consulting services rendered. b. Issued 38 additional shares of common stock at a market price of $190 per share. c. Purchased $780 of office equipment, paying 15 percent in cash and owing the rest on a short-term note. d. Received $1030 from clients for consulting services to be performed in the next year. e. Bought $610 of supplies on account. 1. Incurred and paid $1,940 in utilities for the current year. a. Consulted for clients in the current year for fees totaling $1,760, due from clients in the next year. h. Received $3,120 from clients paying on their accounts. L Incurred $6,350 in salaries in the current year, paying $5,440 and owing the rest (to be paid next year). JPurchased $1,370 in short-term investments and paid $940 for insurance coverage beginning in the next fisc k. Received $80 in interest revenue earned in the current year on short-term investments. What would net income be if Conover, Inc., used the cash basis of accounting? (Enter your answer in thousands, not ir and your final answer to nearest whole dollar.)

consulting services rendered. b. Issued 38 additional shares of common stock at a market price of $190 per share. c. Purchased $780 of office equipment, paying 15 percent in cash and owing the rest on a short-term note. d. Received $1030 from clients for consulting services to be performed in the next year. e. Bought $610 of supplies on account. 1. Incurred and paid $1,940 in utilities for the current year. a. Consulted for clients in the current year for fees totaling $1,760, due from clients in the next year. h. Received $3,120 from clients paying on their accounts. L Incurred $6,350 in salaries in the current year, paying $5,440 and owing the rest (to be paid next year). JPurchased $1,370 in short-term investments and paid $940 for insurance coverage beginning in the next fisc k. Received $80 in interest revenue earned in the current year on short-term investments. What would net income be if Conover, Inc., used the cash basis of accounting? (Enter your answer in thousands, not ir and your final answer to nearest whole dollar.)

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter14: Statement Of Cash Flows

Section: Chapter Questions

Problem 25BEB

Related questions

Topic Video

Question

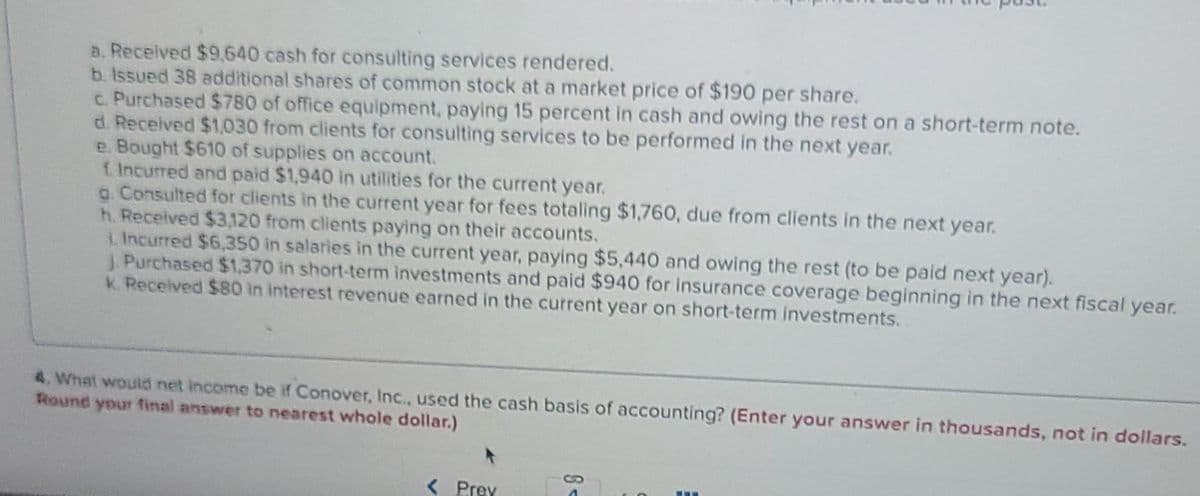

Transcribed Image Text:a. Received $9,640 cash for consulting services rendered.

b. Issued 38 additional shares of common stock at a market price of $190 per share.

c. Purchased $780 of office equipment, paying 15 percent in cash and owing the rest on a short-term note.

d. Received $1,030 from clients for consulting services to be performed in the next year.

e. Bought $610 of supplies on account.

f. Incurred and paid $1,940 in utilities for the current year.

g. Consulted for clients in the current year for fees totaling $1,760, due from clients in the next year.

h. Received $3,120 from clients paying on their accounts.

L Incurred $6,350 in salaries in the current year, paying $5,440 and owing the rest (to be paid next year).

JPurchased $1,370 in short-term investments and paid $940 for insurance coverage beginning in the next fiscal year.

k. Received $80 in interest revenue earned in the current year on short-term investments.

4. What would net income be if Conover, Inc., used the cash basis of accounting? (Enter your answer in thousands, not in dollars.

Round your final answer to nearest whole dollar.)

< Prey

...

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning