3200 2 3200 3 3200 4 3200…

A: Capital budgeting techniques are used to analyze the profitability of long term projects and…

Q: Consider the following two mutually exclusive projects: Cash Flow Cash Flow Year (X) (Y) 519,500…

A: Before investing in new projects, profitability is evaluated by using various methods like NPV, IRR,…

Q: alculate the NPV of project X

A: It refers to the long term investment decisions that has been taken by the top management of a…

Q: Consider the following two mutually exclusive projects: Second part of the Question Year Cash…

A: The difference between the current value of cash inflows and outflow of cash over a period of time…

Q: Blinding Light Co. has a project available with the following cash flows: Year Cash Flow 0…

A: IRR stands for Internal rate of return. It is the rate at which net present value of the project…

Q: The cash flows for two investment projects are as given in Table P6.20. (a) For project A, find the…

A:

Q: A project has the following cash flows: Year Cash Flow 0 –$ 16,100 1 6,800 2 8,100 3…

A: Capital budgeting techniques and methods are widely used methods and techniques for evaluating the…

Q: Consider two investments with the following sequences of cash nows:Net Cash flown Project A Project…

A: The computations as follows: Hence, the IRR of project A is 17% and project B is 13%. The internal…

Q: Consider the following investment projects.Year (n) Net Cash FlowProject 1 Project 20 -$1,200…

A: Internal Rate of return: Internal Rate of Return can be defined as a financial measure used to…

Q: Expected Cash Flows Year Project A Project B 0 -400 -575 1 95 150 2 110 200 3 118 250 4 125 275 5…

A: Net Present Value is used to find out the present worth of an investment or a project by considering…

Q: There a project with the following cash flows: Year: 1, 2, 3, 4 Cash Flow: -$21,800 6,300 7,350…

A: Capital budgeting is a financial technique to evaluate a project's liquidity and profitability…

Q: Consider a project with the following cash flows: End of Year (n) Cash Flows ($)0…

A: Capital budgeting indicates the evaluation of the profitability of possible investment and projects…

Q: You are considering the following two projects. Which project(s) should you choose? Year 0 Year 1…

A: NPV= Present value of cash flows – Initial outlay NPV = CF0 + CF1+ ··· + CFt (1+rt)t Where CF= Cash…

Q: 4. Consider the two projects depicted in Table 2: The net present value (NPV) of project A is…

A: When the difference between the present value of series of cash inflows and the present value of…

Q: ) Consider the following project: Year Cash Flow 0 – $ 3,024…

A: Internal rate of return (IRR) is a metric used by corporations to determine the rate of return on…

Q: Consider the following two sets of project cash flows: Project Year 0 Year 1 Year 2 Year 3 Year 4…

A: a) It is assumed that both the project is mutually exclusive. The correct investment decision and…

Q: Consider the following two projects: Year 4 Cash Flow Cash Flow Cash Flow Cash Flow Cash Flow N/A…

A: Given: Year Particulars Amount 0 Cash outflows -$73 1 Cash inflows $30 2 Cash inflows $30…

Q: Consider the following two mutually exclusive projects: Net Cash Flow End of year Project A Project…

A: According to the time value of money concept, money available today is worth more than the same…

Q: Use the table for the question(s) below. Consider the following two projects: Project Year…

A: Net Present Value (NPV) is a capital budgeting technique which uses a discount rate to bring all the…

Q: A limited estimated the expected cash flows for two possible projects. Project 1 Year: 0 1…

A: Before investing in new projects, profitability is evaluated by using various methods like NPV, IRR,…

Q: Consider the following two projects: Project Year o Year 1 Year 2 Year 3 Year 4 Discount Cash Flow…

A: Net present value (NPV) is the difference between the present value of cash inflows and the present…

Q: Net Cash Flows and NPVs for different discount rate for projects S and L are given below Net…

A: NPV is the net current worth of cash flows that are expected to occur in the future. It is…

Q: Sketch the NPV profiles for X and Y over a range of discount rates from zero to 25 percent (take 0%,…

A: Since you have posted a question with multiple subparts, we will solve the first three sub-parts for…

Q: Net Cash Flows and NPVs for different discount rate for projects S and L are given below Net…

A: NPVs @10% is 161.33. It is given in the question itself.

Q: If the cash flows for Project M are C0 = -1,000; C1 = +800; C2 = +700 and C3= -200. Calculate the…

A: IRR is the discount rate at which net present value is zero. IRR is calculated by excel function…

Q: Consider the following two mutually exclusive projects: Cash Flow Cash Flow Year (M) 19,700 (X)…

A: Hello. Since you have posted multiple questions and not specified which question needs to be solved,…

Q: Project A has the following estimated cash flows and present values: Year…

A: Given: Cost = -$95,000 Contribution = $50,000 Fixed cost = -$25,000 Residual value = 20,000

Q: Consider the following two projects: Project Year 0 Year 1 Year 2 Year 3 Year 4 Discount Cash Flow…

A: YEAR CASHFLOWS DISCOUNT FACTOR DISCOUNTED CASHFLOWS 0 73 1 30 0.909 27.27 2 30 0.826…

Q: A project’s cash flows are listed below. Assume the appropriate discount rate for this project is…

A: Given:

Q: 1. Consider the following investment projects: Year(n) Net cash flow Project 1 -$1,200 Project 2…

A: We need to find the incremental IRR (r) Initial incremental cashflow (I) = - $2000 - (- $1200) = -…

Q: Consider the following two mutually exclusive investment projects:Project Cash Flowsn A…

A: NPW are calculated as follows

Q: Net Cash Flows and NPVs for different discount rate for projects S and L are given below Net…

A: IRR is the rate at which NPV of the project is equal to zero that means total PV of cash inflows…

Q: 2. You are evaluating an investment project with the following cash flows : Period Cash Flows - $200…

A: The following calculations are done to evaluate the profitability of the project.

Q: Compute the Internal Rate of Return for a project with the following cash flows: Year Cash Flow 0…

A: Internal rate of return of the stock is the rate at which the Net Present Value of the project…

Q: Cash Flows and NPVs for different discount rate for projects S and L are given below Net Cash…

A: independednt projects are one which are not dependent on each other.1.now for to find which project…

Q: The cash flow streams for three alternative investment A, B, C and D are: Project Co 230000 Cash…

A: i. Payback period payback period=period prior to fullrecovery period+uncovered cashflowcashflow…

Q: Here are the cash-flow forecasts for two mutually exclusive projects: Cash Flows (dollars) Project A…

A: Net Present Value(NPV) is excess of present value(PV) of all cash inflows over initial cash outlay…

Q: the project's net cash flow is listed as follows. Please calculate its simple payback period and…

A: The selection of company's project is based upon the return generated by the company or the possible…

Q: The following economical indictors are referring to types of project (A and B). Answer the following…

A: Standard Disclaimers"Since you have posted a question with multiple subparts, we will solve the…

Q: The cash flow streams for three alternative investment A, B, C and D are: Project Cash Flow (Tk.) Со…

A: Given information: Required rate of return is 11%

Q: Consider the following two projects: Project Year 0 Year 1 Year 2 Year 3 Year 4 Discount Cash Flow…

A: Payback period for Project A can be calculated as below: Here, A = Last period or year in which the…

Q: The cash flow streams for three alternative investment A, B, C and D are: Project Co Cash Flow (Tk.)…

A: Payback period = Year before the Payback Occur +( cumulative Cashflow in the year before Recovery…

Step by step

Solved in 2 steps

- 1- Evaluate the following projects using the payback method assuming a rule of 3 yearsfor payback. Year Project A Project B 0 -10,000 -10,000 1 4,000 4,000 2 4,000 3,000 3 4,000 2,000 4 0 1,000,0006) Year Project A Project B Difference 0 -75000 -75000 0 1 26300 24000 2300 2 29500 26900 2600 3 45300 51300 -6000 Crossover rate 14.60% Hi I need help with the following question! Thank you! Are you going to accept project A or project B? Why?What is the “cross-over” rate of the following projects? Year Project A Project B 0 -1,400 -800 1 950 600 2 950 600

- What is the IRR of Project A? Year Project A 0 -3000 1 1000 2 1000 3 2500 18.54% 19.54% 23.54% 29.54% unansweredPROJECT A PROJECT BInitial Outlay -60,000 -80,000Inflow year 1 17,000 18,000Inflow year 2 17,000 18,000Inflow year 3 17,000 18,000Inflow year 4 17,000 18,000Inflow year 5 17,000 18,000Inflow year 6 17,000 18,000Determine the B/C ratio for the following project.First Cost = P100, 000Project life, years = 5Salvage value = P10, 000Annual benefits = P60, 000Annual O and M = P22, 000Interest rate= 15%

- NPV and project selection Project A Project B initial investment -50000 -60000 Year 1 5000 4000 Year 2 6000 7000 Year 3 7000 14000 Year 4 9000 13000 Year 5 4000 4000 Year 6 9000 9000 Year 7 5000 10000 Year 8 8000 8000 Year 9 9000 9000 Year 10 5000 7000 Calculate the NPV of each project with a 4% discount rate. Which project(s) will be undertaken if all are mutually exclusive (still 4% discount)? Which project(s) will be undertaken if all are independent and the firm only has $125k in available capital (still 4% discount)? Which projects will be undertaken if all are independent and the firm’s cost of capital is 3%? Please do in Excel and show stepsIf the opportunity cost is 11%, which of these projects is worth pursuing? Year Project A Project B 0 -$200 -$200 1 80 100 2 80 100 3 80 100 4 80Emusk Inc. is evaluating two mutually exclusive projects. The required rate of return on these projects is 8%. Calculate the internal rate of return for Project B. (Enter percentages as decimals and round to 4 decimals). Year Project A Project B 0 -15,000,000 -15,000,000 1 2,000,000 6,000,000 2 3,000,000 6,000,000 3 5,000,000 6,000,000 4 5,000,000 1,000,000 5 6,000,000 1,000,000

- The following information relates to two projects of which you have to select one to invest in.Both projects have an initial cost of $400,000 and only one can be undertaken.Project X YExpected profits $ $Year 1 160,000 60,000Year 2 160,000 100,000Year 3 80,000 180,000Year 4 40,000 240,000Estimated resale value atthe end of year 4 80,000 80,000i) Profit is calculated after deducting straight line depreciationii) The cost of capital is 16%Required:a) For both projects, calculate the following:i) The payback period to one decimal place ii) The accounting rate of return using average investments iii) The net present value iv) Advise the board which project in your opinion should be undertaken, givingreasons for your decision.The following information relates to machines A and B. Year Machine A Machine B Shs Shs 0 (100,000) (120,000) 1 60,000 50,000 2 40,000 50,000 3 20,000 50,000 Find the Internal Rate of Return (IRR) of the project at rates 10%)Calculate the MIRR for a project where the WACC is 6%. Invest: $95 today plus $30 at the end of year 2. Returns: $33, 40, 43, and 45 to be received at the end of years 1, 2, 3, and 4 respectively. (Draw a timeline and express your answer as a % carried to 1 decimal place.)