contain the following information ($ in millions): 2017 2016 Balance sheets: Accounts receivable, net Income statements: $ 4,612 $ 4,176 Sales revenue $36,985 $35,011 A note disclosed that the allowance for uncollectible accounts had a balance of $36 million and $60 million at the end of 2017 and 2016, respectively. Bad debt expense for 2017 was $57 million. Assume that all sales are made on a credit basis. Required: 1. What is the amount of gross (total) accounts receivable due from customers at the end of 2017 and 2016? 2. What is the amount of bad debt write-offs during 2017? 3. Analyze changes in the following Accounts Receivable (gross) T-account to calculate the amount of cash received from customers during 2017. 4. Analyze changes in the following Accounts Receivable (net) T-account to calculate the amount of cash received from customers 0017

contain the following information ($ in millions): 2017 2016 Balance sheets: Accounts receivable, net Income statements: $ 4,612 $ 4,176 Sales revenue $36,985 $35,011 A note disclosed that the allowance for uncollectible accounts had a balance of $36 million and $60 million at the end of 2017 and 2016, respectively. Bad debt expense for 2017 was $57 million. Assume that all sales are made on a credit basis. Required: 1. What is the amount of gross (total) accounts receivable due from customers at the end of 2017 and 2016? 2. What is the amount of bad debt write-offs during 2017? 3. Analyze changes in the following Accounts Receivable (gross) T-account to calculate the amount of cash received from customers during 2017. 4. Analyze changes in the following Accounts Receivable (net) T-account to calculate the amount of cash received from customers 0017

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter7: Receivables And Investments

Section: Chapter Questions

Problem 7.3DC

Related questions

Question

Required 1-4?

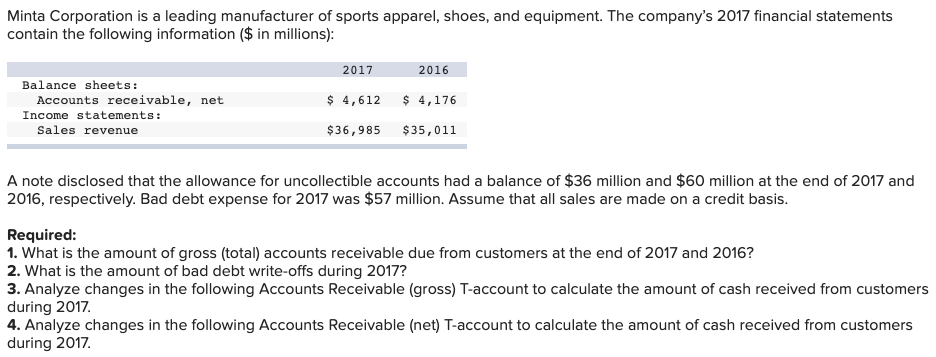

Transcribed Image Text:Minta Corporation is a leading manufacturer of sports apparel, shoes, and equipment. The company's 2017 financial statements

contain the following information ($ in millions):

2017

2016

Balance sheets:

Accounts receivable, net

$ 4,612

$ 4,176

Income statements:

Sales revenue

$36,985

$35,011

A note disclosed that the allowance for uncollectible accounts had a balance of $36 million and $60 million at the end of 2017 and

2016, respectively. Bad debt expense for 2017 was $57 million. Assume that all sales are made on a credit basis.

Required:

1. What is the amount of gross (total) accounts receivable due from customers at the end of 2017 and 2016?

2. What is the amount of bad debt write-offs during 2017?

3. Analyze changes in the following Accounts Receivable (gross) T-account to calculate the amount of cash received from customers

during 2017.

4. Analyze changes in the following Accounts Receivable (net) T-account to calculate the amount of cash received from customers

during 2017.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning