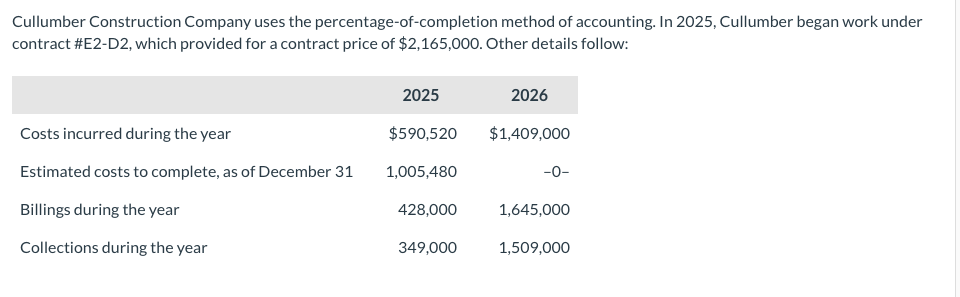

contract #E2-D2, which provided for a contract price of $2,165,000. Other details follow: 2025 2026 Costs incurred during the year $590,520 $1,409,000 Estimated costs to complete, as of December 31 1,005,480 -0- Billings during the year 428,000 1,645,000 Collections during the year 349,000 1,509,000

Cullumber Construction Company uses the percentage-of-completion method of accounting. In 2025, Cullumber began work under contract #E2-D2, which provided for a contract price of $2,165,000. Other details follow:On July 1, 2025, Wildhorse Construction Company Inc, contracted to build an office building for Indigo Corp. for a total contract price of 1,880,000 . On July 1, Wildhorse estimated that it would take between 2 and 3 years to complete the building. On December 31, 2027, the building was deemed substantially completed. Following are accumulated contract costs incurred, estimated costs to complete the contract, and accumulated billings to Indigo for 2025, 2026, and 2027. Do the same thing for 2027 and find the Gross profit from each year [[,At,At,At],[,(12)/(31)/25 ,(12)/(31)/26 ,(12)/(31)/27 prepare a complete set of

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images