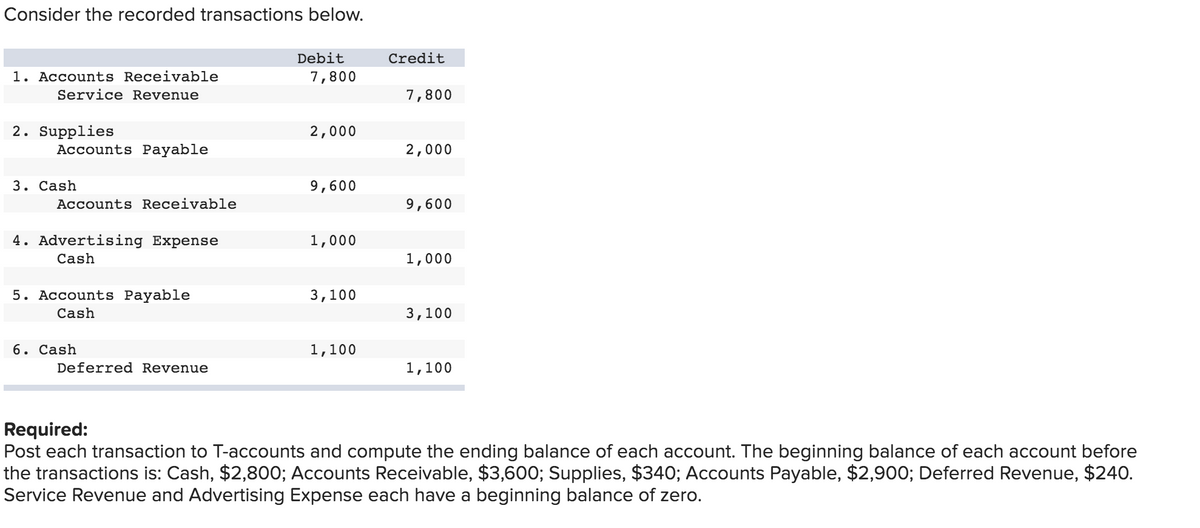

Consider the recorded transactions below. Debit Credit 1. Accounts Receivable 7,800 Service Revenue 7,800 2. Supplies 2,000 Accounts Payable 2,000 3. Cash 9,600 Accounts Receivable 9,600 4. Advertising Expense 1,000 Cash 1,000 5. Accounts Payable 3,100 Cash 3,100 6. Cash 1,100 Deferred Revenue 1,100 Required: Post each transaction to T-accounts and compute the ending balance of each account. The beginning balance of each account before the transactions is: Cash, $2,800; Accounts Receivable, $3,600; Supplies, $340; Accounts Payable, $2,900; Deferred Revenue, $240. Service Revenue and Advertising Expense each have a beginning balance of zero.

Consider the recorded transactions below. Debit Credit 1. Accounts Receivable 7,800 Service Revenue 7,800 2. Supplies 2,000 Accounts Payable 2,000 3. Cash 9,600 Accounts Receivable 9,600 4. Advertising Expense 1,000 Cash 1,000 5. Accounts Payable 3,100 Cash 3,100 6. Cash 1,100 Deferred Revenue 1,100 Required: Post each transaction to T-accounts and compute the ending balance of each account. The beginning balance of each account before the transactions is: Cash, $2,800; Accounts Receivable, $3,600; Supplies, $340; Accounts Payable, $2,900; Deferred Revenue, $240. Service Revenue and Advertising Expense each have a beginning balance of zero.

Chapter4: The Adjustment Process

Section: Chapter Questions

Problem 2PA: To demonstrate the difference between cash account activity and accrual basis profits (net income),...

Related questions

Question

100%

Transcribed Image Text:Consider the recorded transactions below.

Debit

Credit

1. Accounts Receivable

7,800

Service Revenue

7,800

2. Supplies

2,000

Accounts Payable

2,000

3. Cash

9,600

Accounts Receivable

9,600

4. Advertising Expense

1,000

Cash

1,000

5. Ассounts Payable

3,100

Cash

3,100

6. Cash

1,100

Deferred Revenue

1,100

Required:

Post each transaction to T-accounts and compute the ending balance of each account. The beginning balance of each account before

the transactions is: Cash, $2,800; Accounts Receivable, $3,600; Supplies, $340; Accounts Payable, $2,900; Deferred Revenue, $240.

Service Revenue and Advertising Expense each have a beginning balance of zero.

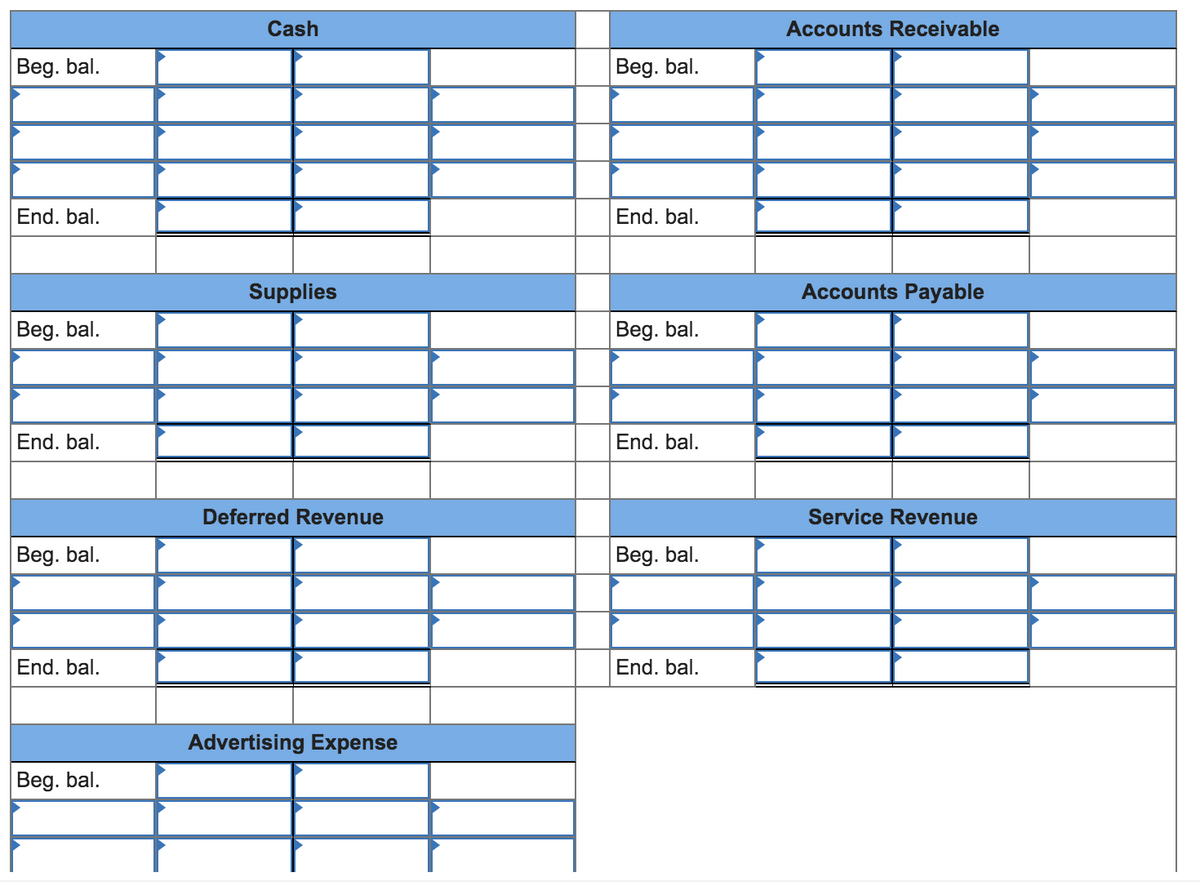

Transcribed Image Text:Cash

Accounts Receivable

Beg. bal.

Beg. bal.

End. bal.

End. bal.

Supplies

Accounts Payable

Beg. bal.

Beg. bal.

End. bal.

End. bal.

Deferred Revenue

Service Revenue

Beg. bal.

Beg. bal.

End. bal.

End. bal.

Advertising Expense

Beg. bal.

Expert Solution

Step 1

PLEASE LIKE THE ANSWER

when asset is debited, it will increase

when asset is credited, it will decrease

when liability is credited, it will increase

when liability is debited, it will decrease

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,