Cornerstone Brief exercise 3-29 Hi, I am stuck on how to solve the problem attached. Could you please help me figure it out?

Cornerstone Brief exercise 3-29 Hi, I am stuck on how to solve the problem attached. Could you please help me figure it out?

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter2: The Accounting Information System

Section: Chapter Questions

Problem 62BPSB: Problem 2-62B Comprehensive Problem Mulberry Services sells electronic data processing services to...

Related questions

Question

Cornerstone Brief exercise 3-29 Hi, I am stuck on how to solve the problem attached. Could you please help me figure it out?

Transcribed Image Text:We

Bb My

M Uh

b Co

b M)

6 IM

E Ric

E Co M) Ce * x * Mi

C Se

b Bri

G bri

+

keAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false

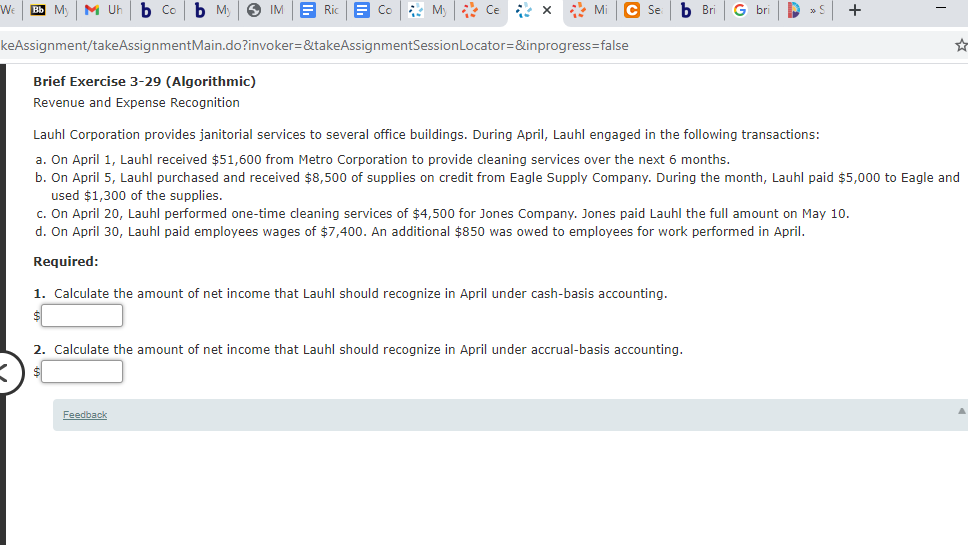

Brief Exercise 3-29 (Algorithmic)

Revenue and Expense Recognition

Lauhl Corporation provides janitorial services to several office buildings. During April, Lauhl engaged in the following transactions:

a. On April 1, Lauhl received $51,600 from Metro Corporation to provide cleaning services over the next 6 months.

b. On April 5, Lauhl purchased and received $8,500 of supplies on credit from Eagle Supply Company. During the month, Lauhl paid $5,000 to Eagle and

used $1,300 of the supplies.

c. On April 20, Lauhl performed one-time cleaning services of $4,500 for Jones Company. Jones paid Lauhl the full amount on May 10.

d. On April 30, Lauhl paid employees wages of $7,400. An additional $850 was owed to employees for work performed in April.

Required:

1. Calculate the amount of net income that Lauhl should recognize in April under cash-basis accounting.

2. Calculate the amount of net income that Lauhl should recognize in April under accrual-basis accounting.

Feedback

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,