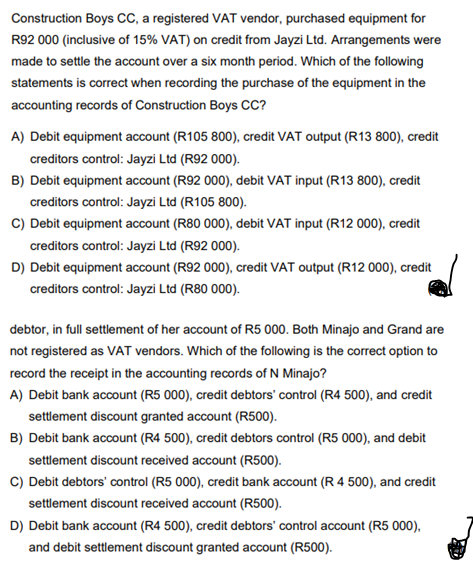

Construction Boys CC, a registered VAT vendor, purchased equipment for R92 000 (inclusive of 15% VAT) on credit from Jayzi Ltd. Arrangements were made to settle the account over a six month period. Which of the following statements is correct when recording the purchase of the equipment in the accounting records of Construction Boys CC? A) Debit equipment account (R105 800), credit VAT output (R13 800), credit creditors control: Jayzi Ltd (R92 000). B) Debit equipment account (R92 000), debit VAT input (R13 800), credit creditors control: Jayzi Ltd (R105 800). C) Debit equipment account (R80 000), debit VAT input (R12 000), credit creditors control: Jayzi Ltd (R92 000). D) Debit equipment account (R92 000), credit VAT output (R12 000), credit creditors control: Jayzi Ltd (R80 000).

Construction Boys CC, a registered VAT vendor, purchased equipment for R92 000 (inclusive of 15% VAT) on credit from Jayzi Ltd. Arrangements were made to settle the account over a six month period. Which of the following statements is correct when recording the purchase of the equipment in the accounting records of Construction Boys CC? A) Debit equipment account (R105 800), credit VAT output (R13 800), credit creditors control: Jayzi Ltd (R92 000). B) Debit equipment account (R92 000), debit VAT input (R13 800), credit creditors control: Jayzi Ltd (R105 800). C) Debit equipment account (R80 000), debit VAT input (R12 000), credit creditors control: Jayzi Ltd (R92 000). D) Debit equipment account (R92 000), credit VAT output (R12 000), credit creditors control: Jayzi Ltd (R80 000).

Century 21 Accounting Multicolumn Journal

11th Edition

ISBN:9781337679503

Author:Gilbertson

Publisher:Gilbertson

Chapter21: Accounting For Accruals, Deferrals, And Reversing Entries

Section: Chapter Questions

Problem 1MP

Related questions

Question

Please see attached and kindly assist? Thanks

Transcribed Image Text:Construction Boys CC, a registered VAT vendor, purchased equipment for

R92 000 (inclusive of 15% VAT) on credit from Jayzi Ltd. Arrangements were

made to settle the account over a six month period. Which of the following

statements is correct when recording the purchase of the equipment in the

accounting records of Construction Boys CC?

A) Debit equipment account (R105 800), credit VAT output (R13 800), credit

creditors control: Jayzi Ltd (R92 000).

B) Debit equipment account (R92 000), debit VAT input (R13 800), credit

creditors control: Jayzi Ltd (R105 800).

C) Debit equipment account (R80 000), debit VAT input (R12 000), credit

creditors control: Jayzi Ltd (R92 000).

D) Debit equipment account (R92 000), credit VAT output (R12 000), credit

creditors control: Jayzi Ltd (R80 000).

debtor, in full settlement of her account of R5 000. Both Minajo and Grand are

not registered as VAT vendors. Which of the following is the correct option to

record the receipt in the accounting records of N Minajo?

A) Debit bank account (R5 000), credit debtors' control (R4 500), and credit

settlement discount granted account (R500).

B) Debit bank account (R4 500), credit debtors control (R5 000), and debit

settlement discount received account (R500).

C) Debit debtors' control (R5 000), credit bank account (R 4 500), and credit

settlement discount received account (R500).

D) Debit bank account (R4 500), credit debtors' control account (R5 000),

and debit settlement discount granted account (R500).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,