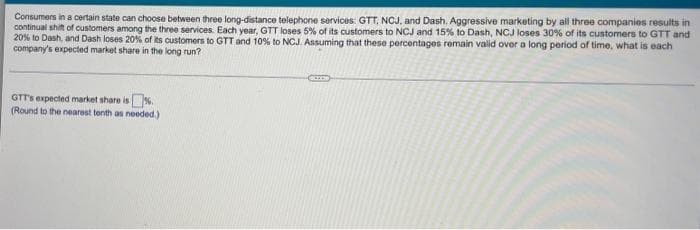

Consumers in a certain state can choose between three long-distance telephone services: GTT, NCJ, and Dash. Aggressive marketing by all three companies results in continual shit of customers among the three services. Each year, GTT loses 5% of its customers to NCJ and 15% to Dash, NCJ loses 30% of its customers to GTT and 20% to Dash, and Dash loses 20% of ts customers to GTT and 10% to NCJ. Assuming that these percentages remain valid over a long period of time, what is each company's expected market share in the long run? GTT's expected market share is. (Round to the nearest tenth as needed.)

Consumers in a certain state can choose between three long-distance telephone services: GTT, NCJ, and Dash. Aggressive marketing by all three companies results in continual shit of customers among the three services. Each year, GTT loses 5% of its customers to NCJ and 15% to Dash, NCJ loses 30% of its customers to GTT and 20% to Dash, and Dash loses 20% of ts customers to GTT and 10% to NCJ. Assuming that these percentages remain valid over a long period of time, what is each company's expected market share in the long run? GTT's expected market share is. (Round to the nearest tenth as needed.)

Glencoe Algebra 1, Student Edition, 9780079039897, 0079039898, 2018

18th Edition

ISBN:9780079039897

Author:Carter

Publisher:Carter

Chapter10: Statistics

Section10.6: Summarizing Categorical Data

Problem 28PPS

Related questions

Question

Plz solve correct and only typed answer.

Transcribed Image Text:Consumers in a certain state can choose between three long-distance telephone services: GTT, NCJ, and Dash. Aggressive marketing by all three companies results in

continual shit of customers among the three services. Each year, GTT loses 5% of its customers to NCJ and 15% to Dash, NCJ loses 30% of its customers to GTT and

20% to Dash, and Dash loses 20% of ts customers to GTT and 10% to NCJ. Assuming that these percentages remain valid over a long period of time, what is each

company's expected market share in the long run?

GTT's expected market share is.

(Round to the nearest tenth as needed.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 4 images

Recommended textbooks for you

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill

Linear Algebra: A Modern Introduction

Algebra

ISBN:

9781285463247

Author:

David Poole

Publisher:

Cengage Learning

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill

Linear Algebra: A Modern Introduction

Algebra

ISBN:

9781285463247

Author:

David Poole

Publisher:

Cengage Learning