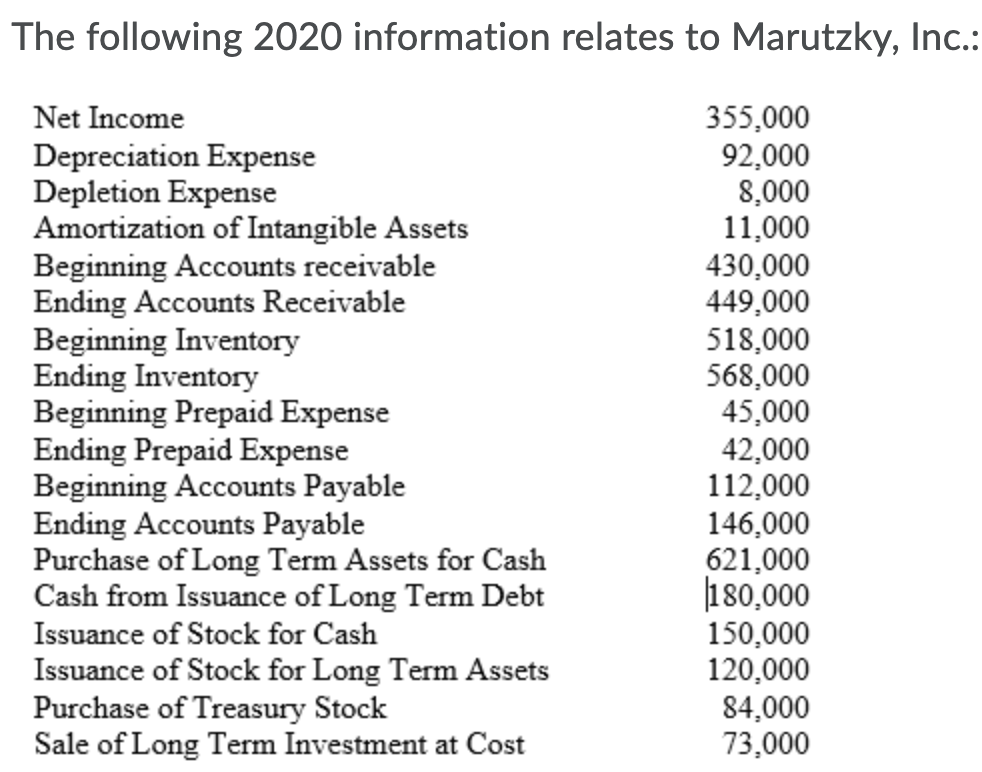

Construct a Statement of Cash Flows including: Net cash flows from operating activities. Net cash flows from investing activities. Net cash flows from financing activities. Net change in cash.

Construct a Statement of Cash Flows including:

- Net cash flows from operating activities.

- Net cash flows from investing activities.

- Net cash flows from financing activities.

- Net change in cash.

CASH FLOW STATEMENT

1 . CASH FLOW FROM OPERATING ACTIVITY

NET INCOME - 3,55,000

ADJUSTMENT TO RECONCILE ET INCOME TO NET CASH PROVIDED BY OPERATING ACTIVITY

ADD : DEPRECIATION EXPENSES - 92,000

ADD : DEPLETION EXPENSE - 8,000

ADD : AMORTIZATION OF INTANGIBLE ASSETS - 11,000

LESS : ACCOUNT RECEIVABLE INCREASE - (19,000)

LESS : INVENTORY INCREASE - (50,000)

ADD : PREPAID EXPENSE DECREASE - 3,000

ADD : ACCOUNT PAYABLE INCREASE - 34,000

TOTAL ADJUSTMENT - 69,000

NET CASH PROVIDED BY OPERATING ACTIVITY (3,55,000 + 69,000 ) = 4,24,000

2 . CASH FLOW FROM INVESTING ACTIVITY

CASH REALISED FROM SALE OF LONG TERM INVESTMENTS - 73,000

CASH PAID TO PURCHASE OF LONG TERM ASSETS - (6,21,000)

NET CASH USED IN INVESTING ACTIVITY (5,48,000)

Trending now

This is a popular solution!

Step by step

Solved in 2 steps